general

Overview

Payment Initiation API aims to make payment providers as simple as a cURL.

Payment Initiation API is available for authorized Payment Initiation Service Providers under PSD2 in the EU and Open Banking in the UK.

Integrations

The Salt Edge platform is incredibly easy to integrate with. We’ve built the Salt Edge Connect interface so your application could start executing payments.

Formats

We use JSON for all the requests and responses, including the errors.

Glossary

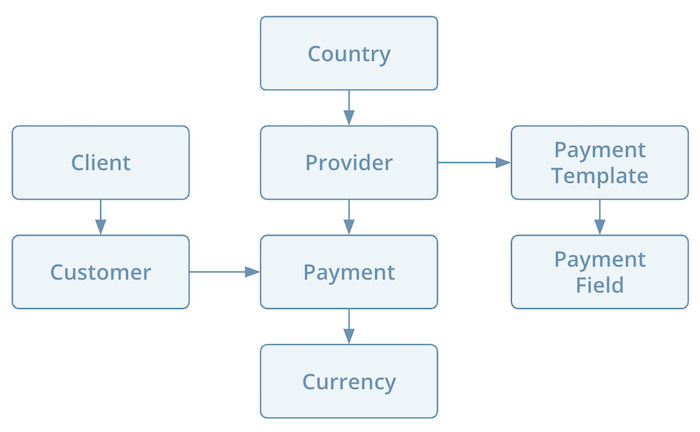

Most of the API revolves around several important concepts:

- Customer - an end-user of the client who is consuming Payment Initiation API;

- Provider - a bank or an online payment system;

- Payment - a payment that was made using Payment Initiation API.

Quick Start

Before we proceed, make sure you have a Client account or you should create one on the Sign Up page.

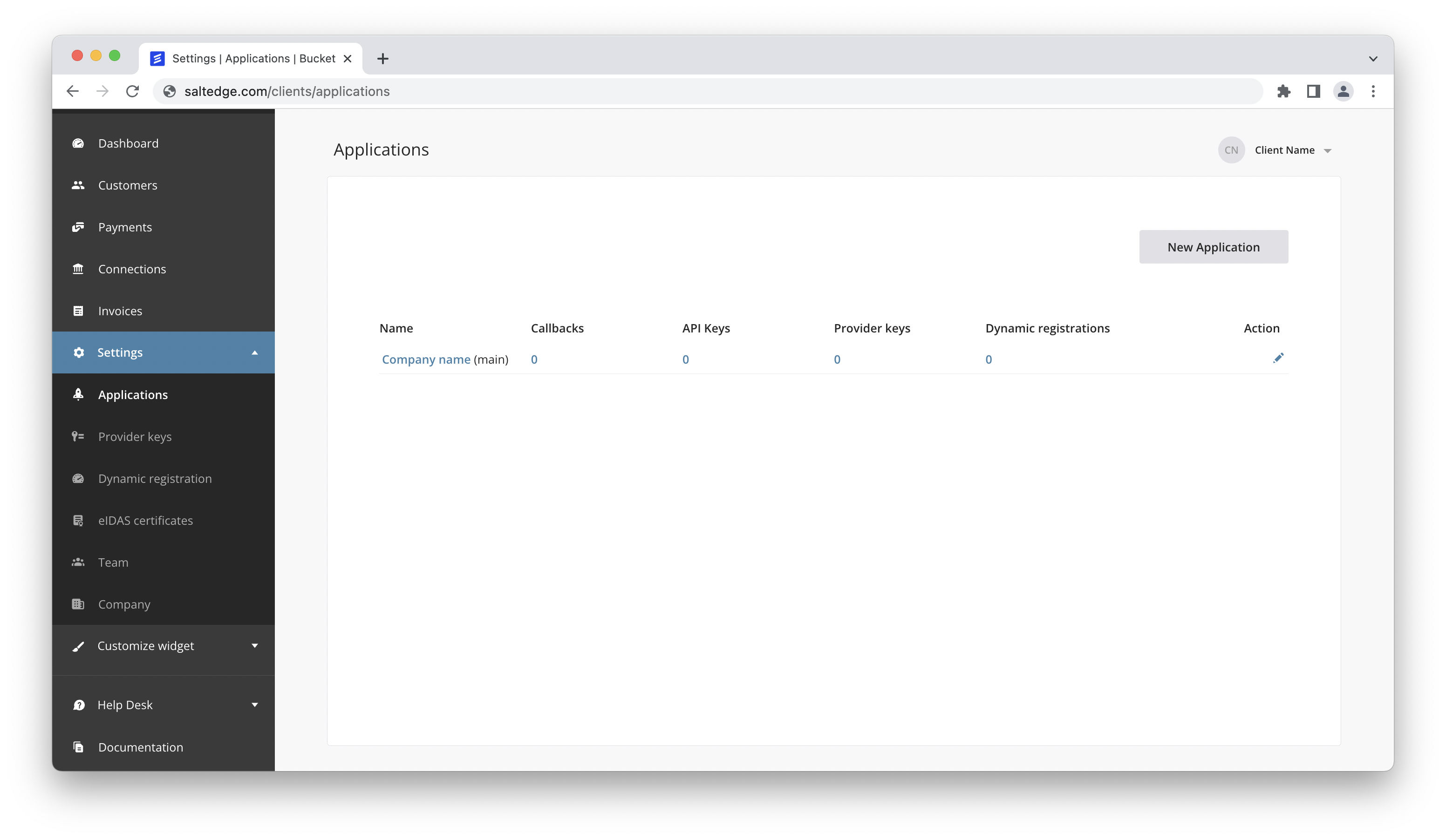

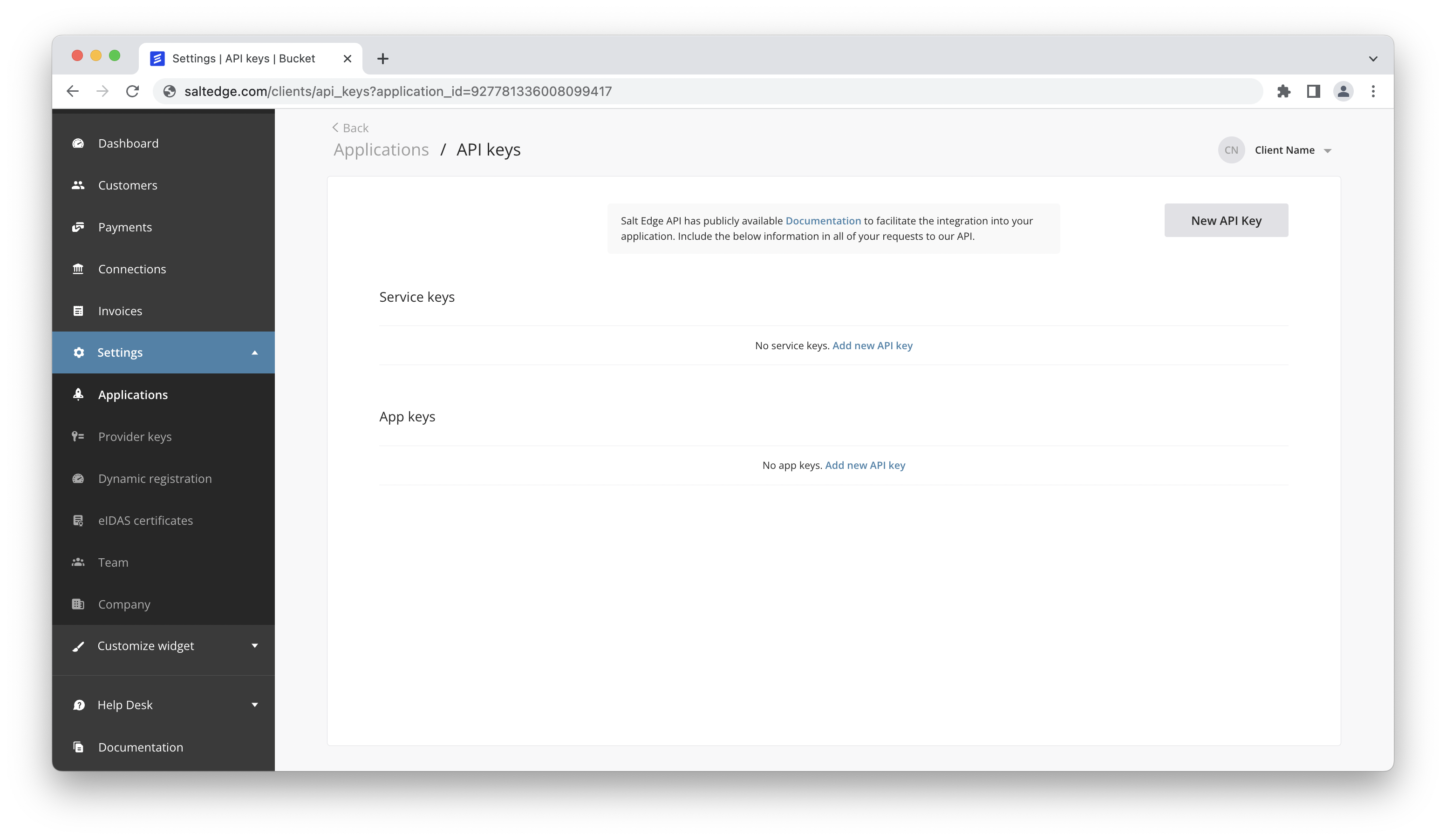

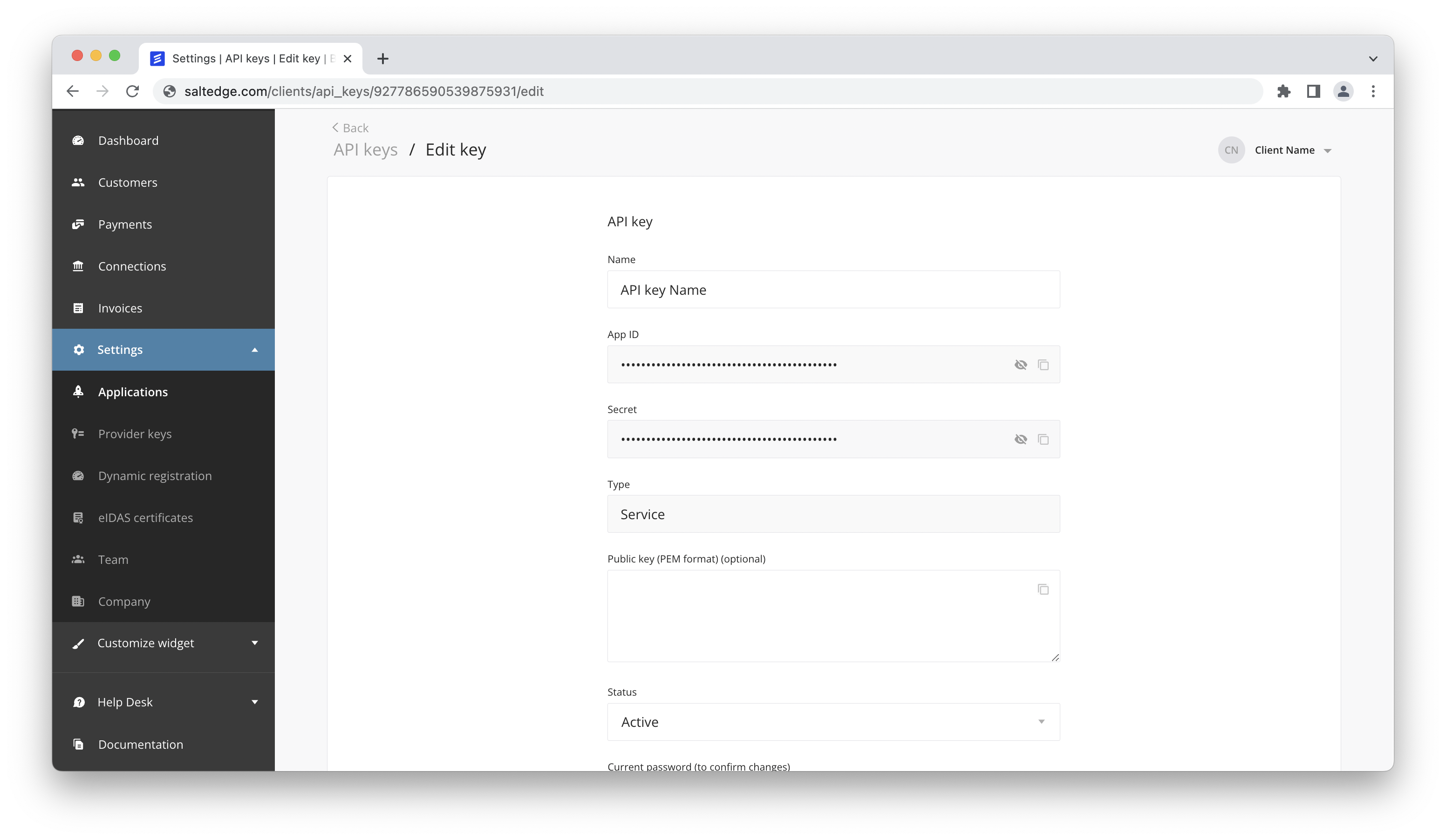

Any request to Account information API is authenticated, so before we are able to fetch any data, we need to create API keys. To do that, visit https://www.saltedge.com/clients/applications first and choose API Keys for the needed application.

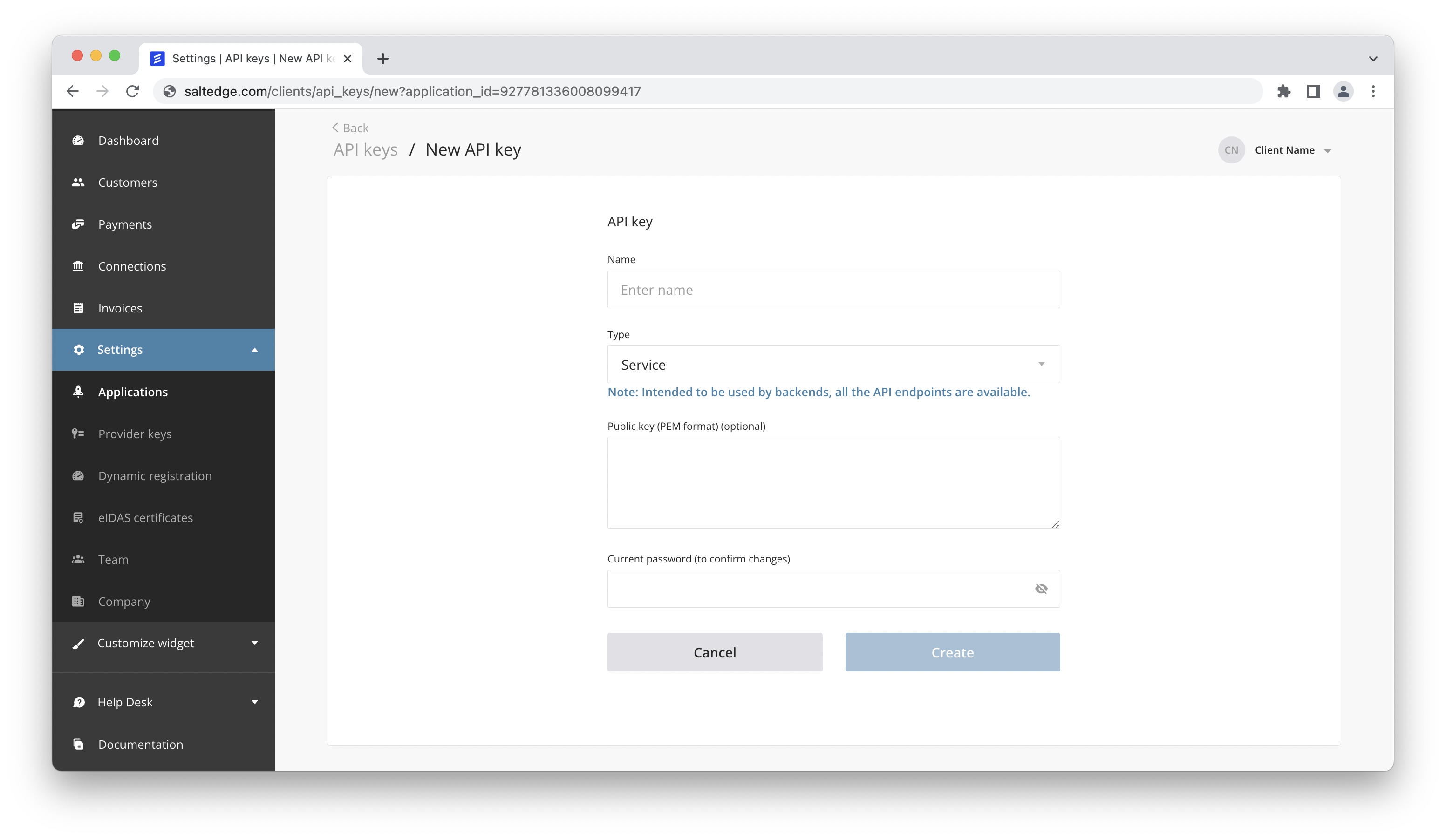

Now a new Service API key can be created. You can leave the “Public key” field blank.

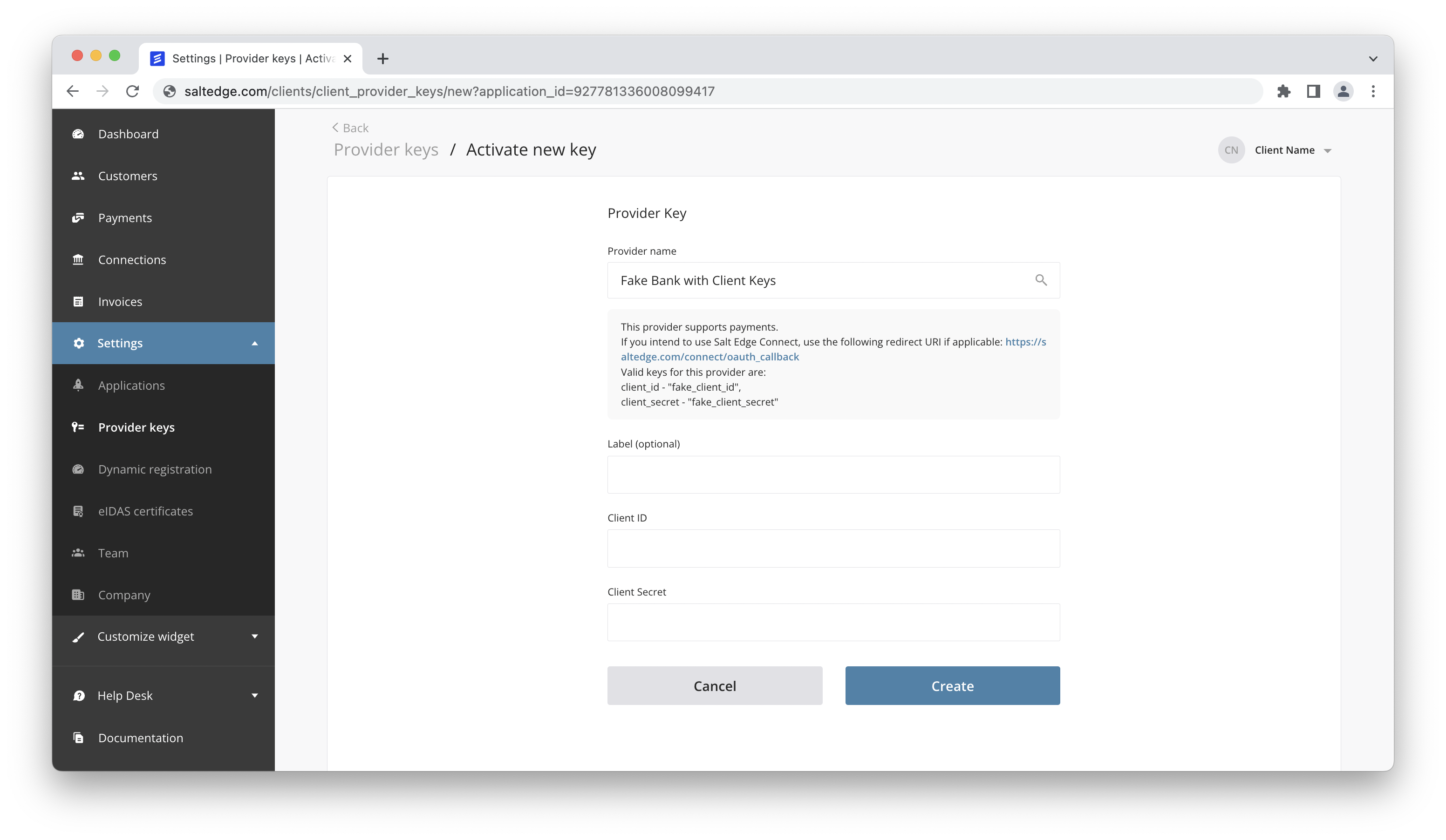

Providers that support payments require a provider key in order to be used. To create one, visit Provider Keys.

Note: Only providers that have available payment templates support payments execution.

Each request to API is authenticated with an App-id, and a Secret. Let’s store them as environment variables so that all the later requests are authenticated.

$ export APP_ID=YOUR_APP_ID

$ export SECRET=YOUR_APP_SECRET

Create customer

Before we can create any payments, we need to create a Customer. A Customer in Payment Initiation API is the end-user of your application.

We need to save the Customer id (in this case “222222222222222222”), because we will use it later to create payments.

See customers reference for Customer related API endpoints.

URL

https://www.saltedge.com/api/payments/v1/customers

https://www.saltedge.com/api/payments/v1/customers

Method

POST

Sample Request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"identifier\": \"test1\" \

} \

}" \

https://www.saltedge.com/api/payments/v1/customerscurl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"identifier\": \"test1\" \

} \

}" \

https://www.saltedge.com/api/payments/v1/customersSample Response

{

"data": {

"id": "222222222222222222",

"identifier": "test1",

"secret": "SECRET"

}

}

$ export CUSTOMER_ID=222222222222222222

Choose provider

Firstly, we need to choose a provider that supports payments and has client provider keys. We need to execute a request.

The response will be a list of providers that support payments.

Each payment provider can support multiple ways of initiating a payment. Each of this method is called a payment template.

For instance, we can see from the response that provider fake_client_xf supports payment templates SEPA, FPS, and SWIFT.

URL

https://www.saltedge.com/api/payments/v1/providers

https://www.saltedge.com/api/payments/v1/providers

Method

GET

Sample Request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/payments/v1/providerscurl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/payments/v1/providersSample Response

{

"data": [

{

"id": "3100",

"code": "fake_client_xf",

"name": "Fake Bank with Client Keys",

"mode": "api",

"status": "active",

"interactive": true,

"instruction": "Valid credentials for this provider are:\nlogin - any string which starts with \"username\",\npassword - \"secret\"\n",

"home_url": "https://example.com",

"forum_url": "https://www.saltedge.com/support_requests/new?provider_code=fake_client_xf",

"logo_url": "https://test.cloudfront.net/logos/providers/xf/fake_client_xf.svg",

"country_code": "XF",

"created_at": "2018-07-02T11:53:11Z",

"updated_at": "2018-07-02T11:53:11Z",

"identification_mode": "client"

"payment_templates": [

"SEPA",

"FPS",

"SWIFT"

]

},

...

],

"meta": {

"next_id": null,

"next_page": null

}

}

Choose payment template

Since in previous steps we only added client keys for provider fake_client_xf, we can only execute payments using payment templates supported by this provider - SEPA, FPS, and SWIFT.

For the purposes of this guide, let’s stick with SEPA. We need to save the payment template identifier (in this case SEPA), because we will use it later.

$ export PAYMENT_TEMPLATE=SEPA

To get the payment templates fields, we need to execute the following request.

The response will be a payment template object with payment fields.

From the response, we can see that payment template SEPA requires the following fields (none of them have optional flag set to true, thus all are mandatory):

end_to_end_idcustomer_last_logged_atcustomer_ip_addresscreditor_namecreditor_country_codecurrency_codeamountdescriptioncreditor_iban

The data type for each of these fields is represented by the nature field.

Please note, that within the same payment template the set of required and optional payment fields for one provider can vary from the set for other providers.

For example, the below providers have the following required_payment_fields for SEPA template:

1) Erste Bank and Sparkassen (erste_bank_sparkassen_oauth_client_at)

debtor_ibancreditor_ibanamountcurrency_codedescription

2) N26 (token.io) (n26_oauth_client_de)

debtor_ibancreditor_ibancreditor_nameamountcurrency_codedescription

3) Intesa Sanpaolo (intesa_sanpaolo_oauth_client_it)

debtor_ibancreditor_ibancreditor_nameamountcurrency_codedescriptioncreditor_country_code

Note: According to the SEPA template, the following fields are supposed to be optional debtor_iban, creditor_name and creditor_country_code. However, they became required for those specific implementations from the above.

Thus, we recommend inspecting the provider to see its specific set of required_payment_fields and make sure to pass them during the payment creation.

URL

https://www.saltedge.com/api/payments/v1/templates/{payment_template}

https://www.saltedge.com/api/payments/v1/templates/{payment_template}

Method

GET

Sample Request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/payments/v1/templates/$PAYMENT_TEMPLATEcurl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/payments/v1/templates/$PAYMENT_TEMPLATESample Response

{

"data": {

"id": "29",

"identifier": "SEPA",

"description": "SEPA Payment",

"deprecated": false,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-10-30T12:03:00Z",

"payment_fields": [

{

"id": "234",

"payment_template_id": "29",

"name": "amount",

"english_name": "Amount",

"localized_name": "Amount",

"nature": "number",

"position": 29,

"extra": {

"validation_regexp": "^[-+]?[0-9]*\\.?[0-9]+$"

},

"optional": false,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "235",

"payment_template_id": "29",

"name": "debtor_iban",

"english_name": "Debtor IBAN",

"localized_name": "Debtor IBAN",

"nature": "text",

"position": 30,

"extra": {

"validation_regexp": "^[a-zA-Z]{2}[0-9]{2}[a-zA-Z0-9]{4}[A-Z0-9]{7}([a-zA-Z0-9]?){0,16}$"

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "236",

"payment_template_id": "29",

"name": "creditor_iban",

"english_name": "Creditor IBAN",

"localized_name": "Creditor IBAN",

"nature": "text",

"position": 31,

"extra": {

"validation_regexp": "^[a-zA-Z]{2}[0-9]{2}[a-zA-Z0-9]{4}[A-Z0-9]{7}([a-zA-Z0-9]?){0,16}$"

},

"optional": false,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "238",

"payment_template_id": "29",

"name": "mode",

"english_name": "Mode",

"localized_name": "Mode",

"nature": "select",

"position": 33,

"extra": {

"validation_regexp": ""

},

"optional": false,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z",

"field_options": [

{

"name": "NORMAL",

"english_name": "NORMAL",

"localized_name": "NORMAL",

"option_value": "NORMAL",

"selected": true

},

{

"name": "INSTANT",

"english_name": "INSTANT",

"localized_name": "INSTANT",

"option_value": "INSTANT",

"selected": false

}

]

},

{

"id": "219",

"payment_template_id": "29",

"name": "debtor_region",

"english_name": "Debtor Region",

"localized_name": "Debtor Region",

"nature": "text",

"position": 14,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "222",

"payment_template_id": "29",

"name": "creditor_agent",

"english_name": "Creditor Agent ID",

"localized_name": "Creditor Agent ID",

"nature": "text",

"position": 17,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "207",

"payment_template_id": "29",

"name": "customer_ip_address",

"english_name": "Customer IP Address",

"localized_name": "Customer IP Address",

"nature": "text",

"position": 2,

"extra": {

"validation_regexp": "^\\d{1,3}\\.\\d{1,3}\\.\\d{1,3}\\.\\d{1,3}$"

},

"optional": false,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "213",

"payment_template_id": "29",

"name": "debtor_name",

"english_name": "Debtor Name",

"localized_name": "Debtor Name",

"nature": "text",

"position": 8,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "221",

"payment_template_id": "29",

"name": "creditor_name",

"english_name": "Creditor Name",

"localized_name": "Creditor Name",

"nature": "text",

"position": 16,

"extra": {

"validation_regexp": ""

},

"optional": false,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "224",

"payment_template_id": "29",

"name": "creditor_address",

"english_name": "Creditor Address",

"localized_name": "Creditor Address",

"nature": "text",

"position": 19,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "216",

"payment_template_id": "29",

"name": "debtor_building_number",

"english_name": "Debtor Building Number",

"localized_name": "Debtor Building Number",

"nature": "text",

"position": 11,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "212",

"payment_template_id": "29",

"name": "customer_longitude",

"english_name": "Customer Longitude",

"localized_name": "Customer Longitude",

"nature": "number",

"position": 7,

"extra": {

"validation_regexp": "^[-+]?[0-9]*\\.?[0-9]+$"

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "218",

"payment_template_id": "29",

"name": "debtor_town",

"english_name": "Debtor Town",

"localized_name": "Debtor Town",

"nature": "text",

"position": 13,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "223",

"payment_template_id": "29",

"name": "creditor_agent_name",

"english_name": "Creditor Agent Name",

"localized_name": "Creditor Agent Name",

"nature": "text",

"position": 18,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "225",

"payment_template_id": "29",

"name": "creditor_street_name",

"english_name": "Creditor Street Name",

"localized_name": "Creditor Street Name",

"nature": "text",

"position": 20,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "226",

"payment_template_id": "29",

"name": "creditor_building_number",

"english_name": "Creditor Building Number",

"localized_name": "Creditor Building Number",

"nature": "text",

"position": 21,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "227",

"payment_template_id": "29",

"name": "creditor_post_code",

"english_name": "Creditor Post Code",

"localized_name": "Creditor Post Code",

"nature": "text",

"position": 22,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "228",

"payment_template_id": "29",

"name": "creditor_town",

"english_name": "Creditor Town",

"localized_name": "Creditor Town",

"nature": "text",

"position": 23,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "229",

"payment_template_id": "29",

"name": "creditor_region",

"english_name": "Creditor Region",

"localized_name": "Creditor Region",

"nature": "text",

"position": 24,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "230",

"payment_template_id": "29",

"name": "creditor_country_code",

"english_name": "Creditor Country Code",

"localized_name": "Creditor Country Code",

"nature": "text",

"position": 25,

"extra": {

"validation_regexp": "^[A-Z]{2}$"

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "231",

"payment_template_id": "29",

"name": "date",

"english_name": "Payment Date",

"localized_name": "Payment Date",

"nature": "text",

"position": 26,

"extra": {

"validation_regexp": "^\\d{4}-\\d{2}-\\d{2}$"

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "232",

"payment_template_id": "29",

"name": "time",

"english_name": "Payment Time",

"localized_name": "Payment Time",

"nature": "text",

"position": 27,

"extra": {

"validation_regexp": "^\\d{2}:\\d{2}(:\\d{2})?$"

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "208",

"payment_template_id": "29",

"name": "customer_ip_port",

"english_name": "Customer IP Port",

"localized_name": "Customer IP Port",

"nature": "number",

"position": 3,

"extra": {

"validation_regexp": "^\\d{1,5}$"

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "209",

"payment_template_id": "29",

"name": "customer_device_os",

"english_name": "Customer Device OS",

"localized_name": "Customer Device OS",

"nature": "text",

"position": 4,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "211",

"payment_template_id": "29",

"name": "customer_latitude",

"english_name": "Customer Latitude",

"localized_name": "Customer Latitude",

"nature": "number",

"position": 6,

"extra": {

"validation_regexp": "^[-+]?[0-9]*\\.?[0-9]+$"

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "233",

"payment_template_id": "29",

"name": "description",

"english_name": "Description",

"localized_name": "Description",

"nature": "text",

"position": 28,

"extra": {

"validation_regexp": "^.{2,1000}$"

},

"optional": false,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-21T16:27:16Z"

},

{

"id": "205",

"payment_template_id": "29",

"name": "end_to_end_id",

"english_name": "End to End Identification",

"localized_name": "End to End Identification",

"nature": "text",

"position": 0,

"extra": {

"validation_regexp": "^.{1,35}$"

},

"optional": false,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-21T16:59:14Z"

},

{

"id": "239",

"payment_template_id": "29",

"name": "reference",

"english_name": "Payment Reference",

"localized_name": "Payment Reference",

"nature": "text",

"position": 0,

"extra": {

"validation_regexp": "^.{1,35}$"

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-21T16:59:14Z"

},

{

"id": "214",

"payment_template_id": "29",

"name": "debtor_address",

"english_name": "Debtor Address",

"localized_name": "Debtor Address",

"nature": "text",

"position": 9,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "215",

"payment_template_id": "29",

"name": "debtor_street_name",

"english_name": "Debtor Street Name",

"localized_name": "Debtor Street Name",

"nature": "text",

"position": 10,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "217",

"payment_template_id": "29",

"name": "debtor_post_code",

"english_name": "Debtor Post Code",

"localized_name": "Debtor Post Code",

"nature": "text",

"position": 12,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "220",

"payment_template_id": "29",

"name": "debtor_country_code",

"english_name": "Debtor Country Code",

"localized_name": "Debtor Country Code",

"nature": "text",

"position": 15,

"extra": {

"validation_regexp": "^[A-Z]{2}$"

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "237",

"payment_template_id": "29",

"name": "currency_code",

"english_name": "Currency",

"localized_name": "Currency",

"nature": "select",

"position": 32,

"extra": {

"validation_regexp": ""

},

"optional": false,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z",

"field_options": [

{

"name": "EUR",

"english_name": "EUR",

"localized_name": "EUR",

"option_value": "EUR",

"selected": true

}

]

},

{

"id": "210",

"payment_template_id": "29",

"name": "customer_user_agent",

"english_name": "Customer User Agent",

"localized_name": "Customer User Agent",

"nature": "text",

"position": 5,

"extra": {

"validation_regexp": ""

},

"optional": true,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

},

{

"id": "206",

"payment_template_id": "29",

"name": "customer_last_logged_at",

"english_name": "Customer Last Logged At",

"localized_name": "Customer Last Logged At",

"nature": "text",

"position": 1,

"extra": {

"validation_regexp": ""

},

"optional": false,

"created_at": "2018-11-27T17:07:23Z",

"updated_at": "2019-01-15T14:49:17Z"

}

]

}

}

Initiate payment

To initiate a payment in Salt Edge Connect, we need to execute a request to create a payment.

The response will contain the connect_url. This is the URL we will visit to authorize the user and initiate the payment.

URL

https://www.saltedge.com/api/payments/v1/payments/connect

https://www.saltedge.com/api/payments/v1/payments/connect

Method

POST

Sample Request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"customer_id\": \"222222222222222222\", \

\"provider_code\": \"fake_client_xf\", \

\"show_consent_confirmation\": true, \

\"template_identifier\": \"SEPA\", \

\"return_to\": \"http://example.com/\", \

\"payment_attributes\": { \

\"end_to_end_id\": \"#123123123\", \

\"customer_last_logged_at\": \"2020-06-06T13:48:40Z\", \

\"customer_ip_address\": \"255.255.255.255\", \

\"customer_device_os\": \"iOS 11\", \

\"creditor_name\": \"Jay Dawson\", \

\"creditor_street_name\": \"One Canada Square\", \

\"creditor_building_number\": \"One\", \

\"creditor_post_code\": \"E14 5AB\", \

\"creditor_town\": \"London\", \

\"creditor_country_code\": \"UK\", \

\"currency_code\": \"EUR\", \

\"amount\": \"199000.00\", \

\"description\": \"Stocks purchase\", \

\"creditor_iban\": \"GB33BUKB20201555555555\", \

\"mode\": \"normal\" \

} \

} \

}" \

https://www.saltedge.com/api/payments/v1/payments/connectcurl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"customer_id\": \"222222222222222222\", \

\"provider_code\": \"fake_client_xf\", \

\"show_consent_confirmation\": true, \

\"template_identifier\": \"SEPA\", \

\"return_to\": \"http://example.com/\", \

\"payment_attributes\": { \

\"end_to_end_id\": \"#123123123\", \

\"customer_last_logged_at\": \"2020-06-06T13:48:40Z\", \

\"customer_ip_address\": \"255.255.255.255\", \

\"customer_device_os\": \"iOS 11\", \

\"creditor_name\": \"Jay Dawson\", \

\"creditor_street_name\": \"One Canada Square\", \

\"creditor_building_number\": \"One\", \

\"creditor_post_code\": \"E14 5AB\", \

\"creditor_town\": \"London\", \

\"creditor_country_code\": \"UK\", \

\"currency_code\": \"EUR\", \

\"amount\": \"199000.00\", \

\"description\": \"Stocks purchase\", \

\"creditor_iban\": \"GB33BUKB20201555555555\", \

\"mode\": \"normal\" \

} \

} \

}" \

https://www.saltedge.com/api/payments/v1/payments/connectSample Response

{

"data": {

"token": "GENERATED_TOKEN",

"expires_at": "2020-07-03T07:23:58Z",

"connect_url": "https://www.saltedge.com/payments/connect?token=GENERATED_TOKEN"

}

}

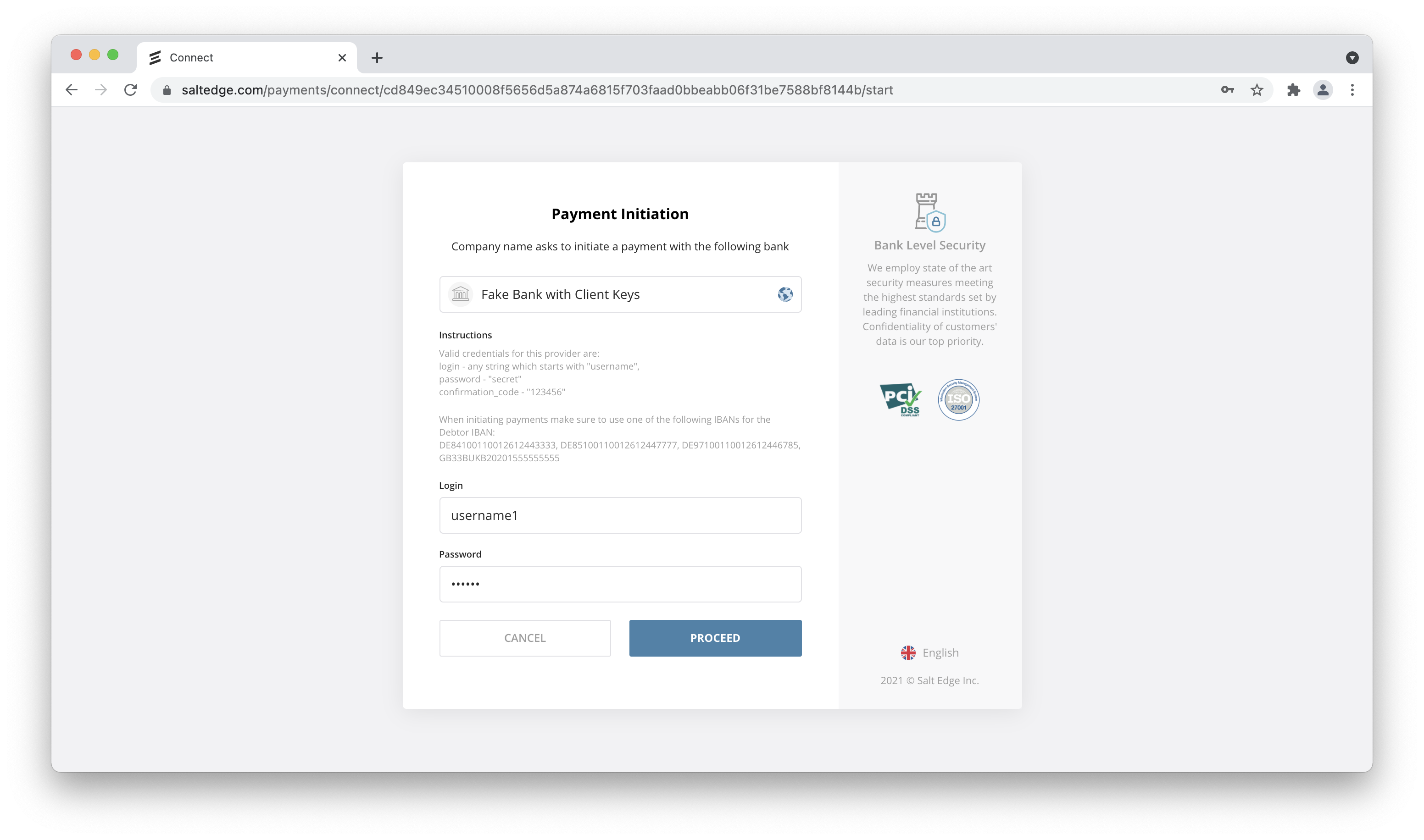

Visit Payment Widget URL

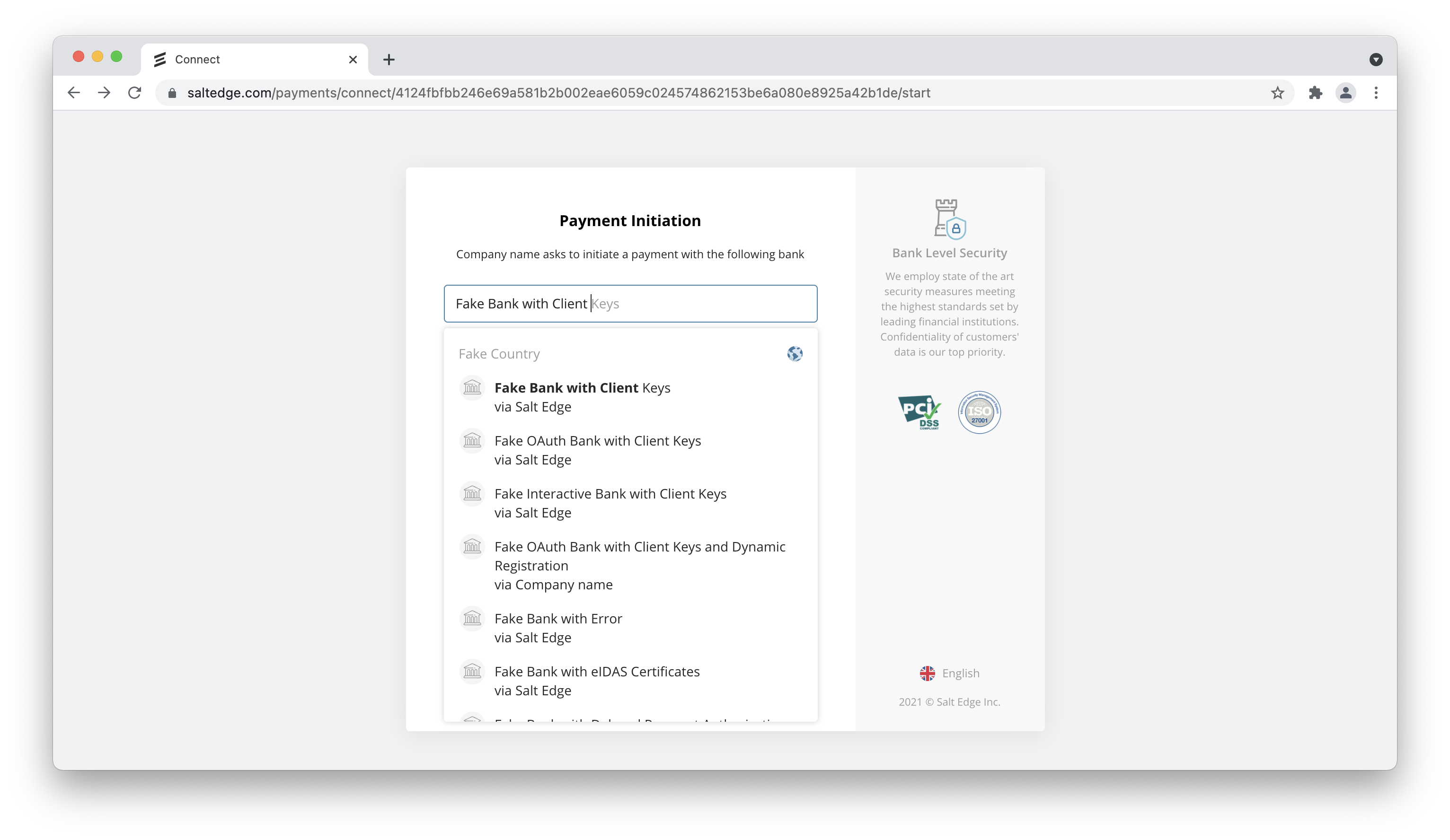

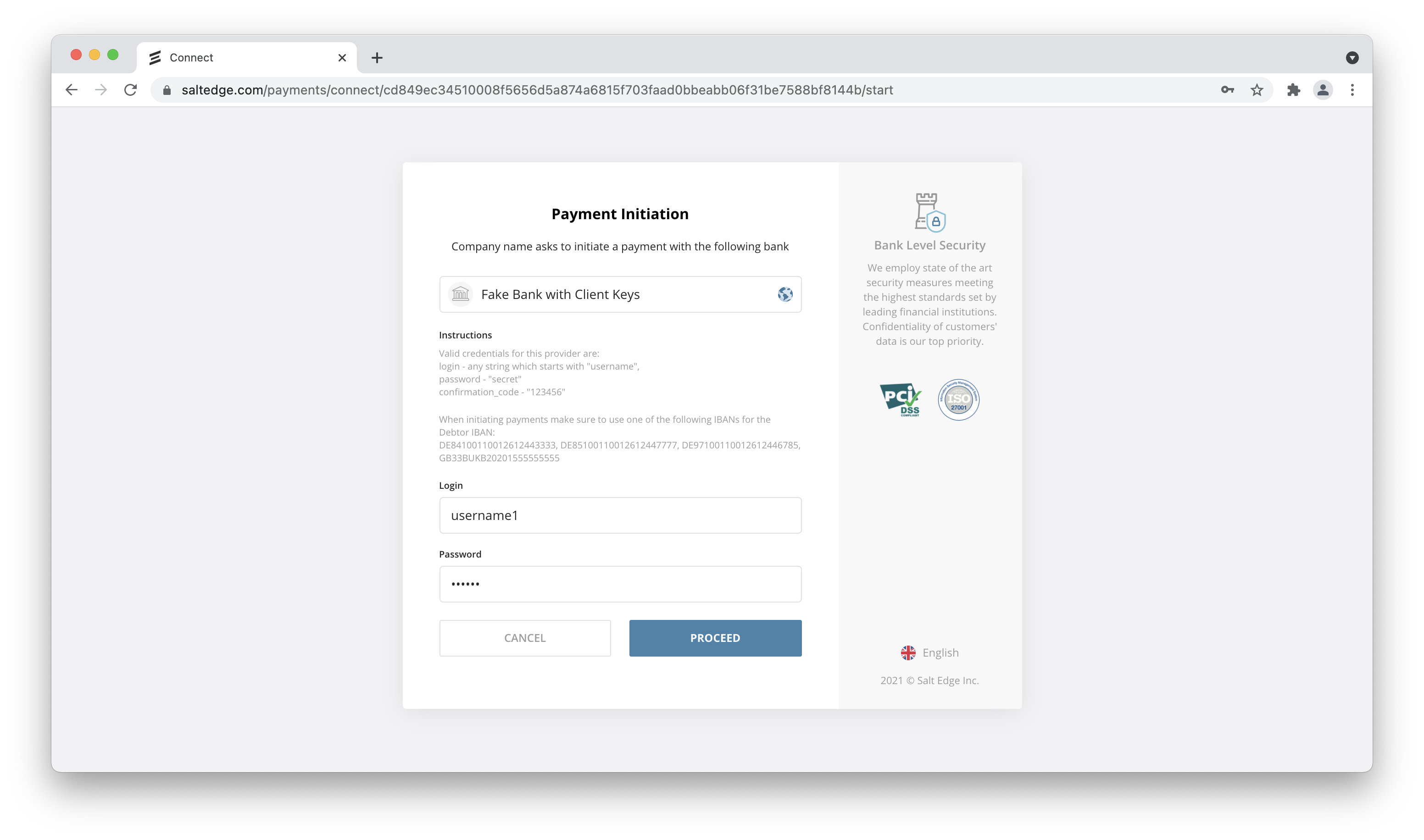

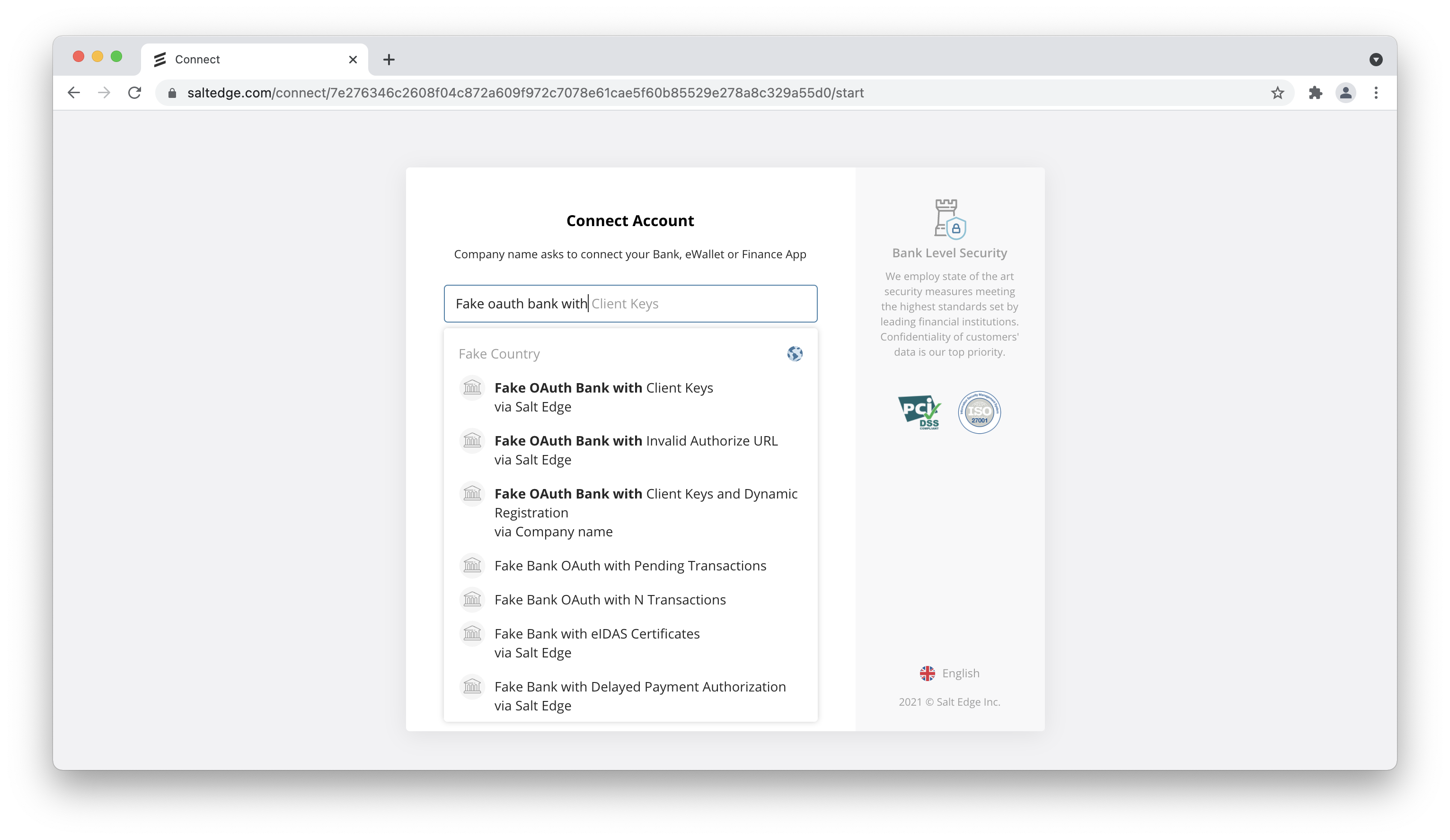

Visit the connect_url from the previous API response. You will be presented with a form for user credentials input. Put “fake” in search and choose a Fake Bank:

Input username and secret as per the on-screen instructions and press Proceed.

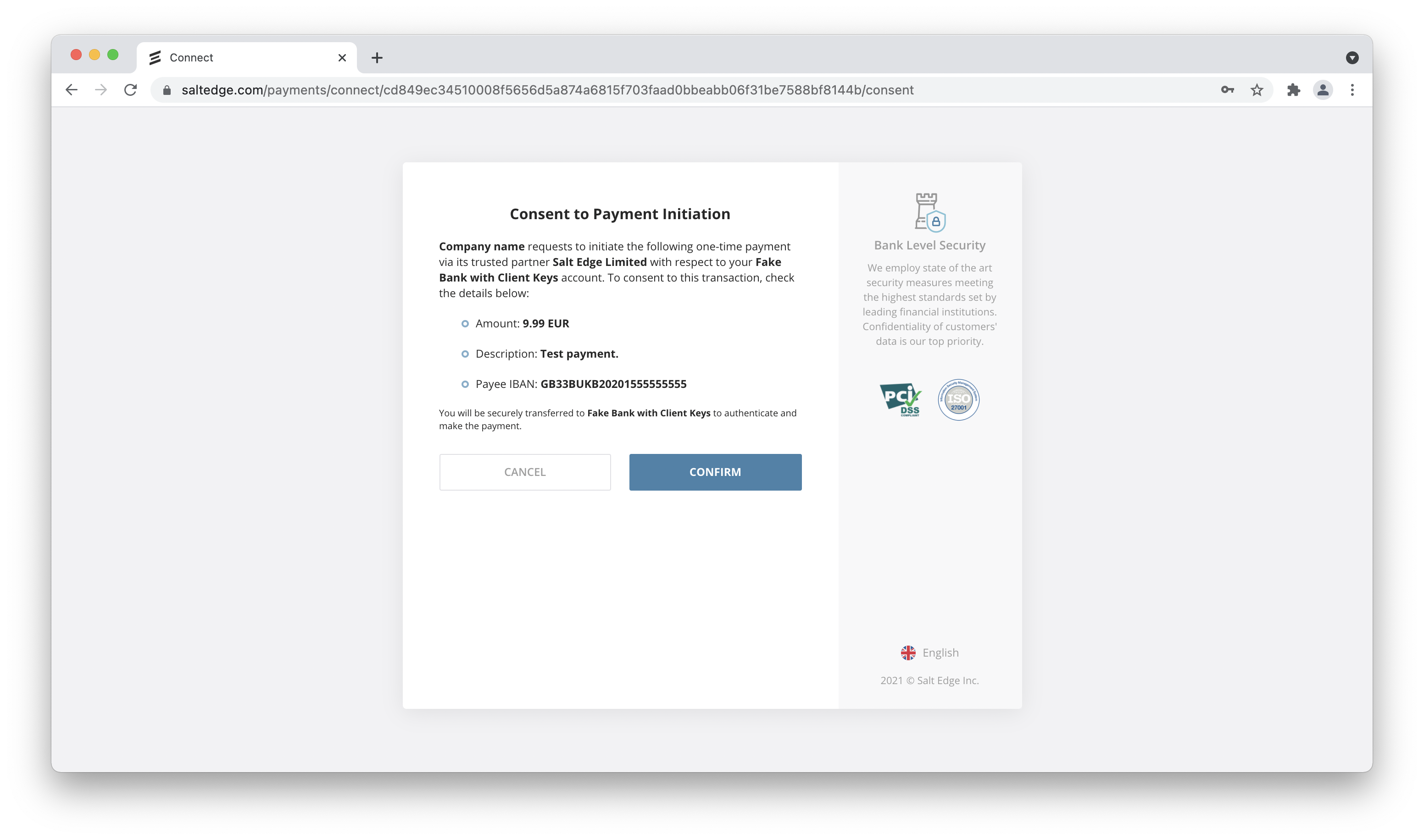

After that, you will see the consent window.

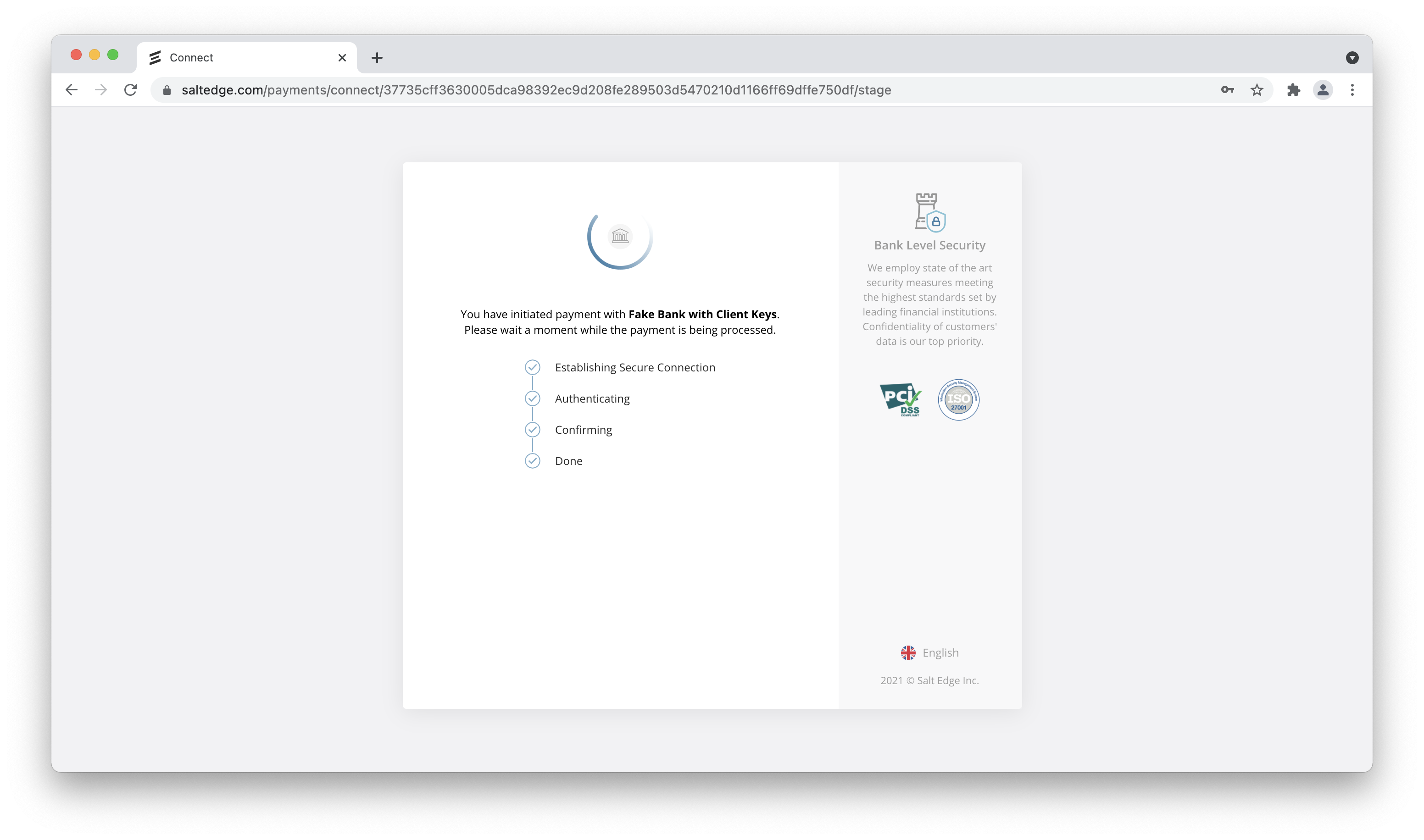

After confirming, it will start to initiate the payment.

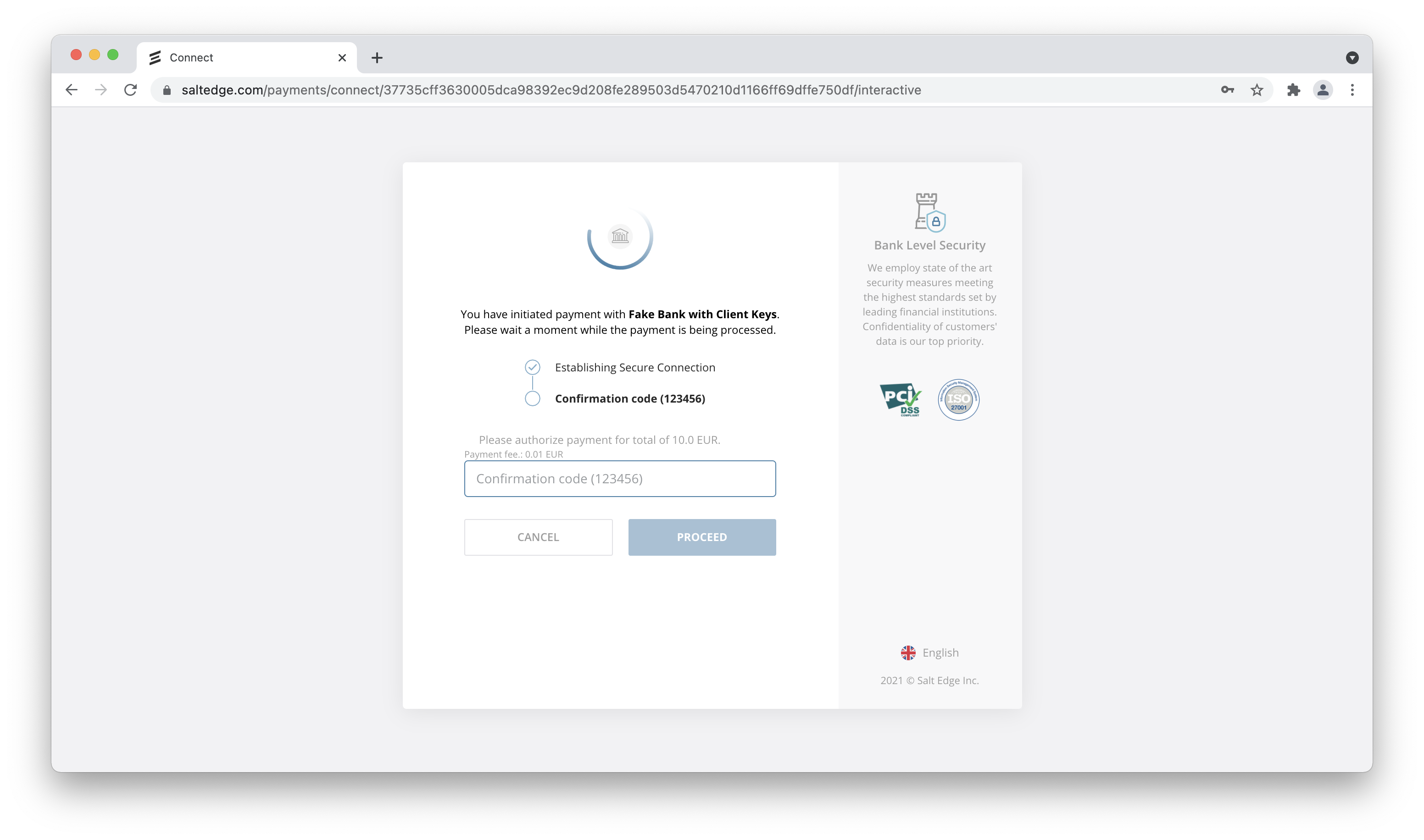

In case the provider has interactive fields, a form will be presented for filling these fields.

After that, we will have to wait for the payment process to finish.

Try in Postman

Step 1

Install Postman. You can get it on https://www.getpostman.com/apps.

Step 2

Import the postman collection, click the below button to do that.

Step 3

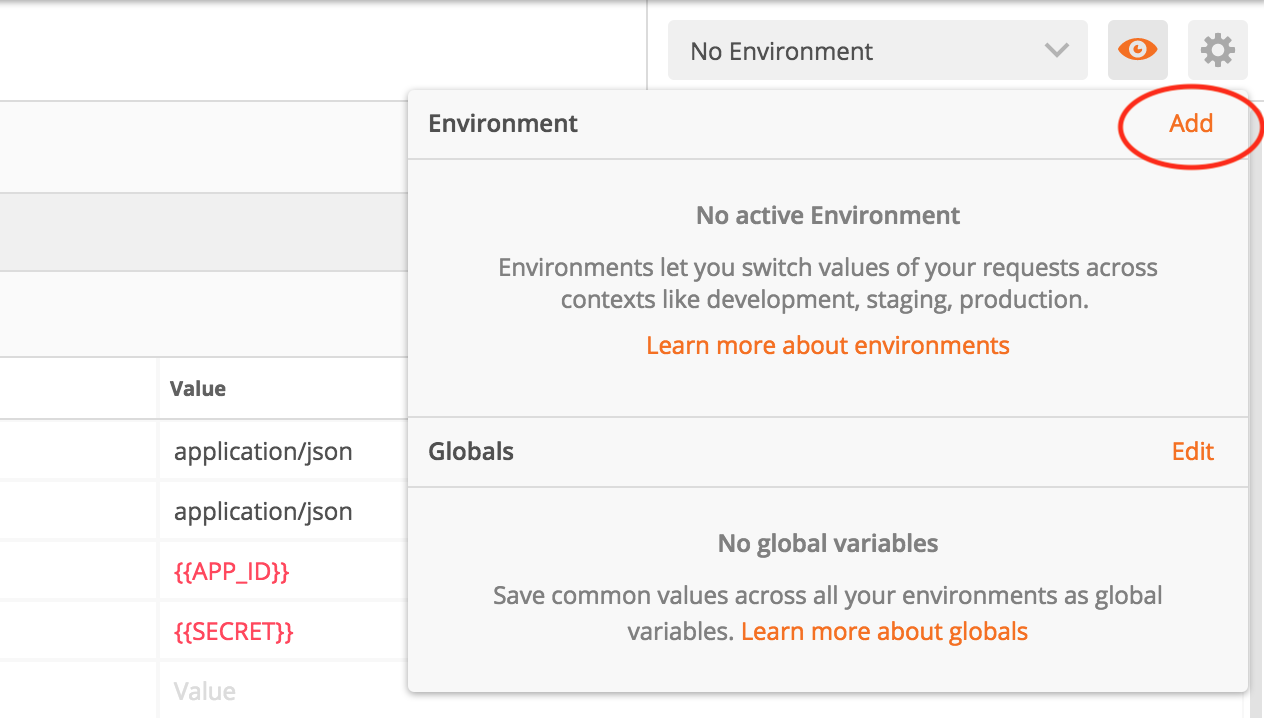

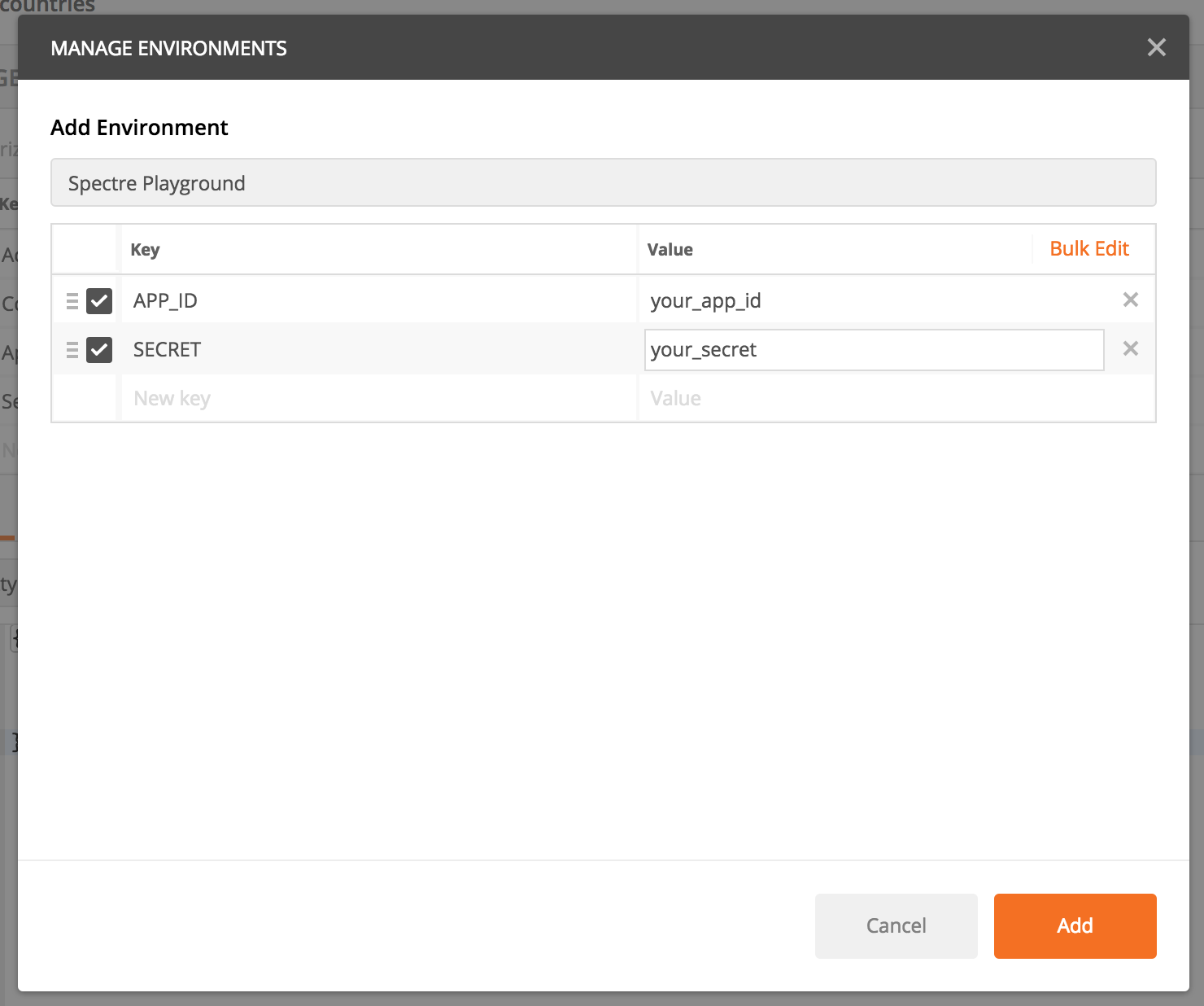

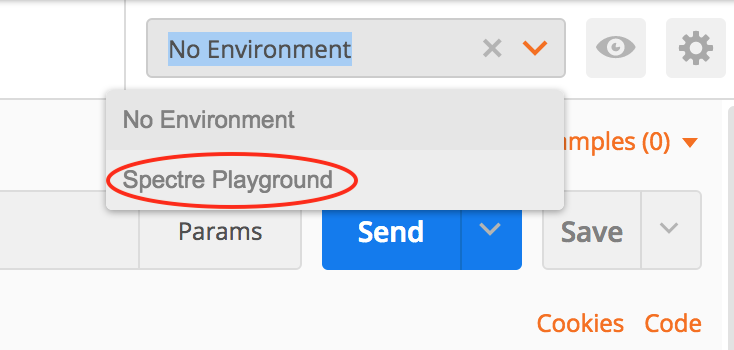

Payment Initiation API requires APP_ID and SECRET headers in order to authenticate its clients. If you don’t have an API key created yet, you can you use our quick start guide to help you create one. Once you have the API key created, you can add its secrets to postman.

Click on the eye on the top right corner and press on “Add” next to “Environments”.

Define variables APP_ID and SECRET with values from the key that you generated on Keys and Secrets page, then add the environment.

Once added, you can select it in the top right corner, and all the requests to Payment Initiation API will be authenticated using your API key.

eIDAS Certificates

Open Banking Gateway supports only soft issued eIDAS certificates and Open Banking UK certificates.

For the purpose of identification, ASPSPs (Account Servicing Payment Service Providers) and TPPs (Third Party Providers) shall rely on using eIDAS (electronic Identification, Authentication and trust Services) Certificates for electronic seal and/or for website authentication. Identifying themselves is mandatory for all TPPs that wish to get access to ASPSP’s sandbox, live API, and/or to non-dedicated channel.

eIDAS Certificates are provided by Qualified Trust Service Providers (QTSPs) who are responsible for assuring the electronic identification of signatories and services by using strong mechanisms for authentication, digital certificates, and electronic signatures.

There are two types of eIDAS Certificates:

Qualified Website Authentication Certificates (QWAC)- identification at the transport layer. QWAC is similar to SSL/TLS with Extended Validation used in Internet for the same purpose. It is used for website authentication, so that ASPSPs and Third Party Providers (TPPs) can be certain of each other’s identity, securing the transport layer. TPP should present its QWAC client certificate towards an ASPSP. The ASPSP can choose between using the ASPSP QWAC server certificate or just an existing SSL/TLS certificate to receive the TPP’s identification request.Qualified Certificate for Electronic Seals (QSEAL)- identification at the application layer. It is used for identity verification, so that transaction information is protected from potential attacks during or after a communication. This means that the person receiving digitally signed data can be sure who signed the data and that it hasn’t been changed.

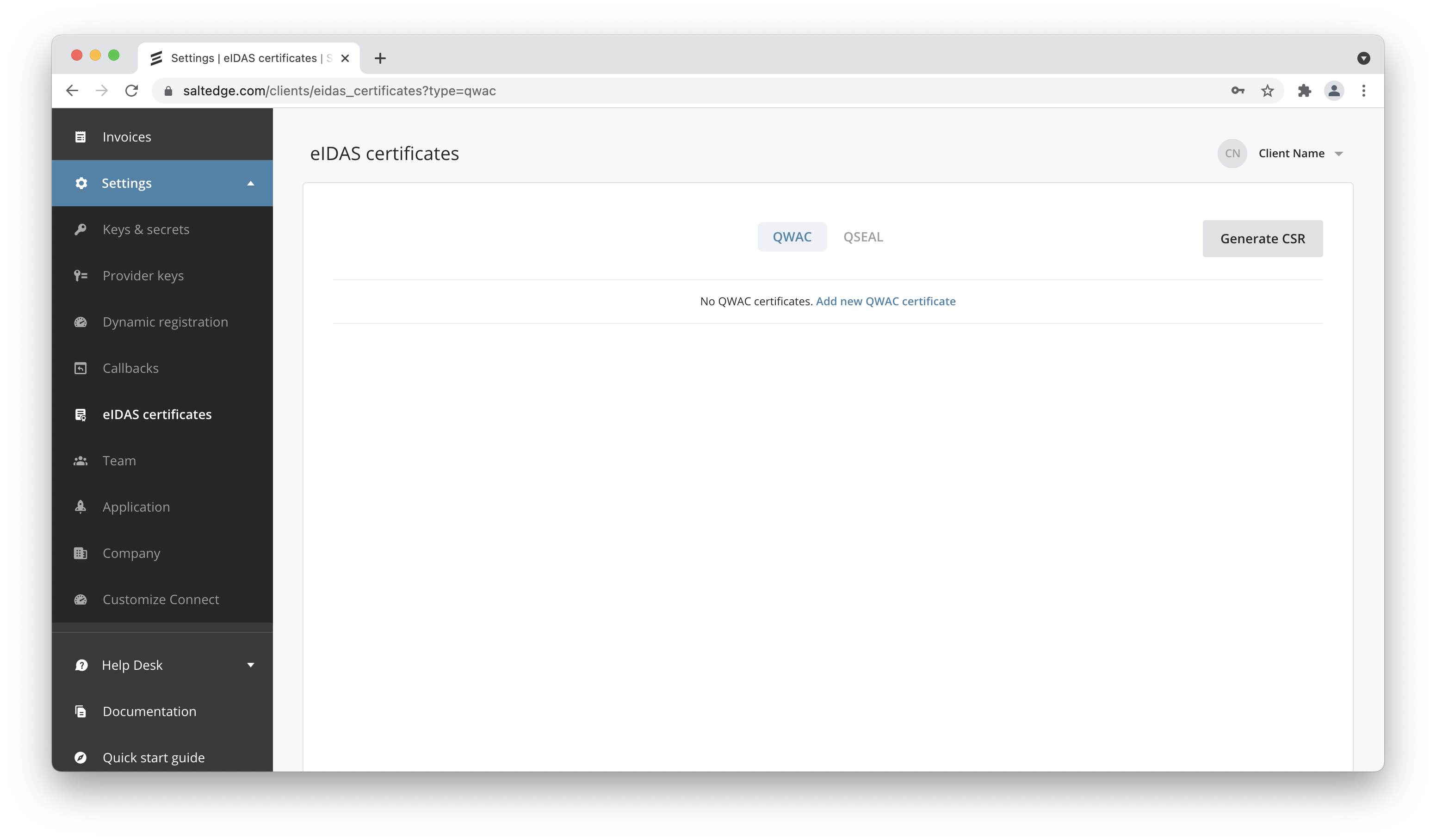

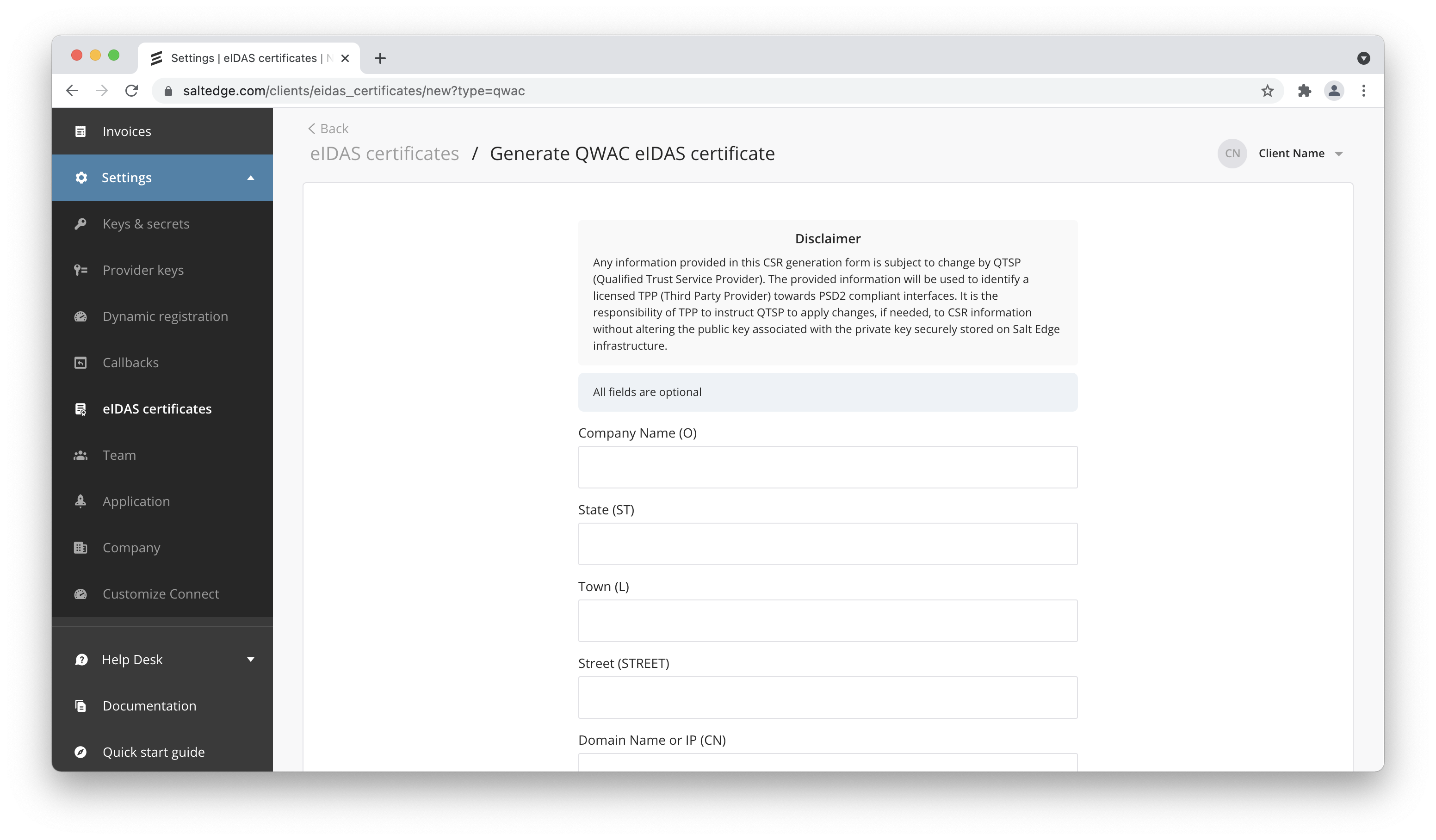

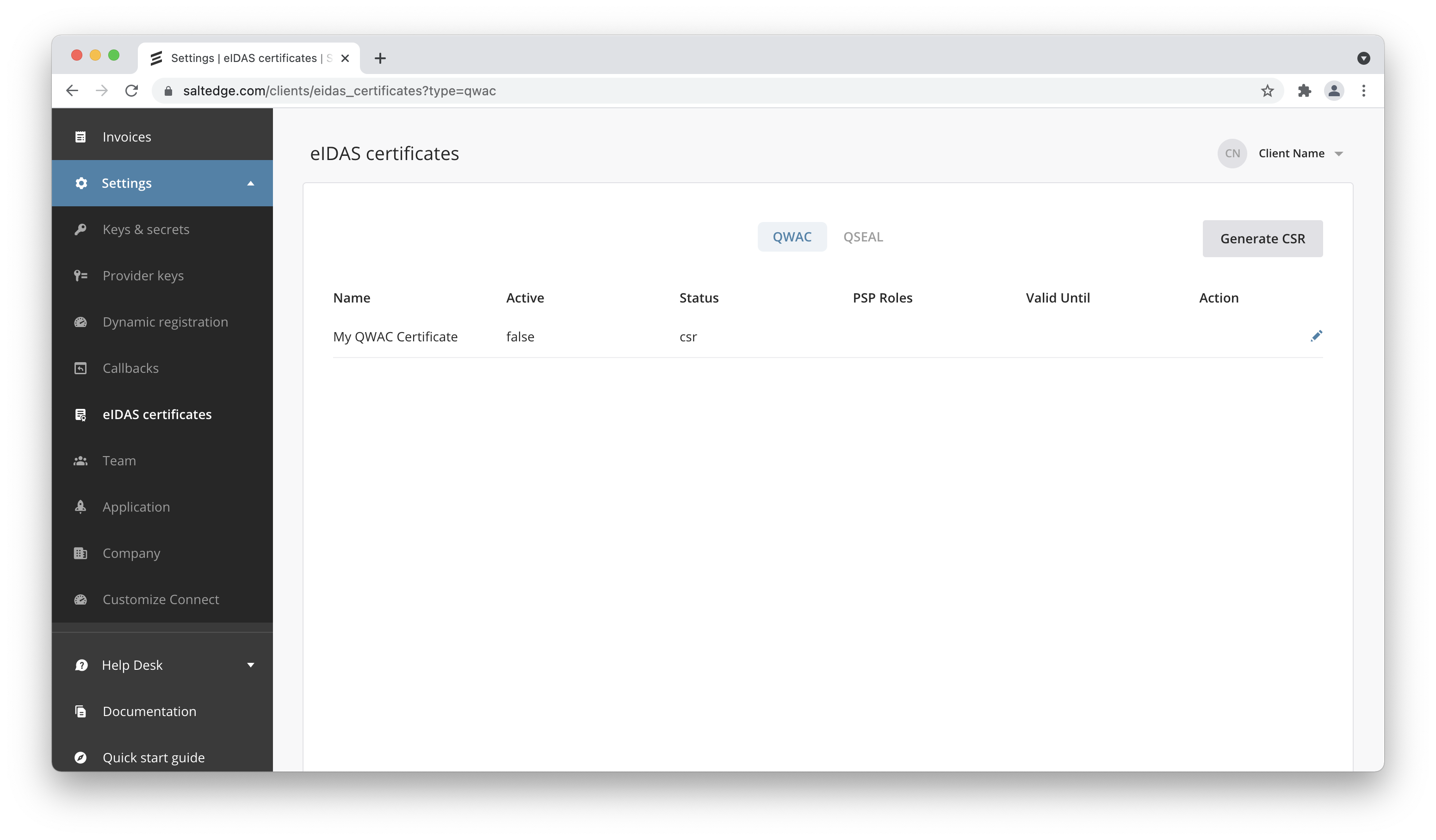

To create an eIDAS certificate in the Salt Edge system, you should accomplish the following steps:

a. Go to the Client Dashboard.

b. Go to Settings > eIDAS Certificates

c. Choose the certificate type you want to create (QWAC or QSEAL) and press Generate CSR.

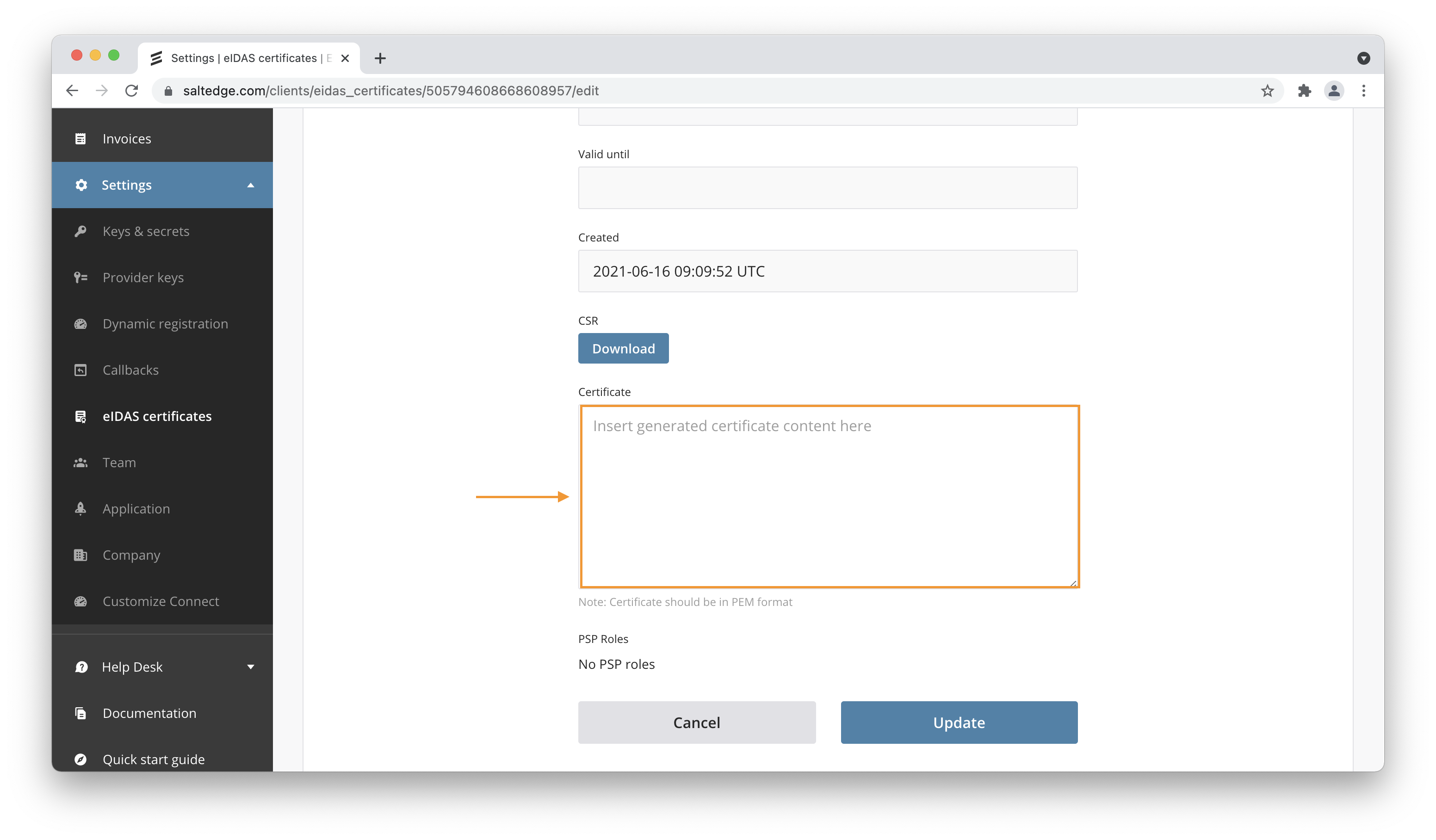

d. Send the CSR to the QTSP (you can get test certificate, or buy production certificate)

e. Get a signed certificate from the QTSP

f. Go to Settings > eIDAS Certificates and press edit on previously created record.

g. Insert the received certificate in PEM format into the form and press update.

h. Choose a certificate that you want to use for identification, press edit and mark it as active.

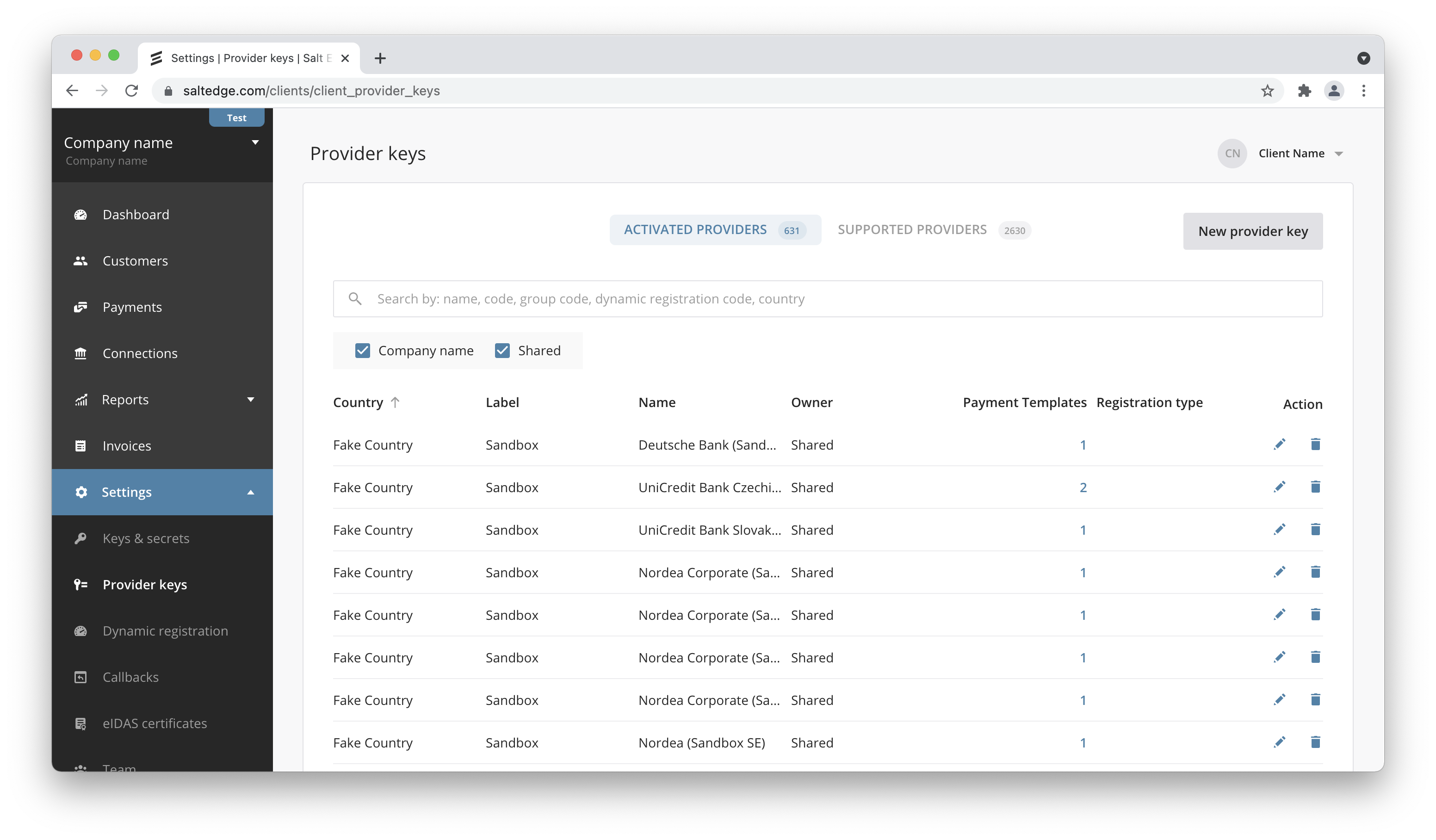

Client Provider Keys

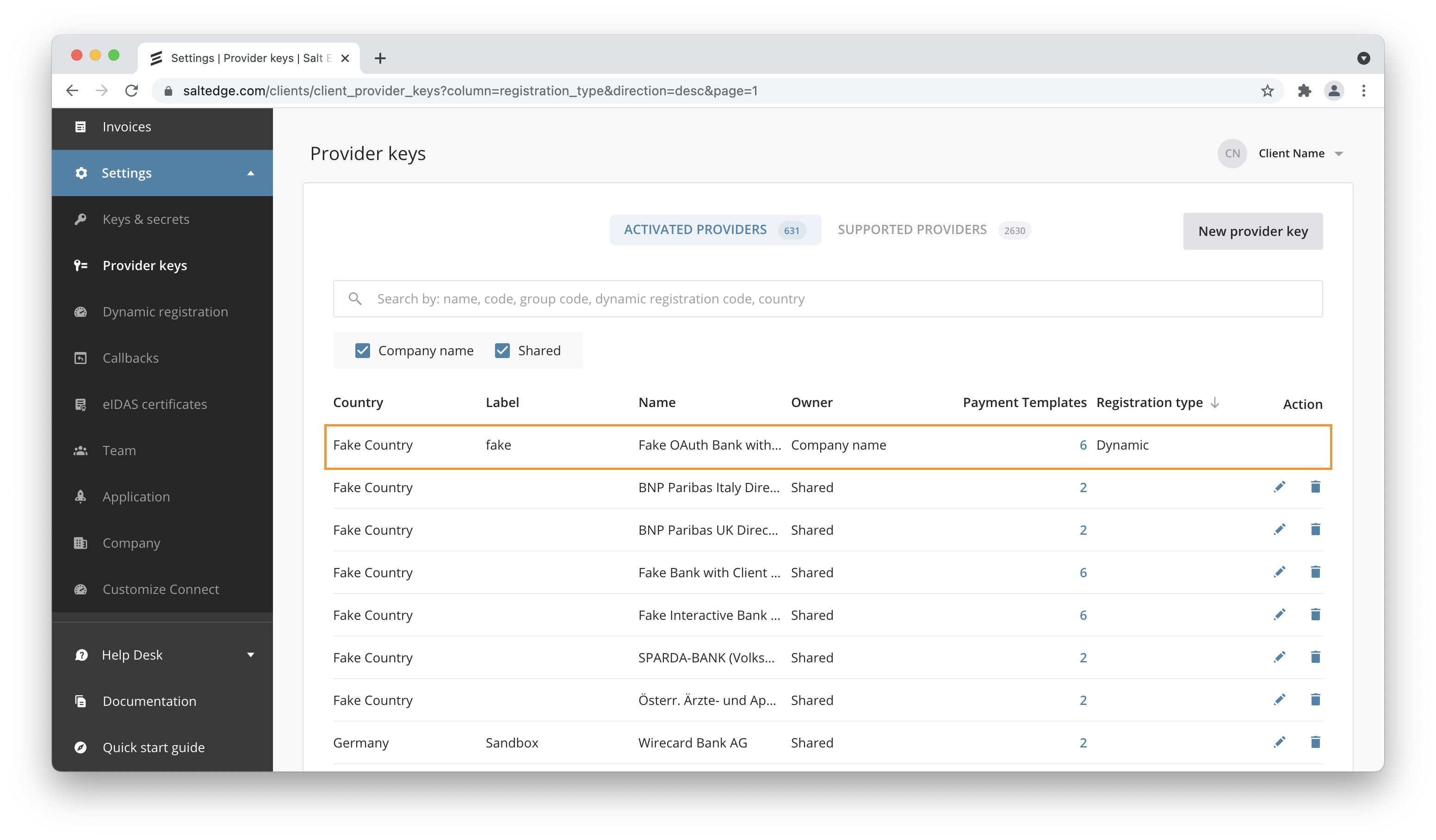

Open Banking Gateway now supports Account Information and Payment Initiation Services channels, which can be used with PSD2 and Open Banking compliant APIs. The connection to such a provider is possible only if you create a Provider Key (set of credentials) for it. In this case, the API keys for Providers are provided and controlled by you. The number of keys is restricted to 1 per provider. After you create the key, the provider will be accessible as an usual provider.

Salt Edge now supports eIDAS Certificates. Learn more.

Integration

To integrate your App’s individual keys with a Financial Provider (ASPSP in PSD2 terms), follow these steps:

- Visit Provider Keys page of your Client Dashboard, select a provider you want add your client keys for, read the instructions and complete the form. You can see all the available providers by going to the

Newtab on the same page;

- Proceed by visiting the Connect page and search the provider you just created the key for. It will have a small subscript below the provider name stating that this provider is accessed

via YOUR_CLIENT_NAME;

- The rest of the process is exactly the same as with usual providers.

Direct API - Salt Edge Connect

In case of using Direct API instead of Salt Edge Connect, it should be ensured that the code handles the new payments’s field nature - dynamic_select, with its options dynamically generated and sent in an Interactive callback.

Testing

For the purpose of testing individual keys Salt Edge has developed the following list of Fake providers:

fake_client_xf- requires a username and password (embedded);

Sample key:

client_id: "fake_client_id",

client_secret: "fake_client_secret"

fake_oauth_client_xf- asks for authorization (OAuth redirect);

Sample key:

client_id: "fake_client_id",

client_secret: "fake_client_secret"

fake_interactive_client_xf- asks to enter a fake captcha code in addition to a username and a password (embedded).

Sample key:

client_id: "fake_client_id",

client_secret: "fake_client_secret"

fake_interactive_decoupled_client_xf- decoupled interactive flow (e.g. push notification), asks to wait 10 seconds in Connect widget and then click Proceed to continue in addition to a username and a password (embedded).

Sample key:

client_id: "fake_client_id",

client_secret: "fake_client_secret"

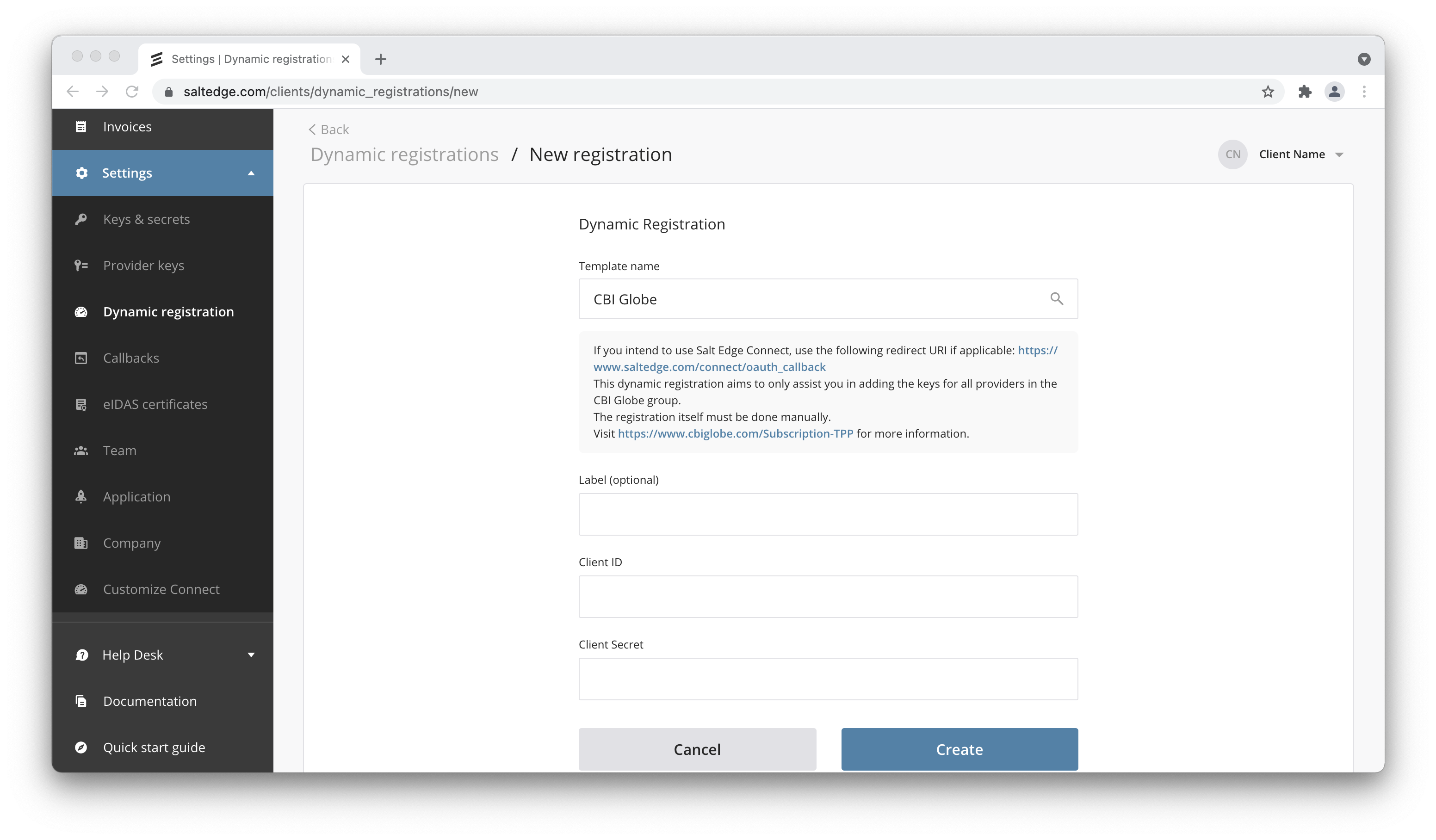

Dynamic Registration

Many banks provide the possibility to dynamically onboard in their API. In this context, Salt Edge has a self-service instrument called Dynamic Registration that helps its clients to register quicker with the desired banks’ PSD2 and Open Banking channels.

This type of registration can eliminate manual processes including the need to manually create an account in the bank’s developer portal, fill in of data forms, and lengthy emails exchange with the bank.

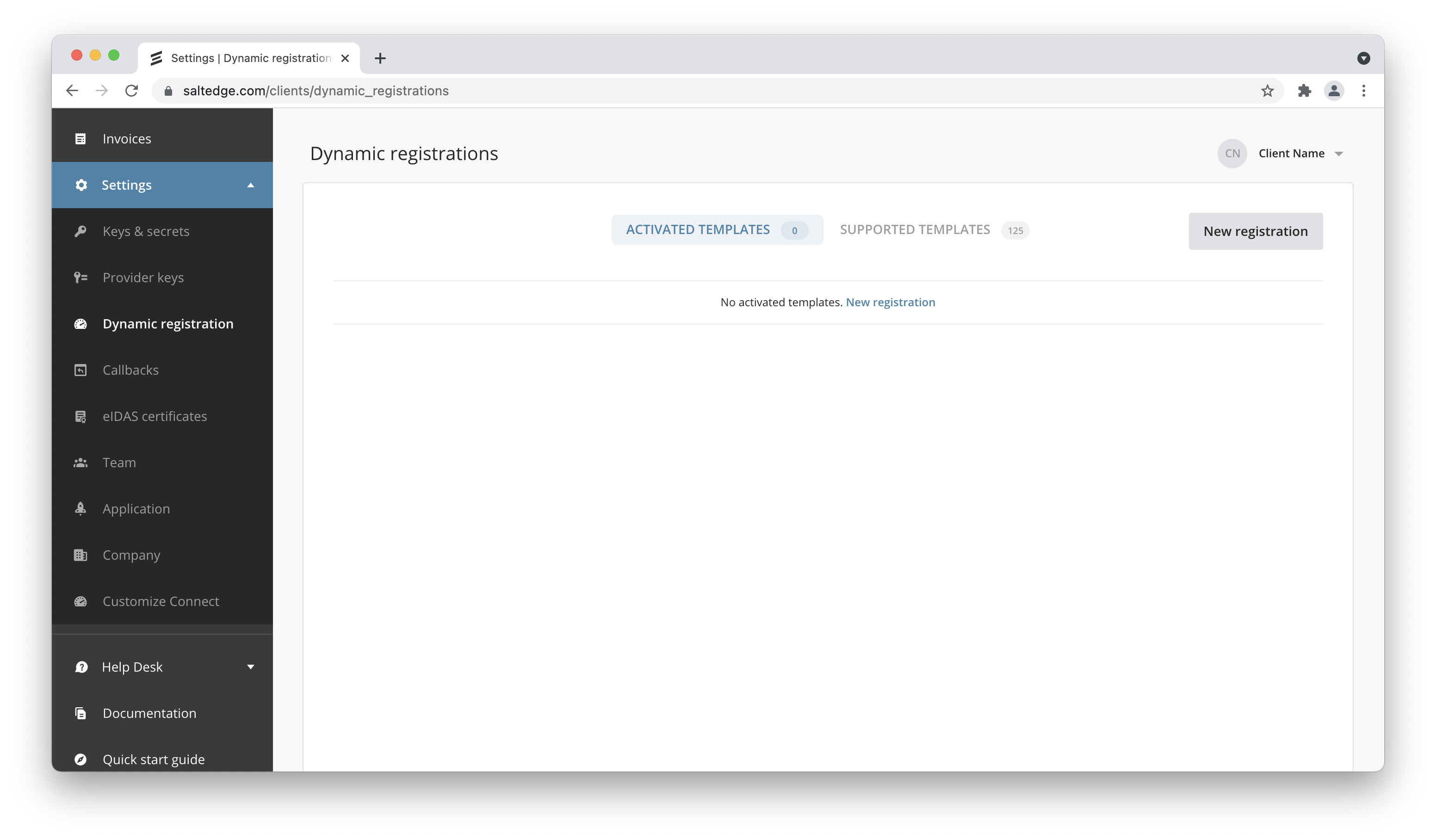

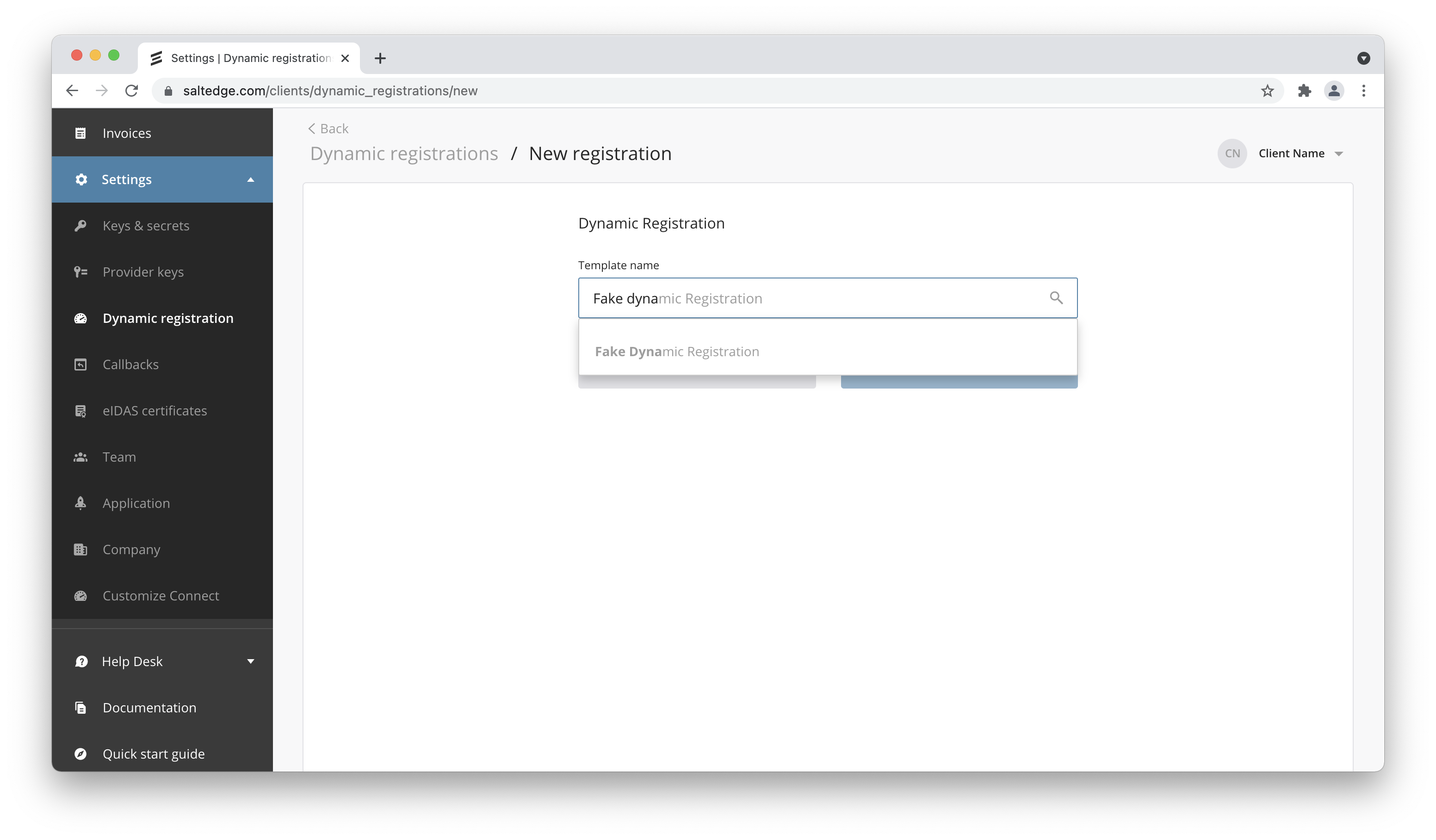

To find out if a bank has a dynamic registration on Salt Edge’s side, please follow these steps:

a. Sign in to Client Dashboard.

b. Go to Settings >Dynamic registration.

c. Сlick on New registration and input the desired bank/group name, then complete the form.

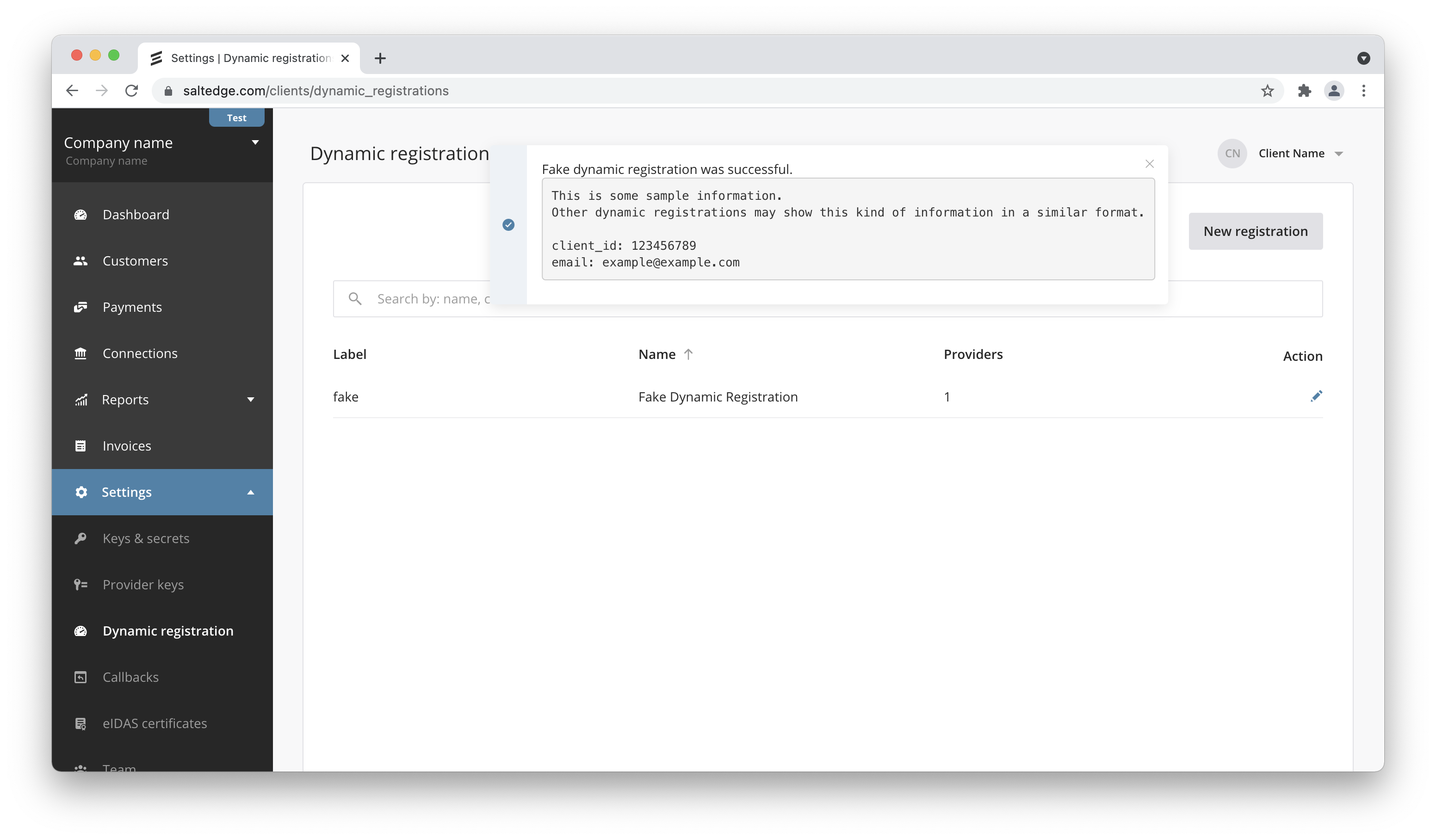

e. As a result, you will get a message with the status of Dynamic Registration.

f. On your Provider Keys page all the providers related to that Dynamic Registration will now appear. You will also notice that they’re categorized as Dynamic registration type.

Types of Dynamic registration

Salt Edge supports the following types of dynamic registration:

Dynamic registration that executes an API request

This is the base dynamic registration aimed at consuming the registration API implemented by the bank. Currently, this dynamic registration is separated into three subtypes:

- A registration endpoint that will create a new client and/or application on the bank’s side;

- An API endpoint that will update the eIDAS certificates associated with an already registered TPP;

- A validation endpoint that only verifies the validity of the eIDAS certificate.

Dynamic registration that doesn’t execute an API request

This type of dynamic registration does not contain any request to the bank, and its purpose is solely to help Salt Edge’s clients to add multiple client provider keys at once without the need to do it manually.

For example, the dynamic registration CBI Globe will add the client provider keys to 300+ providers, which means Salt Edge’s clients won’t need to do it manually for every provider separately.

Instruction

Every dynamic registration template contains an instruction which provides more details about its purpose and what additional steps must be done.

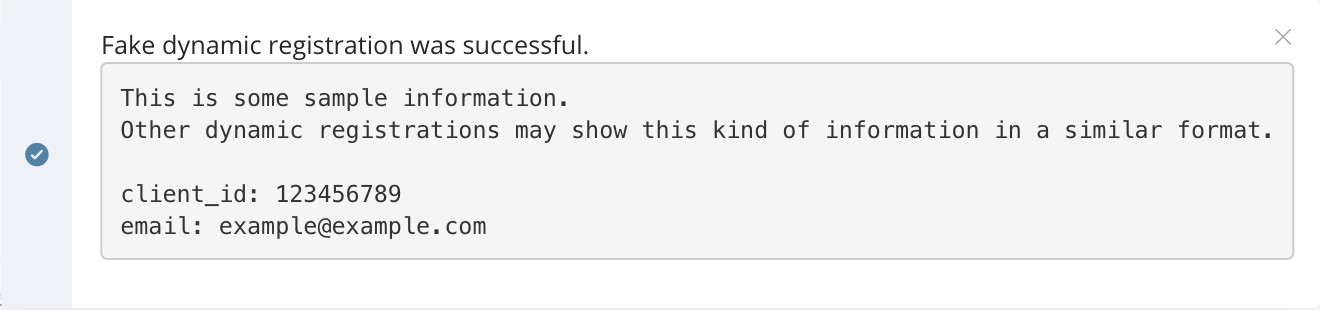

Dynamic registration result

Any dynamic registration attempt will result in one of the following:

Successful registration

A pop-up window with a confirmation message will be displayed. The client should save the displayed result for future reference and use.

The Client Provider Keys will be automatically added to all the associated providers.

Note: Sometimes the clients are required to perform additional steps after a successful registration. All additional information will be displayed in the pop-up window or in the initial instruction.

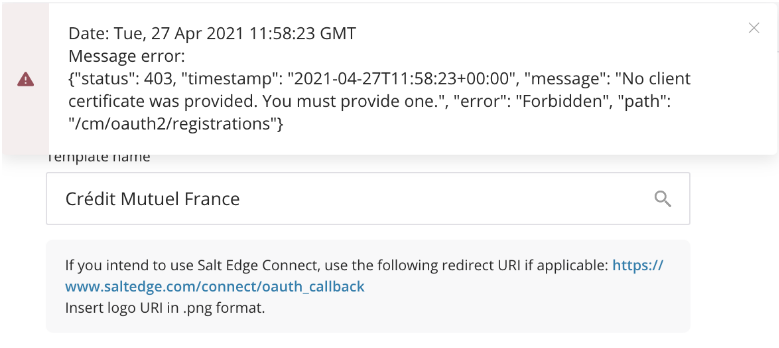

Failed registration

A pop-up window with the error’s details will be displayed.

If the error was raised by the bank and Salt Edge didn’t handle this error yet, the pop-up window will contain also the Date of the request and the response Salt Edge received from the bank.

Depending on the nature of the error, Salt Edge’s clients will have to:

- Adjust some of the information they input in the required dynamic registration fields;

- Address the issue with their Salt Edge representative;

- Contact the bank directly to report the problem.

Most common dynamic registration errors

Validation of the certificates failed

Possible error messages:

- Validation of QWAC failed

- Validation of QSealC failed

- Check on EBA register failed

The bank didn’t accept the TPP’s eIDAS certificates or EBA register check has failed. Hence, the TPP should contact and ask the bank to add their certificate in the bank’s trust store. If this is not the case, the bank will investigate additionally why the certificates were not accepted.

TPP already registered

Possible error messages:

- TPP Application was already registered

- Organization already exists

The TPP is already registered in the bank’s system, either using manual process or via Salt Edge. Hence, the TPP should contact the bank and clarify how to solve the encountered problem. The solution can differ depending on the bank.

Before going LIVE

In order to upgrade your Client account status to LIVE mode, the following steps should be followed:

- Be sure to provide the signature in accordance with the instructions.

- Your application should handle correctly a few fake banks (

fake_oauth_client_xf,fake_client_xfare mandatory). - The Two-factor authentication must be enabled for your account and all your teammates;

- Be sure to indicate

Incident reporting Emailin the dashboard settings on the Company page. - Perform at least one successful payment initiation test with each provider from your key market.

After your Account Manager at Salt Edge has reviewed the app’s integration with Payment Initiation API and made sure that payment initiation tests were successfully performed, the account’s status will be upgraded to live.

Salt Edge Connect

The most simple and easy way to execute payments in Payment Initiation API is to use Salt Edge Connect.

Salt Edge Connect is a web page that handles all the user interaction during a payment initiation process:

- user credentials input

- interactive confirmation

- progress reporting

- error reporting

After your application has received an URL for executing a payment using Salt Edge Connect, you can redirect your end-user to it. There, they will see a screen that lets them pick a provider to execute a payment.

Your user will also be asked to input credentials and, if needed, any of the interactive credentials.

After the process is done, the user will be redirected back to your application URL, or to the URL

specified as return_to argument to create payment endpoint.

You can easily test Connect from your Dashboard

page by pressing New Payment button or by using the create payment route.

Embed connect in your app

At the moment, the only way to embed Salt Edge Connect in your application is to open it in a pop-up.

When opening it in a pop-up using window.open, it will post notifications during the payment process.

To enable these notifications when you request an URL for executing payments, you can pass an optional argument javascript_callback_type with the value post_message.

This tells Salt Edge Connect to use postMessage for sending messages to a parent window.

You can then subscribe to those messages by calling window.addEventListener("message", callback) in the parent window.

Sample Request

window.addEventListener("message", function(event) {

console.log(JSON.parse(event.data))

}

)

Sample Response

{

data: {

payment_id: "131313131313131313",

custom_fields: {},

stage: "start",

status: "processing"

}

}

Callbacks

The most important parts of Payment Initiation API (e.g. Payment initiation) are asynchronous.

Every Web application has to provide a set of valid URLs which will be used to notify about the payment progress. Other applications can poll Payment Initiation API in order to retrieve the current payment status.

There are several common points about the request we send to the callback URLs provided by the client:

- The

Content-Typeheader isapplication/json; - There is a

Signatureheader that identifies the request was signed by Payment Initiation API; - The request method is always

POST; - The JSON object sent will always have a

datafield; - The

metafield will display the version of the callbacks API.

You can set the callback URLs for your application by accessing your Payment Initiation tab on the callbacks page.

Due to security reasons, the callbacks can be sent to ports 80/HTTP (in test and pending modes) and 443/HTTPS (in test, pending and live modes) only!

Also, the callbacks do not follow redirects.

Signature

In order for the client to identify that the request is coming from Payment Initiation API, there is a Signature header in the request.

Signature - base64 encoded SHA256 signature of the string represented in the

form callback_url|post_body - 2 parameters concatenated

with a vertical bar |, signed with a Payment Initiation API’s private key. You can find the version of the signature key used to sign the callback in the Signature-key-version header. The current version is 4.0 which corresponds to the following public key:

-----BEGIN PUBLIC KEY-----

MIIBIjANBgkqhkiG9w0BAQEFAAOCAQ8AMIIBCgKCAQEAzi1XL1b0XwUYVHj7/AR6

Hr0YN34wH/bDOIub0nwt0s/s3tD+DPxNB85xpMEZrLikPW5PAKkQ/oC3OyPYxKOb

8TNhzGmQhEfyCkbdRwxNZqRMRwuOc+N4sdBtQKPN8+XF3RIcRZAk25JGROtb1M2o

d/Nb9QqdQwMjdk6W+Vdq5Sj25Tj2efJc8zmBJkNXR4WtW45p4XSdjSEjuVCSZjOy

+N8/Od8MGixC99jYbiKm3RrVDJCgDi4YYnNRI0QgxZRpJKbQX/WeZiYOrbctG3m8

l1/Hpkv3w1QHz/YFIshCOKwUL+xg1hLMaW4IH7XFHenE+JlUKdCqhcWyi7oIDkyr

7wIDAQAB

-----END PUBLIC KEY-----

An example of the string that is to be used to generate the signature looks as follows:

https://www.client.com/api/payments/callbacks/success|{"data":{"payment_id":"131313131313131313","customer_id":"222222222222222222","custom_fields":{},"status": "processing"},"meta":{"version":"1","time":"2021-01-03T13:00:28Z"}}

The pseudocode that we use to generate the signature looks like this:

base64(sha256_signature(private_key, "callback_url|post_body"))

Success

We send a callback to your application’s success URL whenever an operation has caused a change in the data we store for a particular payment.

For instance, after you’ve redirected your users to the Connect page and they have selected a provider, gave consent and pressed Proceed, we’ll send you a success callback.

This callback will contain the customer identifier, the id of the newly created payment and its status.

Afterwards, your application will be able to use the show payment route and query the information about this payment.

Whenever there is more information about the payment, we will send another success callback.

A success callback marks a change in the data and you can generally expect from one to three success callbacks with the same payload within several minutes.

We recommend that your application fetch the full payment data at each callback, as some information might change during the fetching process.

For instance, when your user has initiated a payment using Salt Edge Connect, we will send the following success callback:

{

"data": {

"payment_id": "131313131313131313",

"customer_id": "222222222222222222",

"custom_fields": { "key": "value" },

"status": "processing"

},

"meta": {

"version": "1",

"time": "2025-07-01T07:10:57.764Z"

}

}

You can now use the show payment route and obtain the provider and some other attributes of the new payment.

Failure

Sometimes, a payment might fail to go through.

This might happen because for some reason it could not be performed.

In this case, you will receive a fail callback, containing a JSON similar to the following:

{

"data": {

"payment_id": "131313131313131313",

"customer_id": "222222222222222222",

"custom_fields": { "key": "value" },

"status": "rejected",

"error_class": "PaymentFailed",

"error_message": "Payment cancelled"

},

"meta": {

"version": "1",

"time": "2025-07-01T07:10:57.768Z"

}

}

After you get this callback, you need to request the payment to check for its updates.

Please note that even if there’s an error, the payment_id will still be stored.

Notify

After a new payment was created in the payment initialization process, Salt Edge can inform you about the payment’s progress via a notify callback.

Your app can expect the notify callback several times, but you can use this information to inform your end-user about the payment’s progress.

The possible stages sent in a notify callback are described here.

Here’s an example callback sent to the /notify route of your app:

{

"data": {

"payment_id": "131313131313131313",

"customer_id": "222222222222222222",

"custom_fields": { "key": "value" },

"stage": "submission",

"stage_id": "242424242424242424",

"status": "processing"

},

"meta": {

"version": "1",

"time": "2025-06-30T07:10:57Z"

}

}

For some of the payments you might not receive all the stages.

Interactive

Some of the providers require an additional step in the payment initialization process, asking users to input an SMS, Token, solve a CAPTCHA, etc.

Whenever we encounter that the payment initialization process requires an interactive step, we will send the interactive callback to the interactive route set in your app’s profile. Your app should prompt the users for the interactive credentials and send them to the confirm route.

We also send a snippet of HTML so that it would be easier for your app to display the CAPTCHA or image to the user.

If the provider requires filling a CAPTCHA, the img tag in the HTML will contain the image URL.

During this process, the payment’s stage will be set to interactive.

The interactive callback should contain the values of the interactive_credentials field

from the corresponding provider.

Here’s an example callback sent to your app’s /confirm route:

{

"data": {

"payment_id": "131313131313131313",

"customer_id": "222222222222222222",

"status": "processing",

"html": "<div id='interactive'><img src='https://docs.saltedge.com/images/saltedge_captcha.png' width='10' height='10' alt='some description' title='some description'></div>",

"stage": "interactive",

"stage_id": "242424242424242424",

"session_expires_at": "2025-06-30T08:10:57Z",

"interactive_fields_names": ["image"],

"custom_fields": { "key": "value" }

},

"meta": {

"version": "4",

"time": "2025-06-30T07:10:57Z"

}

}

Interactive Redirect

Some OAuth providers require 2 redirects for payment authorization. In these cases, for the 2nd redirect Salt Edge will send an interactive callback with redirect_url field:

{

"data": {

"payment_id": "131313131313131313",

"customer_id": "222222222222222222",

"status": "processing",

"html": "",

"redirect_url": "https://bank.com/authorize"

"stage": "interactive",

"stage_id": "242424242424242424",

"session_expires_at": "2025-06-30T08:10:57Z",

"interactive_fields_names": [],

"custom_fields": { "key": "value" }

},

"meta": {

"version": "4",

"time": "2025-06-30T07:10:57Z"

}

}

In these cases, your application should redirect the user to redirect_url field

value of the interactive callback payload. Once the end-users are authorized on the provider’s side, they will be redirected to the return_to URL indicated in the initiate payment request, with a bunch of parameters appended to it by the provider that are needed for authorizing the payment. Those parameters need to be sent to the payments confirm route as query_string field.

Errors

The Payment Initiation API can return multiple errors for any operation, each having its meaning and usage.

Attributes

error_class

string

The class of the error.

error_message

string

A message describing the error.

request

object

The body of the request that caused the error.

error_class

string

The class of the error.

error_message

string

A message describing the error.

request

object

The body of the request that caused the error.

Payment status

- failed - the payment failed due to an error on the bank’s side.

- unknown - the payment didn’t reach the

endstatus on the bank’s side. The status can beunknownuntil we get an updated status from the bank (eitherrejectedoraccepted). - rejected - the payment was rejected either by the user or by the bank. It can be rejected explicitly or due to different errors on the bank’s side.

- no payment object created - an error happened before the payment was created.

Error codes

[400] Bad Request

[404] Not Found

[406] Not Acceptable

[409] Duplicated

Sample response

{

"error_class": "PaymentNotFound",

"error_message": "Payment with id: '131313131313131313' was not found.",

"request": {

"id": "131313131313131313"

}

}

Bank integration layer

- Errors could take place either between Salt Edge and the bank, or on the bank’s end.

- Some of the errors are displayed to the end-users, while others are hidden.

- There are multiple reasons which cause the errors, for example, bank issues, incorrect user actions, invalid PSD2 access, etc.

ProviderErrorandExecutionTimeouterrors should be reported to Salt Edge.- The rest of the errors from the below table are caused by incorrect actions of end-users.

| Error class | HTTP code | Description | Payment status |

|---|---|---|---|

| ExecutionTimeout | 406 | It took too long to execute the payment | unknown |

| InteractiveAdapterTimeout | 406 | The customer hasn’t completed the interactive step of the payment in time | rejected |

| InvalidCredentials | 406 | The customer tried to initiate a payment with invalid credentials | rejected |

| InvalidInteractiveCredentials | 406 | The interactive credentials that were sent are wrong | rejected |

| PaymentFailed | 406 | Failed to create the payment for some reason | rejected |

| PaymentStatusUnknown | 200 | Payment status has not yet changed on the bank side. The status can be | unknown |

| PaymentValidationError | 406 | Failed to validate the payment for some reason | failed |

| ProviderError | 406 | There’s an error on the provider’s side which obstructs us from initiating the payment | failed |

Payments API Reference

- Errors can occur if the client configures API requests incorrectly.

- These errors are not displayed to end-users.

| Error class | HTTP code | Description | Payment status |

|---|---|---|---|

| ActionNotSupported | 406 | At least one of the current | no payment object created |

| CertificateNotFound | 400 | The current client does not have | no payment object created |

| CustomFieldsFormatInvalid | 406 | The | no payment object created |

| CustomFieldsSizeTooBig | 406 | The | no payment object created |

| CustomerLocked | 406 | The customer is locked. It can be unlocked | no payment object created |

| CustomerNotFound | 404 | A customer with such a | no payment object created |

| DateFormatInvalid | 400 | We have received an invalid Date format | no payment object created |

| DateOutOfRange | 400 | Sending a date value that does not fit in admissible range | no payment object created |

| DuplicatedCustomer | 409 | The customer you are trying to create already exists | no payment object created |

| IdentifierInvalid | 406 | An invalid identifier sent for creating a new customer | no payment object created |

| InvalidPaymentAttributes | 406 | Some of the passed payment attributes are invalid | no payment object created |

| PaymentAlreadyAuthorized | 406 | Request for authorizing the current payment has been already processed | does not change status |

| PaymentAlreadyFinished | 406 | The payment is already executed | does not change status |

| PaymentAlreadyStarted | 406 | The payment is in progress | does not change status |

| PaymentInitiationTimeout | 406 | The payment execution expired | unknown, will be overridden by ExecutionTimeout error |

| PaymentNotFinished | 406 | The payment has not finished yet | processing |

| PaymentNotFound | 404 | A payment with such attributes cannot be found | no payment object to check status |

| PaymentTemplateNotFound | 404 | The payment template does not exist | no payment object created |

| PaymentTemplateNotSupported | 406 | The chosen provider does not support the desired payment template | no payment object created |

| ProviderDisabled | 406 | The accessed provider is disabled | no payment object created |

| ProviderInactive | 406 | The accessed provider is temporarily inactive due to maintenance, or other temporary issue on the provider’s side | no payment object created |

| ProviderNotFound | 404 | Sending a | no payment object created |

| ProviderUnavailable | 406 | Unable to contact the provider in order to generate an | no payment object created |

| ReturnURLInvalid | 406 | Either | no payment object created |

| ReturnURLTooLong | 406 | The | no payment object created |

| ValueOutOfRange | 400 | Sending a value (e.g. | no payment object created |

| WrongProviderMode | 406 | The requested provider’s mode is neither | no payment object created |

| WrongRequestFormat | 400 | The | no payment object created |

Client Configuration

- Errors can happen if the client’s account isn’t configured properly.

- They will not affect payments as none of these errors will allow initiating a payment.

- These errors should be reported to Salt Edge.

| Error class | HTTP code | Description | Payment status |

|---|---|---|---|

| ApiKeyNotFound | 400 | The API key with the provided | no payment object created |

| AppIdNotProvided | 400 | The | no payment object created |

| ClientDisabled | 406 | The client’s account has been disabled | no payment object created |

| ClientNotFound | 404 | The API key used in the request does not belong to an existing client | no payment object created |

| ClientPending | 406 | The client’s account is in pending state | no payment object created |

| ClientRestricted | 406 | The client’s account is in restricted state | no payment object created |

| ConnectionFailed | 406 | Some network errors appear while fetching data | network issue, depends on the stage/status |

| ConnectionLost | N/A | Internet connection was lost in the process | no payment object created |

| ExpiresAtInvalid | 400 | The | no payment object created |

| InternalServerError | 500 | An internal error has occured | no payment object created |

| InvalidEncoding | 400 | Invalid JSON encoded values | no payment object created |

| JsonParseError | 400 | It was passed some other request format instead of JSON, or the body could not be parsed | no payment object created |

| MissingExpiresAt | 400 | The | no payment object created |

| MissingSignature | 400 | The | no payment object created |

| PaymentLimitReached | 406 | The client exceeded the number of payments allowed in | no payment object created |

| ProviderKeyNotFound | 404 | The chosen provider does not have provider keys | no payment object created |

| PublicKeyNotProvided | 400 | The public key was not specified on Keys & secrets page | no payment object created |

| RateLimitExceeded | 406 | Too many payments are being processed at the same time from one application (the same client account) | no payment object created |

| RequestExpired | 400 | The request has expired, took longer than mentioned in the | no payment object created |

| SecretNotProvided | 400 | The | no payment object created |

| SignatureNotMatch | 400 | The | no payment object created |

| TooManyRequests | 400 | Excessive number of requests have occured for initiating payments from one IP address in a small period of time | rate limit, depends on the stage/status |

FAQ

Can you set up scheduled payments for varied or fixed amounts?

Scheduled Payments support only fixed amounts under existing Payment Initiation API.

Do I need a PIS licence to initiate payments?

Yes, Salt Edge Clients should be authorized PISP in the UK and/or EU with a valid set of eIDAS (Open Banking UK) certificates.

Can I issue cross border payments?

Yes, depending on the ASPSP (Provider) API payment product availability.

Can a merchant be added as a trusted beneficiary?

Beneficiary APIs are currently available as premium APIs, with only a small number of banks supporting such functionality. Salt Edge plans to add support for Beneficiary APIs in the future.

Which banks can I use to make payments from a Business Account?

Providers with an supported_account_types array that includes business accounts.

How long will payments take to settle?

This strongly depends on the Payment Product, payment scheme and the ASPSP’s (Provider) internal process.

How can I reconcile a payment?

Using end_to_end_id and/or reference that you can receive via AISP APIs on the creditor account.

Do I need to onboard with each bank?

It depends on the ASPSP’s (provider’s) API. If it allows Dynamic Registration and onboarding using eIDAS or Open Banking UK certificates, Salt Edge provides a Dynamic Registration option in the Client Dashboard.

Otherwise, you will need to register and onboard with each ASPSP (Provider) manually and upload the required information to the Provider keys section of the Client Dashboard. For more information, please refer to the Client Provider Keys section.

How do I register several applications?

By Signing Up multiple Client Accounts. We are looking to provide Application Management from the Client Dashboard during 2021.

How and when do I get a payment_id?

When creating a Payment Order, you need to populate Payment attributes which include a mandatory field as the end_to_end_id, which will be sent to the ASPSP Payment Initiation endpoints. Once the Payment Order is accepted by the Debtor ASPSP for execution, the same end_to_end_id will be sent to the Creditor ASPSP as a part of remittance information. Each Payment Order is also associated with a Salt Edge payment_id to allow listing payments with all associated payment attributes.

Do I have to send the provider_code for each payment request?

Payment Initiation API is not linked to existing connected banks of the Customer.

You need to provide the provider_code if you are trying to execute a payment from a Bank or connection known by the Customer.

What is the difference between optional and required payment fields?

Required fields are mandatory for a payment to be initiated, while optional fields are supported by the provider for additional information. If optional fields are passed, however, they not even present in the optional_payment_fields, they will be logged on our side, but not used for payment initiation.

Why the very same payment template can have different sets of required and optional payment fields for different providers?

Depending on the standard the bank implemented PISP and functionality it decided to expose, the set of required and optional fields for a payment template can vary for different providers. Some optional fields from a template may become required for a specific provider.

What are the recommendations for the description field?

Most ASPSPs have certain limitations in place when it comes to the formatting of the unstructured payment remittance information (description). Using alphanumeric characters along with ., ,, -, /, ?, (, ), +, ' and spaces as well as keeping the length of the description under 1000 characters should be a safe approach for most ASPSPs (RegExp: /[A-Za-z0-9.-,()+'? ]{2,1000}/). ASPSPs may extend these constraints depending on their core banking system, payment schema and other relevant factors.

How cross-border payments work in Fiducia hub?

At this moment there is no possibility to do a full check prior to the payment initiation whether the payment goes under SEPA or cross-border payment schemes with Fiducia hub providers.

This is how SEPA and cross-border payments are handled on Fiducia’s end:

In principle, a distinction must be made between a normal SEPA credit transfer and a foreign credit transfer. This distinction is to be made on the part of the third party provider and not on the part of the third party provider interface.

The following specifications apply to a SEPA credit transfer:

- Payment in Euro

- IBAN of the beneficiary is available

- The beneficiary’s bank is located in the SEPA area and can be reached via SEPA.

- Fee regulation: Shared (SHA), i.e. the fees are shared

If one of the criteria is not met, a SEPA credit transfer is no longer possible, only a cross-border transfer.

Example: A payment is to be made to a beneficiary in France, but in US dollars or with a special fee regulation/instruction, or only one account number is known for the beneficiary, etc.

On Salt Edge’s end SEPA and cross-border payments are handled under SEPA and SWIFT payment templates correspondingly.

Considering there are payment conditions and criteria which can’t be controlled or influenced by TPPs, if the criteria are not met according to the response received from the bank during payment initiation, Salt Edge will return the following errors:

1) PaymentFailed with the message Cross Border Payment is not supported. Please retry using SEPA payment scheme.

2) PaymentFailed with the message Please retry using the cross-border (SWIFT) payment scheme.

api

Pay with Connect

The easiest way to initiate payments using Payment Initiation API is to use Salt Edge Connect, which handles all the authentication interaction with the user.

After the request is executed, you will receive a connect_url field, which the user should be redirected to in order to process with the payment flow.

Please see the sequence diagram for details on how to handle payments via Connect.

Parameters

provider_code

string, optional

The code of the desired provider. To access the list of providers that support payments, see providers list. If passed, make sure the chosen provider supports the desired payment template.

Even though the provider_code is an optional field, its absence during payment initiation may lead to the following outcomes:

- The end-user may choose a provider that does not support the payment template the client has passed to Salt Edge. This will result in an error.

- The end-user may choose a provider that has additional

required_payment_fields. Absence of required payment attributes during payment initiation will result in an error.

payment_attributes

object

All the attributes (required and optional) that are needed for a successful payment initiation received in show templates

return_to

string, optional

The URL the user will be redirected to. Defaults to the client's home URL

show_consent_confirmation

boolean, optional

If sent as false, upon submitting the form, the end-user will not be asked to give consent to Salt Edge. Defaults to true.

disable_provider_search

boolean, optional

If sent as true, together with provider_code, does not allow the end-user to change the preselected provider. Defaults to false.

javascript_callback_type

string, optional

Allows you to specify what kind of callback type you are expecting. Possible values: post_message. Defaults to null.

return_payment_id

boolean, optional

Whether to append payment_id to return_to URL. Defaults to false.

return_error_class

boolean, optional

Whether to append error_class to return_to URL. Defaults to false.

locale

string, optional

The language of the Payments Connect widget and of the returned error message(s) in the ISO 639-1 format. Possible values are: bg, cz, de, en, es-MX, es, fi, fr, he, hr, hu, it, nl, pl, pt-BR, pt, ro, ru, si, sk, sv, tr, uk, zh-HK(Traditional), zh(Simplified). Defaults to en.

country_code

string, optional

Returns the list of providers only from given country. Possible values: any country code from ISO 3166-1 alpha-2, e.g.: 'DE'. Defaults to null.

custom_fields

object, optional

A JSON object, which will be sent back on any of your callbacks

provider_code

string, optional

The code of the desired provider. To access the list of providers that support payments, see providers list. If passed, make sure the chosen provider supports the desired payment template.

Even though the provider_code is an optional field, its absence during payment initiation may lead to the following outcomes:

- The end-user may choose a provider that does not support the payment template the client has passed to Salt Edge. This will result in an error.

- The end-user may choose a provider that has additional

required_payment_fields. Absence of required payment attributes during payment initiation will result in an error.

payment_attributes

object

All the attributes (required and optional) that are needed for a successful payment initiation received in show templates

return_to

string, optional

The URL the user will be redirected to. Defaults to the client's home URL

show_consent_confirmation

boolean, optional

If sent as false, upon submitting the form, the end-user will not be asked to give consent to Salt Edge. Defaults to true.

disable_provider_search

boolean, optional

If sent as true, together with provider_code, does not allow the end-user to change the preselected provider. Defaults to false.

javascript_callback_type

string, optional

Allows you to specify what kind of callback type you are expecting. Possible values: post_message. Defaults to null.

return_payment_id

boolean, optional

Whether to append payment_id to return_to URL. Defaults to false.

return_error_class

boolean, optional

Whether to append error_class to return_to URL. Defaults to false.

locale

string, optional

The language of the Payments Connect widget and of the returned error message(s) in the ISO 639-1 format. Possible values are: bg, cz, de, en, es-MX, es, fi, fr, he, hr, hu, it, nl, pl, pt-BR, pt, ro, ru, si, sk, sv, tr, uk, zh-HK(Traditional), zh(Simplified). Defaults to en.

country_code

string, optional

Returns the list of providers only from given country. Possible values: any country code from ISO 3166-1 alpha-2, e.g.: 'DE'. Defaults to null.

custom_fields

object, optional

A JSON object, which will be sent back on any of your callbacks

Possible Errors

| Error class | HTTP code | Description |

|---|---|---|

| ActionNotSupported | 406 Not Acceptable | At least one of current eIDAS certificates does not have the |

| CertificateNotFound | 400 Bad Request | Current client does not have QWAC and QSEAL certificates |

| CustomerLocked | 406 Not Acceptable | If current customer is locked. It may be unlocked |

| InvalidPaymentAttributes | 406 Not Acceptable | Some of the |

| PaymentTemplateNotSupported | 406 Not Acceptable | The |

| WrongRequestFormat | 400 Bad Request | The |

URL

https://www.saltedge.com/api/payments/v1/payments/connect

https://www.saltedge.com/api/payments/v1/payments/connect

Method

POST

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"customer_id\": \"222222222222222222\", \

\"provider_code\": \"fake_client_xf\", \

\"show_consent_confirmation\": true, \

\"template_identifier\": \"SEPA\", \

\"return_to\": \"http://example.com/\", \

\"payment_attributes\": { \

\"end_to_end_id\": \"#123123123\", \

\"reference\": \"p:131313131313131313\", \

\"customer_last_logged_at\": \"2020-07-12T13:48:40Z\", \

\"customer_ip_address\": \"255.255.255.255\", \

\"customer_device_os\": \"iOS 11\", \

\"creditor_name\": \"Jay Dawson\", \

\"creditor_street_name\": \"One Canada Square\", \

\"creditor_building_number\": \"One\", \

\"creditor_post_code\": \"E14 5AB\", \

\"creditor_town\": \"London\", \

\"creditor_country_code\": \"UK\", \

\"currency_code\": \"EUR\", \

\"amount\": \"199000.00\", \

\"description\": \"Stocks purchase\", \

\"creditor_iban\": \"GB33BUKB20201555555555\", \

\"mode\": \"normal\" \

} \

} \

}" \

https://www.saltedge.com/api/payments/v1/payments/connectcurl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"customer_id\": \"222222222222222222\", \

\"provider_code\": \"fake_client_xf\", \

\"show_consent_confirmation\": true, \

\"template_identifier\": \"SEPA\", \

\"return_to\": \"http://example.com/\", \

\"payment_attributes\": { \

\"end_to_end_id\": \"#123123123\", \

\"reference\": \"p:131313131313131313\", \

\"customer_last_logged_at\": \"2020-07-12T13:48:40Z\", \

\"customer_ip_address\": \"255.255.255.255\", \

\"customer_device_os\": \"iOS 11\", \

\"creditor_name\": \"Jay Dawson\", \

\"creditor_street_name\": \"One Canada Square\", \

\"creditor_building_number\": \"One\", \

\"creditor_post_code\": \"E14 5AB\", \

\"creditor_town\": \"London\", \

\"creditor_country_code\": \"UK\", \

\"currency_code\": \"EUR\", \

\"amount\": \"199000.00\", \

\"description\": \"Stocks purchase\", \

\"creditor_iban\": \"GB33BUKB20201555555555\", \

\"mode\": \"normal\" \

} \

} \

}" \

https://www.saltedge.com/api/payments/v1/payments/connectSample response

{

"data": {

"expires_at": "2025-07-01T08:10:57Z",

"connect_url": "https://www.saltedge.com/payments/connect?token=GENERATED_TOKEN"

}

}{

"data": {

"expires_at": "2025-07-01T08:10:57Z",

"connect_url": "https://www.saltedge.com/payments/connect?token=GENERATED_TOKEN"

}

}Pay with Direct API

If you wish to handle the credentials, consent and authorization for payments yourself, you can create payments directly via the API.

Create

Your app will have to pass the user’s values of provider’s fields within the payload in the credentials object.

Please note that you still have to use redirects (see OAuth in all cases when the provider mode is oauth).

The credentials object should be modeled after the provider’s fields.

For instance, if the provider’s required fields contain a field with the value of name equal to username, the credential object should contain a username attribute with the value being the actual username.

For example, here’s a provider:

{

"data": {

"code": "bigbank_us",

"required_fields": [

{

"english_name": "Pass Code",

"localized_name": "Pass Code",

"name": "code",

"nature": "text",

"position": 1

}

]

}

}

The user should be prompted to input Pass Code.

If they input Pass Code (in this case, “hunter2”), your app should send the following data in the credentials object:

{

"code": "hunter2"

}

Here’s another example that includes a select:

{

"data": {

"code": "anotherbank_us",

"required_fields": [

{

"english_name": "Password",

"localized_name": "Password",

"name": "password",

"nature": "password",

"position": 1

},

{

"nature": "select",

"name": "image",

"english_name": "Image",

"localized_name": "Imagine",

"position": 2,

"optional": false,

"field_options": [

{

"name": "1",

"english_name": "Home",

"localized_name": "Casa",

"option_value": "home",

"selected": false

},

{

"name": "2",

"english_name": "Car",

"localized_name": "Automobil",

"option_value": "car",

"selected": false

}

]

}

]

}

}

In this case, your app should prompt the user to input Password and offer selecting the options of “Casa” and “Automobil” (the localized_name or english_name values, depending on your service).

The credentials should contain the name of the select field (in this case image) as the key and the user’s selected option_value as its value.

Let’s say the user has input hunter2 as the password and has chosen “Automobil” from the select.

The credentials object should look like this:

{

"password": "hunter2",

"image": "car"

}

Please see the sequence diagram for details on how to handle embedded payments correctly.

Parameters

provider_code

string

The code of the desired provider. To access the list of providers that support payments, see providers list.

Even though the provider_code is an optional field, its absence during payment initiation may lead to the following outcomes:

- The end-user may choose a provider that does not support the payment template the client has passed to Salt Edge. This will result in an error.

- The end-user may choose a provider that has additional

required_payment_fields. Absence of required payment attributes during payment initiation will result in an error.

credentials

object

The credentials required to initiate a payment

payment_attributes

object

All the attributes (required and optional) that are needed for a successful payment initiation received in show templates

custom_fields

object, optional

A JSON object, which will be sent back on any of your callbacks

locale

string, optional

The language of the error message in the ISO 639-1 format. Possible values are: bg, cz, de, en, es-MX, es, fi, fr, he, hr, hu, it, nl, pl, pt-BR, pt, ro, ru, si, sk, sv, tr, uk, zh-HK(Traditional), zh(Simplified). Defaults to en.

provider_code

string

The code of the desired provider. To access the list of providers that support payments, see providers list.

Even though the provider_code is an optional field, its absence during payment initiation may lead to the following outcomes:

- The end-user may choose a provider that does not support the payment template the client has passed to Salt Edge. This will result in an error.

- The end-user may choose a provider that has additional

required_payment_fields. Absence of required payment attributes during payment initiation will result in an error.

credentials

object

The credentials required to initiate a payment

payment_attributes

object

All the attributes (required and optional) that are needed for a successful payment initiation received in show templates

custom_fields

object, optional

A JSON object, which will be sent back on any of your callbacks

locale

string, optional

The language of the error message in the ISO 639-1 format. Possible values are: bg, cz, de, en, es-MX, es, fi, fr, he, hr, hu, it, nl, pl, pt-BR, pt, ro, ru, si, sk, sv, tr, uk, zh-HK(Traditional), zh(Simplified). Defaults to en.

Possible Errors

| Error class | HTTP code | Description |

|---|---|---|

| CustomerLocked | 406 Not Acceptable | If the current customer is locked. It can be unlocked |

| InvalidCredentials | 406 Not Acceptable | Some critical information is missing from the request (e.g. a specific field in certificate) |

| InvalidPaymentAttributes | 406 Not Acceptable | Some of the |

| PaymentTemplateNotSupported | 406 Not Acceptable | The |

| ProviderDisabled | 406 Not Acceptable | The selected provider is |

| ProviderInactive | 406 Not Acceptable | The selected provider is not |

| ProviderUnavailable | 406 Not Acceptable | Unable to contact provider in order to generate |

| WrongProviderMode | 406 Not Acceptable | If current provider’s mode is neither |

| WrongRequestFormat | 400 Bad Request | Either |

URL

https://www.saltedge.com/api/payments/v1/payments

https://www.saltedge.com/api/payments/v1/payments

Method

POST

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"customer_id\": \"222222222222222222\", \

\"provider_code\": \"fake_client_xf\", \

\"credentials\": { \

\"login\": \"username\", \

\"password\": \"secret\" \

}, \

\"payment_attributes\": { \

\"end_to_end_id\": \"#123123123\", \

\"reference\": \"p:474747474747474747\", \

\"customer_last_logged_at\": \"2020-07-23T13:48:40Z\", \

\"customer_ip_address\": \"255.255.255.255\", \

\"customer_device_os\": \"iOS 11\", \

\"creditor_name\": \"Jay Dawson\", \

\"creditor_street_name\": \"One Canada Square\", \

\"creditor_building_number\": \"One\", \

\"creditor_country_code\": \"UK\", \

\"currency_code\": \"GBP\", \

\"amount\": \"199000.00\", \

\"description\": \"Stocks purchase\", \

\"creditor_iban\": \"GB33BUKB20201555555555\", \

\"mode\": \"normal\" \

}, \

\"template_identifier\": \"SEPA\" \

} \

}" \

https://www.saltedge.com/api/payments/v1/paymentscurl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \