API Reference

Callbacks

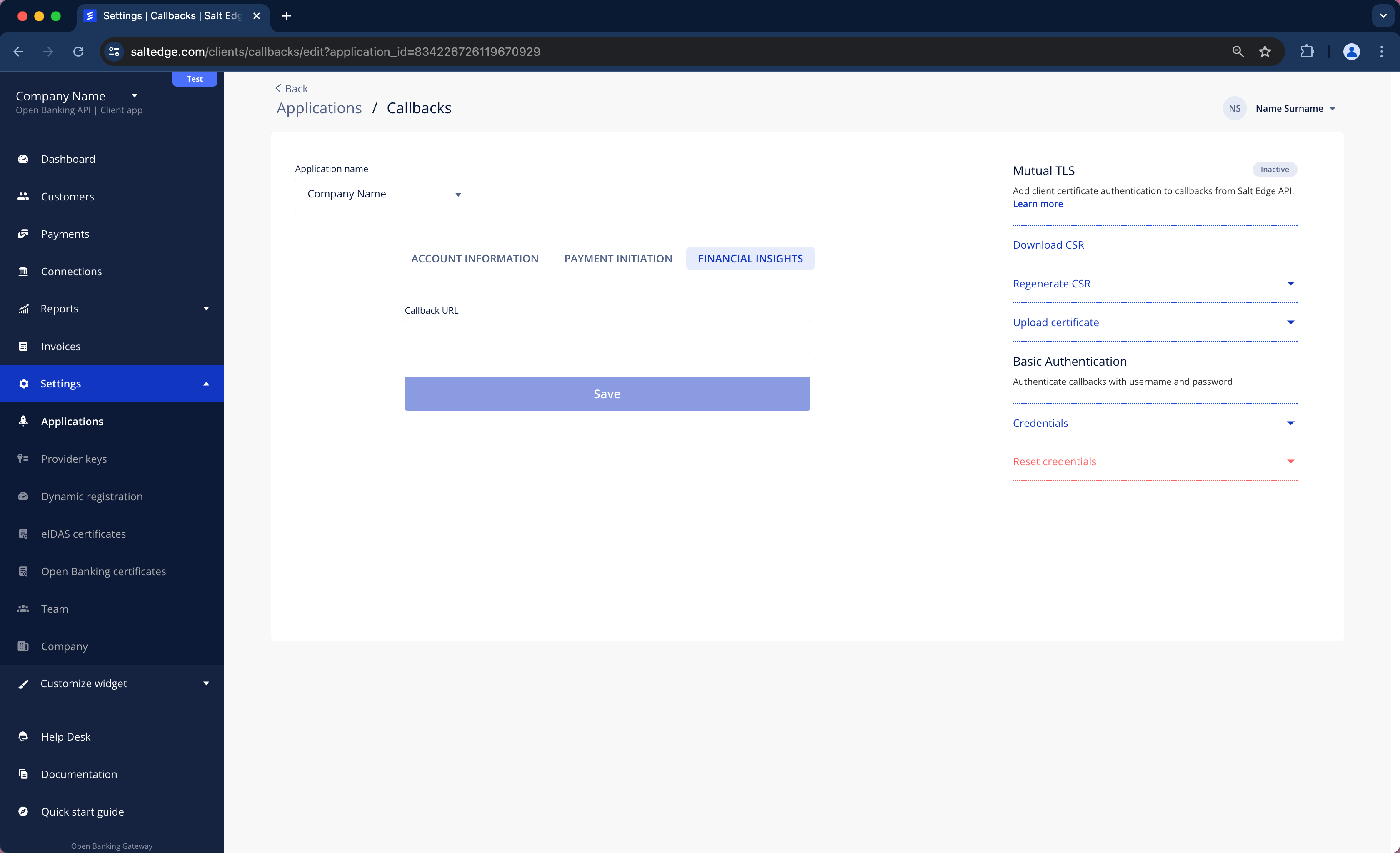

The callback URLs for the application can be set on the dedicated Dashboard callbacks page.

Success

A callback to Client’s application's success URL is sent whenever an operation causes a change in the data stored for a specific connection.

For example, once the User has been redirected to the Connect page, selected the Provider, filled in the credentials fields, and pressed the "Proceed" button, Salt Edge will send a success callback. This callback will include the customer_identifier and the connection_id of the newly created Connection.

Subsequently, the application can use the Connections/ Show route to query information about this Connection. Connections/ Accounts can also be retrieved and query the accounts (if any exist at the time the callback is sent).

Whenever an additional information about the Connection is available, another success callback will be sent.

Success

A change in the data is indicated by a success callback, and generally, one to three success callbacks with the same payload can be expected within several minutes. It is recommended that updated connection objects, Account balances, additional fields, and transactions be listed by the Client’s application using the from_id parameter to fetch newly imported records at each callback, as some information might change during the fetching process.

For instance, when the User creates a connection using Salt Edge Widget, we will send the following success callback:

{

"data": {

"connection_id": "111111111111111111",

"customer_id": "222222222222222222",

"custom_fields": { "key": "value" },

"stage": "finish"

},

"meta": {

"version": "6",

"time": "2024-01-25T10:40:47.965Z"

}

}

The Provider, country, and other attributes of the new Connection can be obtained using the Connections/ Show route.

The possible stages sent in a success callback are as follows:

connect- connecting to the data source.fetch_holder_info- fetching information about the Account holder.fetch_accounts- fetching the accounts.fetch_transactions- fetching the transactions.finish- wrapping up the process.

Failure

Sometimes, information retrieval from the Provider's page may fail. This could be due to the User not sending interactive data, incorrect credentials, or a failure in one of the steps of the fetching process. In such instances, a fail callback will be received containing JSON similar to the following:

{

"data": {

"connection_id": "111111111111111111",

"customer_id": "222222222222222222",

"custom_fields": { "key": "value" },

"error_class": "InvalidCredentials",

"error_message": "Invalid credentials."

},

"meta": {

"version": "6",

"time": "2024-01-25T10:40:47.979Z"

}

}

Upon receiving this callback, the Connection needs to be requested to check for updates. It's important to note that even if an error occurs, the Connection is still stored.

If the objective is to eliminate the incorrect or faulty Connection, the Connections/ Remove route can be used. In the case of an InvalidCredentials error, a Reconnect is recommended.

Note

To prevent Connection duplication errors during new Connection creation, after receiving a fail callback, it is recommended to remove the Connection if the last_fail_error_class is equal to InvalidCredentials and the Connection has zero linked Accounts.

Additional callbacks need to be implemented by the app in order to use the API-only version of the Account Information API.

Notify

Information about the progress the Connection is undergoing can be conveyed by Salt Edge through the usage of a Notify callback. If the appropriate notify URL is configured in the Client Account, it will be dispatched for Create, Reconnect, Refresh, Refresh (without Widget) and Background refresh attempts.

The Notify callback can be expected to be received by the app multiple times, depending on the type of Connection. This information can be used to keep the Users informed about the status of their Connection.

The potential stages included in a Notify callback are as follows:

start- the fetching process has just begunconnect- connecting to the data sourcefetch_holder_info- fetching information about the Account holderfetch_accounts- fetching the accountsfetch_transactions- fetching data for a recent period (several months)finish_fetching- wrapping up the fetching processstart_categorization- starting the process of categorization (skipped if categorization is disabled)

An example callback sent to the notify route of the Client’s app is as follows:

{

"data": {

"connection_id": "111111111111111111",

"customer_id": "222222222222222222",

"custom_fields": { "key": "value" },

"stage": "start"

},

"meta": {

"version": "6",

"time": "2024-01-24T10:40:47Z"

}

}

Note

It's important to note that all stages may not be received for some Connections and Notify callbacks will not be triggered for daily automatic refreshes.

Destroy

Whenever a Connection is removed, a callback will be sent to the Client’s application’s destroy URL, if it is set in the Client Account.

Here’s an example callback sent to the Client’s app’s, destroy route:

{

"data": {

"connection_id": "111111111111111111",

"customer_id": "222222222222222222",

"custom_fields": { "key": "value" },

},

"meta": {

"version": "6",

"time": "2024-01-24T10:40:48Z"

}

}

Provider changes

Whenever the Provider's status changes, notifications will be sent to the Provider Changes URL callback route by Salt Edge.

The callback URLs for Client’s application can be set on the dedicated Dashboard callbacks page.

{

"data": {

"provider_status": "inactive",

"provider_code": "fake_client_xf"

},

"meta": {

"version": 5,

"time": "2023-09-21T09:49:13.472Z"

}

}

Countries

It is represented solely as a string, using ISO 3166-1 alpha-2 country codes. Consequently, all country codes will consist of precisely two uppercase letters. Two special cases are observed:

- "Other" is encoded as

XO. - "Fake" is encoded as

XF.

Note

Fake country is exclusively available for Clients in Test and Pending statuses.

For Clients in Live status, send include_sandboxes: true

Attributes

- namestringName of the country

- codestringCountry code as dated in ISO 3166-1 alpha-2

- refresh_start_timeintegerLocal country time when connections will be automatically refreshed. Possible values are from

0to23

ListGET

Returns a list of countries supported by the API.

Query Parameters

- include_sandboxesbooleanWhether to display Sandboxes and Fake Providers or not.

true(for Clients in Pending & Test status);false(for Live Clients)

Possible values:true,false

Default value:true

Possible errors

No specific errors

URL

https://www.saltedge.com/api/v6/countries?include_sandboxes=true

Method

GET

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/v6/countries?include_sandboxes=trueSample response

{

"data": [

{

"name": "United Arab Emirates",

"code": "AE",

"refresh_start_time": 22

},

{

"name": "Armenia",

"code": "AM",

"refresh_start_time": 22

},

{

"name": "Argentina",

"code": "AR",

"refresh_start_time": 5

},

{

"name": "Austria",

"code": "AT",

"refresh_start_time": 1

},

{

"name": "Australia",

"code": "AU",

"refresh_start_time": 16

},

{

"name": "Azerbaijan",

"code": "AZ",

"refresh_start_time": 22

},

{

"name": "Bosnia and Herzegovina",

"code": "BA",

"refresh_start_time": 1

},

{

"name": "Barbados",

"code": "BB",

"refresh_start_time": 6

},

{

"name": "Bangladesh",

"code": "BD",

"refresh_start_time": 20

},

{

"name": "Belgium",

"code": "BE",

"refresh_start_time": 1

}

],

"meta": {

"next_id": null,

"next_page": null

}

}Providers

A Provider serves as a source of financial data. It is recommended that all of the Providers' fields are updated at least daily.

A better understanding of which Providers have been integrated and whether a Provider is already supported by Salt Edge is provided by the coverage map with the integrated PSD2/ Open Banking and non-regulated Providers.

Attributes

- idstring (integer)The

idof the Provider - codestringA distinct code for identifying a Provider

- namestringProvider’s name

- country_codestringProvider’s country code in ISO 3166-1 alpha-2 format

- bic_codesarray of stringsList of BIC codes identifying supported branches of a specific Provider

- dynamic_registration_codestringThe dynamic registration code assigned to the Provider

- identification_codesarray of stringsThe list of codes identifying the supported branches of a specific Provider

- group_codestringThe code of the group the Provider belongs to

- group_namestringThe name of the group the Provider belongs to

- hubstringThe hub that the Provider is affiliated with

- statusstringProvider’s status that indicates its state.

Possible values are:active- Providers with active status are accessible, returned on both List and Show endpoints, and visible within the Salt Edge Widget for Users.inactive- Providers with an inactive status are returned on both List and Show endpoints, but are not visible in the Salt Edge Widget for Users.disabled- Providers with adisabledstatus are neither returned on List and Show endpoints, nor visible in the Salt Edge Widget for Users.

- modestringThe way a Provider is accessed.

Possible values are:oauth- access through the Provider's dedicated API redirects the User to the Provider's page for authorization.web- access through the Provider's web interface using screen scraping technology. Therefore, the User undergoes the same authorization flow as on the Provider's web interface using identical credentials in the Salt Edge Widget.api- access through a dedicated (regulated: true) or non-dedicated (regulated: false) Provider's API. Some required credential fields might be present, which the User must complete (such as IBAN, username, etc.). In the case of a dedicated API, an interactive redirect might be present, but required credential fields must still be completed by the User (e.g., IBAN, username, etc.). Using these credentials, the User is authorized on the Provider’s side.

- regulatedbooleanWhether the Provider is integrated via a regulated channel under Open Banking/ PSD2

- logo_urlstringThe URL for the Provider logo. May contain a placeholder for Providers with missing logos

- home_urlstringThe URL of the main page of the provider

- login_urlstringPoint of entrance to provider’s login web interface

- timezonestringTime zone data for the capital/ major city in a region corresponding to the Provider

- supported_iframe_embeddingbooleanIndicates whether the Provider supports being embedded within an iframe.

If set totrue, the Provider's content can be securely displayed within an iframe on external websites. - optional_interactivitybooleanProvider that supports toggling the

interactiveandautomatic_fetchflags after connecting.

Relevant for Providers with mode:web - customer_notified_on_sign_inbooleanWhether the Provider will notify the Customer upon a login attempt

- created_atstring (date-time)The timestamp indicating when the Provider was integrated

- updated_atstring (date-time)The timestamp of the most recent update to any of the Provider's attributes

- automatic_fetchbooleanWhether the Provider's Connections can be automatically fetched, with performance contingent on the

optional_interactivityflag - custom_pendings_periodintegerPopulated when custom_pendings:

true.

Displays the number of days corresponding to the custom pending period implemented by the Provider. - holder_infoarray of stringsContains information on the Account holder details retrievable from the requested Provider

- instruction_for_connectionsstringProvides instructions or guidance for establishing Connections with the Provider. It may contain information on the steps Users need to follow during the connection setup process.

- interactive_for_connectionsbooleanIndicates whether the Provider requires the User to perform an interactive step

- max_consent_daysintegerThe maximum allowed consent duration.

If the value isnull, then there are no limits - max_fetch_intervalintegerThe maximum number of days for which a Provider can return transaction data.

The maximum value varies depending on the Provider.

Default value:60 - fetch_policiesobject

- max_interactive_delayintegerThe delay in seconds before an Unfinished error is raised

- refresh_timeoutintegerThe amount of time, in minutes, after which the Provider's Connections are allowed to be refreshed

- supported_account_extra_fieldsarray of stringsAn array of possible extra fields associated with Accounts that can be fetched

- supported_account_naturesarray of stringsAn array of possible Account natures to be fetched

- supported_account_typesarray of stringsCorporate accounts are identified as

Businessaccounts.

Possible values:personal,business - supported_fetch_scopesarray of stringsAn array of supported fetch_scopes

- supported_transaction_extra_fieldsarray of stringsAn array of possible transaction extra fields to be fetched

- payment_templatesarray of stringsIdentifiers of the payment templates supported by this Provider

- instruction_for_paymentsstringProvides instructions or guidance for initiating Payments with the Provider

- interactive_for_paymentsbooleanIndicates whether the Provider requires the User to perform an interactive step

- required_payment_fieldsarray of objectsThe mandatory payment attributes. If any of these fields are not passed, the Payment will not be initiated successfully

- supported_payment_fieldsarray of objectsIf these fields are passed, they will be used by the Provider. Otherwise, the Payment will be processed even without them

- no_funds_rejection_supportedbooleanA flag indicating whether the Provider supports explicit handling of Payment rejection due to insufficient funds

- credentials_fieldsarray of objectsContains the types and details of credentials required from the User during the Connection setup processHide child attributes

- namestringthe field's name that should be used as a key in the credentials object

- english_namestringthe field's name in US English

- localized_namestringthe name of the field in the provider's main language

- naturestringPossible values:

text,password,select,dynamic_select,file,number - optionalbooleanwhether the input for this field is required by the provider

- extraobjectextra information about the field

- positionintegerthe field's position in the public user interface

- field_optionsobjectonly for theHide child attributes

selectfield type. Contains the options for the select- namestringthe name of the field option

- english_namestringthe option's name in US English

- localized_namestringthe name of the field in the provider's main language

- option_valuestringthe value of the option that needs to be passed as credentials

- selectedbooleanwhether the choice is selected by default

- interactive_fieldsarray of objectsContains the types and details of interactive elements that the User may need to provide during the Connection setup processHide child attributes

- namestringthe field's name that should be used as a key in the credentials object

- english_namestringthe field's name in US English

- localized_namestringthe name of the field in the provider's main language

- naturestringPossible values:

text,password,select,dynamic_select,file,number - optionalbooleanwhether the input for this field is required by the provider

- extraobjectextra information about the field

- positionintegerthe field's position in the public user interface

- field_optionsobjectonly for theHide child attributes

selectfield type. Contains the options for the select- namestringthe name of the field option

- english_namestringthe option's name in US English

- localized_namestringthe name of the field in the provider's main language

- option_valuestringthe value of the option that needs to be passed as credentials

- selectedbooleanwhether the choice is selected by default

ListGET

Query Parameters

- include_sandboxesbooleanWhether to display Sandboxes and Fake Providers or not.

true(for Clients in Pending & Test status);false(for Live Clients).

Default value:true - country_codestringFilters the Providers by country

- include_ais_fieldsbooleanIncludes the Provider’s AIS fields. If

true, the following fields are available:automatic_fetch,custom_pendings_period,holder_info,instruction_for_connections,interactive_for_connections,max_consent_days,max_fetch_interval,fetch_policies,max_interactive_delay,refresh_timeout,supported_account_extra_fields,supported_account_natures,supported_account_types,supported_fetch_scopes,supported_transaction_extra_fields

Default value:false - include_pis_fieldsbooleanIncludes supported and required Payment fields. If

true, the following fields are available:payment_templates,instruction_for_payments,interactive_for_payments,required_payment_fields,supported_payment_fields,no_funds_rejection_supported

Default value:false - include_credentials_fieldsbooleanIncludes supported and required credentials fields. If

true, the following fields are available:credentials_fields,interactive_fields

Default value:false - exclude_inactivebooleanExcludes inactive Providers from the list

Default value:false - key_ownerstringFilters Providers by key owner

Possible values:client,saltedge - modestringFilters Providers by mode

Possible values:web,api,oauth - from_idstring (integer)The

idof the Provider which the list starts with - per_pageintegerThe nr. of Providers to be listed per page

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| WrongRequestFormat | 400 | Some parameters or the entire JSON request are in the wrong format |

URL

https://www.saltedge.com/api/v6/providers

Method

GET

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/v6/providers?include_sandboxes=true&country_code=GB&include_ais_fields=false&include_pis_fields=false&include_credentials_fields=false&exclude_inactive=true&key_owner=saltedge&mode=web&from_id=220&per_page=150Sample response

{

"data": [

{

"id": "247",

"code": "hbci_25451345_de",

"country_code": "DE",

"bic_codes": [

"NOLADE21PMT"

],

"dynamic_registration_code": null,

"identification_codes": [

"25451345"

],

"group_code": "sparkasse",

"group_name": "Sparkasse",

"hub": null,

"name": "Stadtsparkasse Bad Pyrmont HBCI",

"status": "active",

"mode": "api",

"regulated": false,

"logo_url": "https://d1uuj3mi6rzwpm.cloudfront.net/logos/providers/de/stadtsparkasse_oberhausen_de.svg",

"home_url": "http://www.ssk-bad-pyrmont.de",

"login_url": "http://www.ssk-bad-pyrmont.de",

"timezone": "Europe/Berlin",

"supported_iframe_embedding": true,

"optional_interactivity": true,

"customer_notified_on_sign_in": false,

"created_at": "2014-08-21T09:07:38Z",

"updated_at": "2023-06-29T10:41:25Z"

},

{

"id": "248",

"code": "hbci_25462680_de",

"country_code": "DE",

"bic_codes": [

"GENODEF1COP"

],

"dynamic_registration_code": null,

"identification_codes": [

"25462680"

],

"group_code": "volksbank_raiffeisen",

"group_name": "Volksbanken Raiffeisenbanken",

"hub": null,

"name": "Volksbank am Ith Coppenbrügge HBCI",

"status": "active",

"mode": "api",

"regulated": false,

"logo_url": "https://d1uuj3mi6rzwpm.cloudfront.net/logos/providers/de/frankfurter_volksbank_de.svg",

"home_url": "http://www.vb-iw.de",

"login_url": "http://www.vb-iw.de",

"timezone": "Europe/Berlin",

"supported_iframe_embedding": true,

"optional_interactivity": true,

"customer_notified_on_sign_in": false,

"created_at": "2014-08-21T09:07:38Z",

"updated_at": "2023-06-29T10:41:25Z"

}

],

"meta": {

"next_id": "249",

"next_page": "/api/v6/providers?from_id=249"

}

}ShowGET

Path Parameters

- provider_codestringmandatoryThe code assigned by Salt Edge for a particular Provider includes the country code for easier differentiation. I.e.: all Spanish providers' codes end with

_es.

Query Parameters

- include_ais_fieldsbooleanIncludes the Provider’s AIS fields. If

true, the following fields are available:automatic_fetch,custom_pendings_period,holder_info,instruction_for_connections,interactive_for_connections,max_consent_days,max_fetch_interval,fetch_policies,max_interactive_delay,refresh_timeout,supported_account_extra_fields,supported_account_natures,supported_account_types,supported_fetch_scopes,supported_transaction_extra_fields

Default value:false - include_pis_fieldsbooleanIncludes supported and required Payment fields. If

true, the following fields are available:payment_templates,instruction_for_payments,interactive_for_payments,required_payment_fields,supported_payment_fields,no_funds_rejection_supported

Default value:false - include_credentials_fieldsbooleanIncludes supported and required credentials fields. If

true, the following fields are available:credentials_fields,interactive_fields

Default value:false

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| ProviderNotFound | 404 | A Provider with such a provider_code could not be found |

| WrongRequestFormat | 400 | Some parameters or the entire JSON request are in the wrong format |

URL

https://www.saltedge.com/api/v6/providers/{provider_code}

Method

GET

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/v6/providers/fake_oauth_client_xf?include_ais_fields=false&include_credentials_fields=false&include_pis_fields=falseSample response

{

"data": {

"id": "3099",

"code": "fake_oauth_client_xf",

"country_code": "XF",

"bic_codes": [],

"dynamic_registration_code": null,

"identification_codes": [],

"group_code": "fake",

"group_name": "Fake",

"hub": null,

"name": "Fake OAuth Bank with Client Keys",

"status": "active",

"mode": "oauth",

"regulated": true,

"logo_url": "https://d1uuj3mi6rzwpm.cloudfront.net/logos/providers/xf/placeholder_global.svg",

"home_url": "https://example.com",

"login_url": "https://example.com",

"timezone": "UTC",

"supported_iframe_embedding": true,

"optional_interactivity": true,

"customer_notified_on_sign_in": false,

"created_at": "2018-04-12T14:30:29Z",

"updated_at": "2024-03-06T07:47:56Z"

}

}Fake

To assist with testing, a Fake country (with the country code XF) and a set of Fake Providers are provided. If the Client’s application is in the Test or Pending status, the selection of the Fake country and its Providers can be made on the Connect page.

Sandboxes

The Sandbox is a live-testing environment provided by Salt Edge, enabling Partners and Clients to test regulated Providers under Salt Edge’s supervision.

To facilitate the testing of regulated Providers, Salt Edge offers a Sandbox environment for some PSD2 Providers - giving the possibility to test different flows. The Sandbox is identified by the term 'Sandbox' in the provider_name (e.g.: Rabobank (Sandbox)), with a designated provider_code containing 'XF' as the country code (e.g.: rabobank_oauth_client_nl_xf).

Similar to Fake Providers, Sandbox Providers can be tested when an application is in Test or Pending status. For Clients in Live status, use include_sandboxes: true. On the Connect page, the selection of the fake country (with the country code XF) and its corresponding Sandbox Providers is allowed.

Authorization instructions are provided under the Instructions field on the Connect page.

Note

Some Sandboxes may not be available indefinitely due to limited support sources for a particular Provider.

Customers

A Customer represents a single end-user of the Client’s/ Partner’s application.

The Client or Partner uses the API to create Connections, i.e. bank Connections, that are further used to aggregate the Customer’s financial data.

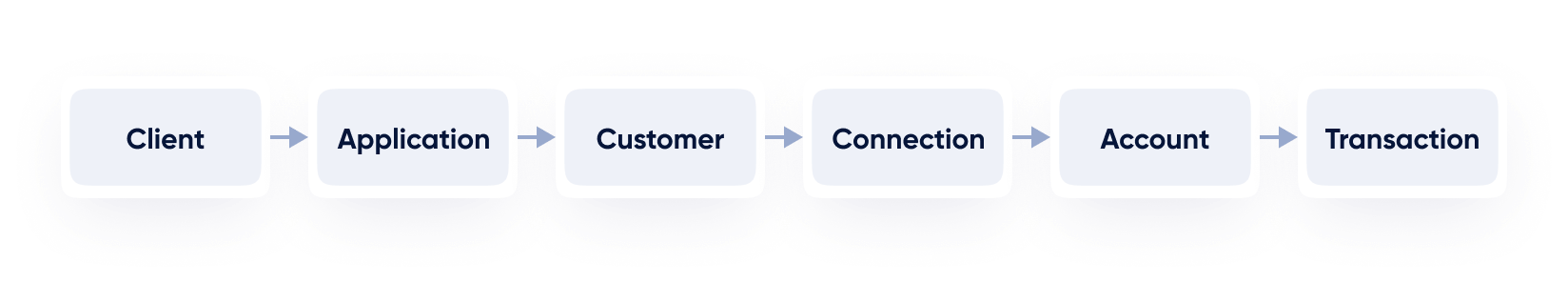

Here’s a diagram that illustrates the Customer and its associated concepts:

For a more comprehensive description of the terms, please refer to the Glossary.

Note

The id returned from the response needs to be stored in the Client’s application, which is necessary when creating Connections.

Attributes

- customer_idstring (integer)The

idof the User - identifierstringThe unique external identifier of a Customer (e.g email,

idon the Client's side) - categorization_typestringType of categorization.

Possible values:personal,business - blocked_atstring (date-time)The date & time in UTC when a Customer has been blocked

- created_atstring (date-time)The date & time in UTC when a Customer has been created

- updated_atstring (date-time)The date & time in UTC when a Customer has been updated

CreatePOST

Creates a Customer and returns the Customer object.

Request Body ParametersClient

- identifierstringmandatoryA unique

identifierof the User assigned by the Client.

The following symbols are not accepted:< > " ' % ; ( ) & \

URL

https://www.saltedge.com/api/v6/customers

Method

POST

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"identifier\": \"example_identifier\" \

} \

}" \

https://www.saltedge.com/api/v6/customersSample response

{

"data": {

"email": "email@email.com",

"customer_id": "111111111111111111",

"identifier": "example_identifier",

"blocked_at": null,

"created_at": "2023-02-08T14:06:41Z",

"updated_at": "2023-02-08T14:06:41Z"

}

}Request Body ParametersPartner

- emailstringmandatoryA unique

emailof the User assigned by the Partner - kycobjectHide child attributes

- citizenship_codestringPossible values: country code as mentioned in ISO 3166-1 alpha-2

- date_of_birthstring (date)

- full_namestring

- genderstringPossible values:

male,female,other - legal_namestring

- place_of_birthstring

- registered_office_codestringPossible values: country code as dated in ISO 3166-1 alpha-2

- registered_office_addressstring

- registration_numberstring

- residence_addressstring

- type_of_accountstring

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| DuplicatedCustomer | 409 | The User being attempted to be created already exists |

| WrongRequestFormat | 400 | Some parameters or the entire JSON request are in the wrong format |

URL

https://www.saltedge.com/api/v6/customers

Method

POST

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"email\": \"email@email.com\", \

\"kyc\": { \

\"citizenship_code\": \"GB\", \

\"date_of_birth\": \"2001-01-01\", \

\"full_name\": \"John Doe\", \

\"gender\": \"male\", \

\"legal_name\": \"Example Company Name\", \

\"place_of_birth\": \"London\", \

\"registered_office_code\": \"GB\", \

\"registered_office_address\": \"London, Independence str, block 5\", \

\"registration_number\": \"12345\", \

\"residence_address\": \"London, Independence str, block 5\", \

\"type_of_account\": \"own\" \

} \

} \

}" \

https://www.saltedge.com/api/v6/customersSample response

{

"data": {

"email": "example@email.com",

"customer_id": "111111111111111111",

"identifier": "example_identifier",

"blocked_at": null,

"created_at": "2023-02-08T14:06:41Z",

"updated_at": "2023-02-08T14:06:41Z"

}

}ListGET

Returns a list with all the application’s Customers

Query Parameters

- from_idstring (integer)The

idof the Customer the list starts with - per_pageintegerThe nr. of Customers to be listed per page

Possible errors

No specific errors

URL

https://www.saltedge.com/api/v6/customers

Method

GET

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/v6/customers?from_id=11111111111111111&per_page=150Sample response

{

"data": [

{

"customer_id": "1111111111111111111",

"identifier": "email@email.com",

"categorization_type": null,

"blocked_at": null,

"created_at": "2021-09-14T15:14:34Z",

"updated_at": "2021-09-14T15:14:34Z"

},

{

"customer_id": "2222222222222222222",

"identifier": "some_identifier",

"categorization_type": null,

"blocked_at": null,

"created_at": "2021-09-14T18:04:11Z",

"updated_at": "2021-09-14T18:04:11Z"

}

],

"meta": {

"next_id": "3333333333333333333",

"next_page": "/api/v6/customers?from_id=3333333333333333333"

}

}ShowGET

Returns the customer object.

Path Parameters

- customer_idstring (integer)mandatoryPartnerA unique

idof the User assigned by Salt Edge - customer_identifierstringA unique

idof the User assigned by Client.

Thecustomer_identifiershould be URL-encoded.

The following symbols are not accepted:< > " ' % ; ( ) & \Note

Clients who own their license should use either customer_id or customer_identifier.

Partners should use customer_id at all times.

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| CustomerNotFound | 404 | The User with the provided customer_id does not exist |

| WrongRequestFormat | 400 | Some parameters or the entire JSON request are in the wrong format |

URL

https://www.saltedge.com/api/v6/customers/{customer_id}

Method

GET

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/v6/customers/111111111111111111Sample response

{

"data": {

"customer_id": "111111111111111111",

"identifier": "email@email.com",

"blocked_at": null,

"created_at": "2023-02-08T14:06:41Z",

"updated_at": "2023-02-08T14:06:41Z"

}

}RemoveDEL

Deletes a Customer and revokes all consents for this Customer.

Path Parameters

- customer_idstring (integer)mandatoryPartnerA unique

idof the User assigned by Salt Edge - customer_identifierstringA unique

idof the User assigned by Client.

Thecustomer_identifiershould be URL-encoded.

The following symbols are not accepted:< > " ' % ; ( ) & \Note

Clients who own their license should use either customer_id or customer_identifier.

Partners should use customer_id at all times.

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| CustomerLocked | 406 | The User was locked manually in the Dashboard and may be unlocked |

| CustomerNotFound | 404 | The User with the provided customer_id does not exist |

URL

https://www.saltedge.com/api/v6/customers/{customer_id}

Method

DELETE

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X DELETE \

https://www.saltedge.com/api/v6/customers/111111111111111111Sample response

{

"data": {

"customer_id": "111111111111111111",

"deleted": true

}

}Connections

A Connection represents a permanent Connection of a specific Customer to a Provider, with a set of credentials required for accessing the Accounts and Transactions.

Within Account Information API a Connection can have one of the following statuses:

- Active - the current set of credentials is valid and enables Salt Edge to fetch the data properly;

- Inactive - an error occurred while fetching the Connection. An inactive Connection cannot be refreshed; thus, it can only be reconnected.

- Disabled - in case of non-compliance with our Terms of Service, the application’s owner may be contacted, and the Connection(s) may be disabled.

Note

When creating a Connection, it is advisable to check whether the Customer already exists to prevent the creation of duplicate Customers & Connections.

Additionally, creating multiple Connections for the same Customer with the same online banking access credentials is not recommended.

Attributes

Using the AIS Widget session the Client can perform: Connect, Reconnect, or Refresh a User's Connection.

It should be noted that the session will be subject to expiration after 60 seconds of inactivity within the Salt Edge Widget. Upon initiation of the session to redirect the User, the entire authentication and data retrieval process will take approximately 10 minutes. Subsequently, the Customer session will expire.

Note

Exceptions may arise with certain Providers, requiring longer periods for data retrieval, potentially extending the 10-minute timeout.

Before generating a request, it should be ensured that the User exists within the system or is created accordingly.

If the Client Account's status is in Pending mode, attempting to establish a Connection not using a Fake Provider, it will result in a ClientPending error.

- idstring (integer)The

idof the created Connection - customer_idstring (integer)The

idof the Customer to which the Connection belongs - customer_identifierstringThe unique external identifier of a Customer (e.g email,

idon the Client's side) - provider_codestringThe code assigned by Salt Edge for a particular Provider includes the country code for easier differentiation. I.e.: all Spanish providers' codes end with

_es. - provider_namestringThe Provider’s

nameused to establish the Connection - country_codestringCountry code of the Provider

- statusstringThe current status of the Connection

Possible values:active,inactive,disabled - categorizationstringThe categorization type applied to transactions from this Connection

Possible values:none,personal,business

Default value:none - categorization_vendorstringThe vendor that performed categorization

- automatic_refreshbooleanWhether the refresh is automatically performed for this Connection

- next_refresh_possible_atstring (date-time)Determines when the next refresh will be available. This field may contain a

nullvalue if the Connection’sautomatic_fetch:falseor is already processing. - created_atstring (date-time)The date and time in UTC when the Connection was created

- updated_atstring (date-time)The date and time in UTC when the Connection was updated

- last_consent_idstring (integer)The

idof the last provided PSD2 consent - last_attemptobjectInformation about the latest executed attempt is provided

- holder_infoobjectInformation about the holder of this ConnectionHide child attributes

- namesarray of stringsAccount holder’s name(s)

- emailsarray of stringsAccount holder’s email(s)

- phone_numbersarray of stringsAccount holder’s phone number(s)

- addressesarray of objectsAccount holder’s address(es):Hide child attributes

- citystring

- statestring

- streetstring

- country_codestring

- post_codestring

- extraobjectHide child attributes

- ssnstringSocial Security Number shortened (last 4 digits)

- cpfstringCadastro de Pessoas Físicas (specific to Brazil)

- birth_datestringAccount holder’s date of birth

- document_numberstringAccount holder’s identification number

Note

api_mode: app is available only for Connections initiated via API V5.

ListGET

All Connections accessible to the Client’s application for a specific Customer are returned.

The Connections are sorted in ascending order based on their ID, so the newest Connections will appear last. It is recommended that the entire list of Connections be fetched to check for any changes in properties. More information about the next_id field can be found in the Pagination section.

Query Parameters

- customer_idstring (integer)mandatoryA unique

idof the User assigned by Salt Edge - from_idstring (integer)The

idof the Connection the list starts with - per_pageintegerThe nr. of Connections to be listed per page

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| CustomerNotFound | 404 | The User with the provided customer_id does not exist |

| WrongRequestFormat | 400 | Some parameters or the entire JSON request are in the wrong format |

URL

https://www.saltedge.com/api/v6/connections

Method

GET

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/v6/connections?customer_id=111111111?from_id=111111111?per_page=120Sample response

{

"data": [

{

"id": "1111111111111111111",

"customer_id": "1111111111111111111",

"customer_identifier": "example_identifier",

"provider_code": "fake_oauth_client_xf",

"provider_name": "Fake OAuth Bank with Client Keys",

"country_code": "XF",

"status": "active",

"categorization": "none",

"categorization_vendor": null,

"automatic_refresh": true,

"next_refresh_possible_at": "2024-02-19T06:26:03Z",

"created_at": "2024-01-03T14:39:58Z",

"updated_at": "2024-02-19T06:11:03Z",

"last_consent_id": "1111111111111111111",

"last_attempt": {

"id": "1111111111111111111",

"consent_id": "1111111111111111111",

"api_version": "6",

"api_mode": "service",

"automatic_fetch": true,

"categorize": false,

"custom_fields": {},

"automatic_refresh": true,

"exclude_accounts": [],

"fetch_from_date": "2024-02-17",

"fetch_to_date": "2024-02-19",

"fetch_scopes": [

"accounts",

"balance",

"transactions"

],

"finished": true,

"finished_recent": true,

"include_natures": null,

"interactive": false,

"locale": "ro",

"partial": false,

"show_consent_confirmation": true,

"store_credentials": true,

"user_present": false,

"user_agent": "Mozilla/5.0 (Macintosh; Intel Mac OS X 10.15; rv:121.0) Gecko/20100101 Firefox/121.0",

"device_type": "desktop",

"remote_ip": "10.9.9.9",

"customer_last_logged_at": null,

"created_at": "2024-02-19T06:10:13Z",

"updated_at": "2024-02-19T06:11:03Z",

"success_at": "2024-02-19T06:11:03Z",

"fail_at": null,

"fail_error_class": null,

"fail_message": null,

"last_stage": {

"id": "1111111111111111111",

"name": "finish",

"created_at": "2024-02-19T06:11:03Z",

"updated_at": "2024-02-19T06:11:03Z"

}

}

},

{

"id": "2222222222222222222",

"customer_id": "1111111111111111111",

"customer_identifier": "example_identifier",

"provider_code": "fake_oauth_client_xf",

"provider_name": "Fake OAuth Bank with Client Keys",

"country_code": "XF",

"status": "active",

"categorization": "personal",

"categorization_vendor": "saltedge",

"automatic_refresh": false,

"next_refresh_possible_at": "2024-01-15T14:10:28Z",

"created_at": "2024-01-03T14:58:19Z",

"updated_at": "2024-01-15T13:55:28Z",

"last_consent_id": "1111111111111111112",

"last_attempt": {

"id": "1111111111111111112",

"consent_id": "1111111111111111112",

"api_version": "6",

"api_mode": "service",

"automatic_fetch": true,

"categorize": true,

"custom_fields": {},

"automatic_refresh": false,

"exclude_accounts": [],

"fetch_from_date": "2023-11-16",

"fetch_to_date": "2024-01-15",

"fetch_scopes": [

"accounts",

"balance",

"holder_info",

"transactions"

],

"finished": true,

"finished_recent": true,

"include_natures": null,

"interactive": false,

"locale": "ro",

"partial": false,

"show_consent_confirmation": true,

"store_credentials": true,

"user_present": true,

"user_agent": "Mozilla/5.0 (Macintosh; Intel Mac OS X 10.15; rv:120.0) Gecko/20100101 Firefox/120.0",

"device_type": "desktop",

"remote_ip": "10.9.9.9",

"customer_last_logged_at": null,

"created_at": "2024-01-15T13:55:11Z",

"updated_at": "2024-01-15T13:55:28Z",

"success_at": "2024-01-15T13:55:28Z",

"fail_at": null,

"fail_error_class": null,

"fail_message": null,

"last_stage": {

"id": "1111111111111111112",

"name": "finish",

"created_at": "2024-01-15T13:55:28Z",

"updated_at": "2024-01-15T13:55:28Z"

}

}

}

],

"meta": {

"next_id": "3333333333333333333",

"next_page": "/api/v6/connections?customer_id=1111111111111111111&from_id=3333333333333333333"

}

}ShowGET

A single Connection object containing comprehensive information about the Connection is returned.

Path Parameters

- connection_idstring (integer)mandatoryThe

idof the Connection

Query Parameters

- include_holder_infobooleanWhether the Connection holder's information should be displayed

Default value:false

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| ConnectionNotFound | 404 | The requested connection_id does not match any existing Connections |

| WrongRequestFormat | 400 | Some parameters or the entire JSON request are in the wrong format |

URL

https://www.saltedge.com/api/v6/connections/{connection_id}

Method

GET

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X GET \

https://www.saltedge.com/api/v6/connections/11111111111111Sample response

{

"data": {

"id": "11111111111111",

"customer_id": "11111111111111",

"customer_identifier": "example_identifier",

"provider_code": "fake_oauth_client_xf",

"provider_name": "Fake OAuth Bank with Client Keys",

"country_code": "XF",

"status": "active",

"categorization": "personal",

"categorization_vendor": "saltedge",

"automatic_refresh": false,

"next_refresh_possible_at": "2024-01-15T14:10:28Z",

"created_at": "2024-01-03T14:58:19Z",

"updated_at": "2024-01-15T13:55:28Z",

"last_consent_id": "11111111111111",

"last_attempt": {

"id": "11111111111111",

"consent_id": "11111111111111",

"api_version": "6",

"api_mode": "service",

"automatic_fetch": true,

"categorize": true,

"custom_fields": {},

"automatic_refresh": false,

"exclude_accounts": [],

"fetch_from_date": "2023-11-16",

"fetch_to_date": "2024-01-15",

"fetch_scopes": [

"accounts",

"balance",

"holder_info",

"transactions"

],

"finished": true,

"finished_recent": true,

"include_natures": null,

"interactive": false,

"locale": "ro",

"partial": false,

"show_consent_confirmation": true,

"store_credentials": true,

"user_present": true,

"user_agent": "Mozilla/5.0 (Macintosh; Intel Mac OS X 10.15; rv:120.0) Gecko/20100101 Firefox/120.0",

"device_type": "desktop",

"remote_ip": "10.9.9.9",

"customer_last_logged_at": null,

"created_at": "2024-01-15T13:55:11Z",

"updated_at": "2024-01-15T13:55:28Z",

"success_at": "2024-01-15T13:55:28Z",

"fail_at": null,

"fail_error_class": null,

"fail_message": null,

"last_stage": {

"id": "11111111111111",

"name": "finish",

"created_at": "2024-01-15T13:55:28Z",

"updated_at": "2024-01-15T13:55:28Z"

}

}

}

}ConnectPOST

Note

Please examine the sequence diagram for details on how Connections/ Connect flow works.

If the User already has a Connection with the same Provider and credentials, initiating a new Connection will perform a reconnect for the existing one.

Relevant for Providers with mode: web and api

Request Body Parameters

- customer_idstring (integer)mandatoryPartnerA unique

idof the User assigned by Salt Edge - customer_identifierstringA unique

idof the User assigned by the ClientNote

Clients who own their license should use eithercustomer_idorcustomer_identifier.

Partners should usecustomer_idat all times, whereascustomer_identifieris optional. - consentobjectmandatoryHide child attributes

- scopesarray of stringsmandatoryData to be allowed for fetching.

The allowed values for this parameter must fall within the Client’sallowed_fetch_scopesand/ or the Provider'ssupported_fetch_scopesrestrictions.

Possible values:holder_info,accounts,transactions.

Accountscovers bothaccountsandbalancefetch_scopes - from_datestring (date)Allows to fetch data starting from a specified date

- to_datestring (date)Allows to fetch data up until a specified date

- period_daysintegerAllows to specify the duration of consent validity (in days)

- attemptobjectHide child attributes

- fetch_scopesarray of stringsA list of scopes requested by Clients from the Provider, deriving from the

consent_scopesoptions.

Possible values:holder_info,accounts,balance,transactions.

Accountsconsent_scopescoversaccountsandbalancefetch_scopes. - fetch_from_datestring (date)The starting date for fetching the data

- fetch_to_datestring (date)The ending date for fetching the data

- account_naturesarray of stringsPossible values:

account,bonus,card,checking,credit,credit_card,debit_card,ewallet,insurance,investment,loan,mortgage,savings - custom_fieldsobjectA JSON object that will be sent back on any of the Client's callbacks

- localestringThe language of the Widget and the language of the returned error message(s).

Possible values: any locale in ISO 639-1 format - store_credentialsbooleanWhether credentials are stored on Salt Edge's side or not.

Relevant for Providers with mode:webandapi

Default value:true - unduplication_strategystringThe unduplication strategy used for duplicated transactions.

The provided value remains unchanged until another value is sent duringConnections/reconnectorConnections/refresh.

mark_as_pending: leaves identified duplicated transactions in Pending status for clients that establish connections with providers having a non-nullcustom_pendings_period.

mark_as_duplicate: identifies transactions as duplicated and sets the duplicated flag totrue.

delete_duplicated: removes identified duplicated transactions.

Possible values:mark_as_pending,mark_as_duplicate,delete_duplicated

Default value:mark_as_pending - return_tostringThe URL to which the User will be redirected. By default, this is the Client’s or Partner’s home URL

- widgetobjectHide child attributes

- show_account_overviewbooleanDisplays information about connected accounts in the Widget

Default value:false - show_consent_confirmationbooleanClientShows confirmation of the Connection

Default value:true - credentials_strategystringThe strategy for storing the User’s credentials.

Relevant for Providers with mode:webandapi.

Possible values:store,do_not_store,ask

Default value:store - javascript_callback_typestringHow the Widget interacts with the opener/ parent window

Possible values:iframe,post_message - disable_provider_searchbooleanEnables Clients to disable Provider searches for Users

Default value:false - skip_provider_selectionbooleanEnables Users to skip the Provider selection page

Default value:false - skip_stages_screenbooleanAllows Users to skip the stage screen

Default value:false - wait_all_transactionsbooleanAllows the User to remain within the Widget until all Transactions have been successfully fetched.

Cannot be combined withskip_stages_screen.

Default value:false - templatestringAllows Clients and Partners to configure a template for the Widget.

By default, Clients usedefault_v3and Partners usepartner_v3. - themestringAllows Clients to specify a color theme for the Widget.

If not set, the Widget uses the User's operating system theme preference by default

Possible values:dark,default,light

Default value:default - allowed_countriesarray of stringsDisplays Providers only from specified countries

- popular_providers_countrystringDisplay in the Widget the most popular Providers from a specified country.

If nothing is sent, the most popular Providers are not shown. - skip_final_screenbooleanAllows Users to skip the error and success screens

Default value:false

- providerobjectHide child attributes

- codestringThe code of the required Provider

- include_sandboxesbooleanWhether to display Sandboxes and Fake Providers or not.

true(for Clients in Pending & Test status);false(for Live Clients)

Possible values:true,false

Default value:true - modesarray of stringsRestricts the list of Providers to only those that have the mode included in the array

Possible values:oauth,web,api - regulatedbooleanClientDetermines which providers are displayed in the Widget based on their regulatory status.

true– only regulated providers are shown.

false– only non-regulated providers are shown.

- kycobjectPartnerHide child attributes

- type_of_accountstringThe type of Account to be connected, only for KYC purposes

Possible values:personal,shared,business

- return_connection_idbooleanAppends

connection_idto thereturn_toURL

Default value:false - return_error_classbooleanAppends

error_classto thereturn_toURL

Default value:false - categorizationstringEnables Clients to change the applied categorization type

Possible values:none,personal,business

Default value:none - automatic_refreshbooleanAllows Clients to enable/ disable automatic refresh. For Client the default value is

false, for Partnertrue

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| AispConsentScopesNotAllowed | 406 | The value of the consent scopes parameter is not permitted by the Provider and/ or for the Partner's API |

| ClientPending | 406 | The Client is pending approval. More information about the pending status can be found on the Pending guides page |

| ClientRestricted | 406 | The Client is in restricted status. More information about the restricted status can be found on the Restricted guides page |

| CustomerLocked | 406 | The User was locked manually in the Dashboard and may be unlocked |

| CustomerNotFound | 404 | The User with the provided customer_id does not exist |

| ProviderDisabled | 406 | The accessed Provider has been disabled. Consequently, it is no longer supported. |

| ProviderInactive | 406 | The requested Provider has the inactive status. This means that new Connections cannot be created, while the current ones cannot be refreshed or reconnected. |

| ProviderKeyNotFound | 404 | The Client does not possess a key for the selected Provider |

| RateLimitExceeded | 406 | Too many connections are being processed at the same time from one application |

| TPPregistration | 406 | Issues related to the certificates and/ or app ID have been detected |

| WrongRequestFormat | 400 | Some parameters or the entire JSON request are in the wrong format |

URL

https://www.saltedge.com/api/v6/connections/connect

Method

POST

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"customer_id\": 111111111111, \

\"consent\": { \

\"scopes\": [ \

\"accounts\", \

\"holder_info\" \

], \

\"from_date\": \"2023-11-05\", \

\"to_date\": \"2023-11-20\", \

\"period_days\": 15 \

}, \

\"attempt\": { \

\"fetch_scopes\": [ \

\"holder_info\", \

\"accounts\" \

], \

\"fetch_from_date\": \"2023-09-30\", \

\"fetch_to_date\": \"2023-10-25\", \

\"account_natures\": [ \

\"account\", \

\"bonus\", \

\"card\", \

\"checking\" \

], \

\"custom_fields\": {}, \

\"locale\": \"DE\", \

\"store_credentials\": true, \

\"unduplication_strategy\": \"delete_duplicated\", \

\"return_to\": \"http://example.com\" \

}, \

\"widget\": { \

\"show_account_overview\": true, \

\"show_consent_confirmation\": false, \

\"credentials_strategy\": \"ask\", \

\"javascript_callback_type\": \"iframe\", \

\"disable_provider_search\": false, \

\"skip_provider_selection\": false, \

\"skip_stages_screen\": true, \

\"template\": \"default_v3\", \

\"theme\": \"default\", \

\"allowed_countries\": [ \

\"XF\", \

\"GB\", \

\"DE\" \

], \

\"popular_providers_country\": \"XF\" \

}, \

\"provider\": { \

\"code\": \"fake_oauth_client_xf\", \

\"include_sandboxes\": true, \

\"modes\": [ \

\"oauth\" \

], \

\"regulated\": true \

}, \

\"kyc\": { \

\"type_of _account\": \"personal\" \

}, \

\"return_connection_id\": false, \

\"return_error_class\": true, \

\"categorization\": \"personal\", \

\"categorization_vendor\": \"saltedge\", \

\"automatic_refresh\": true \

} \

}" \

https://www.saltedge.com/api/v6/connections/connectSample response

{

"data": {

"expires_at": "2024-02-19T17:07:59Z",

"connect_url": "https://www.saltedge.com/connect?token=78abc19673b5978ec2bed15bc7b395e5f4775ccfbc78ecf45cc41e64a9ac51d46",

"customer_id": "1111111111111111111111"

}

}ReconnectPOST

To reconnect a Connection, the connection id and consent object must be sent by the Client's app.

The Widget object, attempt object, and other parameters could be sent by the Client’s app, to customize the User's experience.

Path Parameters

- connection_idstring (integer)mandatoryThe

idof the Connection

Request Body Parameters

- consentobjectmandatoryHide child attributes

- scopesarray of stringsmandatoryData to be allowed for fetching.

The allowed values for this parameter must fall within the Client’sallowed_fetch_scopesand/ or the Provider'ssupported_fetch_scopesrestrictions.

Possible values:holder_info,accounts,transactions.

Accountscovers bothaccountsandbalancefetch_scopes - from_datestring (date)Allows Salt Edge to fetch data starting from a specified date

- to_datestring (date)Allows Salt Edge to fetch data up until a specified date

- period_daysintegerAllows Clients to specify the duration of consent validity (in days)

- attemptobjectHide child attributes

- fetch_scopesarray of stringsA list of scopes requested by Clients from the Provider, deriving from the

consent_scopesoptions.

Possible values:holder_info,accounts,balance,transactions.

Accountsconsent_scopescoversaccountsandbalancefetch_scopes. - fetch_from_datestring (date)The starting date for fetching the data

- fetch_to_datestring (date)The ending date for fetching the data

- account_naturesarray of stringsPossible values:

account,bonus,card,checking,credit,credit_card,debit_card,ewallet,insurance,investment,loan,mortgage,savings - exclude_accountsarray of integersThe IDs of accounts that do not require refreshing

- custom_fieldsobjectA JSON object that will be sent back on any of the Client's callbacks

- localestringThe language of the Widget and the language of the returned error message(s).

Possible values: any locale in ISO 639-1 format. - store_credentialsbooleanWhether credentials are stored on Salt Edge's side or not.

Relevant for Providers with mode:webandapi

Default value:true - unduplication_strategystringThe unduplication strategy used for duplicated transactions.

The provided value remains unchanged until another value is sent duringConnections/reconnectorConnections/refresh.

mark_as_pending: leaves identified duplicated transactions in Pending status for clients that establish connections with providers having a non-nullcustom_pendings_period.

mark_as_duplicate: identifies transactions as duplicated and sets the duplicated flag totrue.

delete_duplicated: removes identified duplicated transactions.

Possible values:mark_as_pending,mark_as_duplicate,delete_duplicated

Default value:mark_as_pending - return_tostringThe URL to which the User will be redirected. By default, this is the Client’s or Partner’s home URL

- widgetobjectHide child attributes

- show_account_overviewbooleanDisplays information about connected accounts in the Widget

Default value:false - show_consent_confirmationbooleanClientShows confirmation of the Connection

Default value:true - credentials_strategystringThe strategy for storing the User’s credentials.

Relevant for Providers with mode:webandapi.

Possible values:store,do_not_store,ask

Default value:store - javascript_callback_typestringHow the Widget interacts with the opener/ parent window

Possible values:iframe,post_message - skip_stages_screenbooleanAllows Users to skip the stage screen

Default value:false - wait_all_transactionsbooleanAllows the User to remain within the Widget until all Transactions have been successfully fetched.

Cannot be combined withskip_stages_screen.

Default value:false - templatestringAllows Clients and Partners to configure a template for the Widget.

By default, Clients usedefault_v3and Partners usepartner_v3. - themestringAllows Clients to specify a color theme for the Widget.

If not set, the Widget uses the User's operating system theme preference by default

Possible values:dark,default,light

Default value:default - skip_final_screenbooleanAllows Users to skip the error and success screens

Default value:false

- return_connection_idbooleanAppends

connection_idto thereturn_toURL

Default value:false - return_error_classbooleanAppends

error_classto thereturn_toURL

Default value:false - automatic_refreshbooleanAllows Clients to enable/ disable automatic refresh.

- override_credentials_strategystringAllows Clients to choose a strategy for credentials:

ask- the User will be prompted to confirm the credentials override upon submitting the form

override- new credentials will automatically override the old ones

Possible values:ask,override

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| ActionNotSupported | 406 | Action is not supported by active eIDAS Certificate |

| AispConsentScopesNotAllowed | 406 | The value of the consent scopes parameter is not permitted by the Provider and/ or for the Partner's API |

| AllAccountsExcluded | 406 | All accounts have been excluded from the Connection fetching process |

| ClientRestricted | 406 | The Client is in restricted status. More information about the restricted status can be found on the Restricted guides page |

| ConnectionAlreadyProcessing | 409 | The Connection is already being processed |

| ConnectionDisabled | 406 | Connection, reconnection, or fetching a Connection was attempted by the Client, but it appears to have been disabled |

| ConnectionNotFound | 404 | The requested connection_id does not match any existing Connections |

| CustomerLocked | 406 | The User was locked manually in the Dashboard and may be unlocked |

| ProviderDisabled | 406 | The accessed Provider has been disabled. Consequently, it is no longer supported. |

| ProviderKeyNotFound | 404 | The Client does not possess a key for the selected Provider |

| RateLimitExceeded | 406 | Too many connections are being processed at the same time from one application |

| TPPregistration | 406 | Issues related to the certificates and/ or app ID have been detected |

| WrongRequestFormat | 400 | Some parameters or the entire JSON request are in the wrong format |

URL

https://www.saltedge.com/api/v6/connections/{connection_id}/reconnect

Method

POST

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"consent\": { \

\"scopes\": [ \

\"accounts\", \

\"holder_info\" \

], \

\"from_date\": \"2023-11-05\", \

\"to_date\": \"2023-11-20\", \

\"period_days\": 15 \

}, \

\"attempt\": { \

\"fetch_scopes\": [ \

\"holder_info\", \

\"accounts\" \

], \

\"fetch_from_date\": \"2023-09-30\", \

\"fetch_to_date\": \"2023-10-25\", \

\"account_natures\": [ \

\"account\", \

\"bonus\", \

\"card\", \

\"checking\" \

], \

\"exclude_accounts\": [ \

1111111111111, \

22222222222222, \

3333333333333 \

], \

\"custom_fields\": {}, \

\"locale\": \"DE\", \

\"store_credentials\": true, \

\"unduplication_strategy\": \"delete_duplicated\", \

\"return_to\": \"http://example.com\" \

}, \

\"widget\": { \

\"show_account_overview\": true, \

\"show_consent_confirmation\": false, \

\"credentials_strategy\": \"ask\", \

\"javascript_callback_type\": \"iframe\", \

\"skip_stages_screen\": true, \

\"template\": \"default_v3\", \

\"theme\": \"default\" \

}, \

\"return_connection_id\": false, \

\"return_error_class\": true, \

\"automatic_refresh\": true, \

\"override_credentials_strategy\": \"ask\" \

} \

}" \

https://www.saltedge.com/api/v6/connections/111111111111111/reconnectSample response

{

"data": {

"expires_at": "2024-02-19T17:07:59Z",

"connect_url": "https://www.saltedge.com/connect?token=78abc19673b5978ec2bed15bc7b395e5f4775ccfbc78ecf45cc41e64a9ac51d46",

"customer_id": "1111111111111111111111"

}

}RefreshPOST

Enables the triggering of a refetch of the data associated with a specific Connection. It should be noted that a Connection can be refreshed only if it has an active consent. If the response is successful, the next_refresh_possible_at value will be included, and the usual callbacks of the fetching workflow can be expected.

The timing of the automatic refresh per Provider is manually set by Salt Edge, to maintain equal system load throughout the day.

Path Parameters

- connection_idstring (integer)mandatoryThe

idof the Connection

Request Body Parameters

- return_connection_idbooleanAppends

connection_idto thereturn_toURL

Default value:false - return_error_classbooleanAppends

error_classto thereturn_toURL

Default value:false - automatic_refreshbooleanAllows Clients to enable/ disable automatic refresh.

Default value is the one that was used when the Connection had been created - override_credentials_strategystringAllows Clients to choose a strategy for credentials:

ask- the User will be prompted to confirm the credentials override upon submitting the form

override- new credentials will automatically override the old ones

Possible values:ask,override - show_widgetbooleanEnables initiating a refresh without having to open the Widget

- attemptobjectHide child attributes

- fetch_scopesarray of stringsA list of scopes requested by Clients from the Provider, deriving from the

consent_scopesoptions.

Possible values inside the array:holder_info,accounts,balance,transactions.

Accountsconsent_scopescoversaccountsandbalancefetch_scopes. - fetch_from_datestring (date)The starting date for fetching the data

- fetch_to_datestring (date)The ending date for fetching the data

- account_naturesarray of stringsPossible values:

account,bonus,card,checking,credit,credit_card,debit_card,ewallet,insurance,investment,loan,mortgage,savings - exclude_accountsarray of integersThe IDs of accounts that do not require refreshing

- custom_fieldsobjectA JSON object that will be sent back on any of the Client's callbacks

- localestringThe language of the Widget and the language of the returned error message(s).

Possible values: any locale in ISO 639-1 format. - unduplication_strategystringThe unduplication strategy used for duplicated transactions.

The provided value remains unchanged until another value is sent duringConnections/reconnectorConnections/refresh.

mark_as_pending: leaves identified duplicated transactions in Pending status for clients that establish connections with providers having a non-nullcustom_pendings_period.

mark_as_duplicate: identifies transactions as duplicated and sets the duplicated flag totrue.

delete_duplicated: removes identified duplicated transactions.

Possible values:mark_as_pending,mark_as_duplicate,delete_duplicated

Default value:mark_as_pending - return_tostringThe URL to which the User will be redirected. By default, this is the Client’s or Partner’s home URL

- widgetobjectHide child attributes

- show_account_overviewbooleanDisplays information about connected accounts in the Widget

Default value:false - javascript_callback_typestringHow the Widget interacts with the opener/ parent window

Possible values:iframe,post_message - skip_stages_screenbooleanAllows Users to skip the stage screen

Default value:false - wait_all_transactionsbooleanAllows the User to remain within the Widget until all Transactions have been successfully fetched.

Cannot be combined withskip_stages_screen.

Default value:false - templatestringAllows Clients and Partners to configure a template for the Widget.

By default, Clients usedefault_v3and Partners usepartner_v3. - themestringAllows Clients to specify a color theme for the Widget.

If not set, the Widget uses the User's operating system theme preference by default

Possible values:dark,default,light

Default value:default - skip_final_screenbooleanAllows Users to skip the error and success screens

Default value:false

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| AispConsentScopesNotAllowed | 406 | The value of the consent scopes parameter is not permitted by the Provider and/ or for the Partner's API |

| AllAccountsExcluded | 406 | All accounts have been excluded from the Connection fetching process |

| BackgroundRefreshNotAllowed | 406 | Background refresh is not allowed, as this Connection requires User interaction (via Widget) |

| ClientRestricted | 406 | The Client is in restricted status. More information about the restricted status can be found on the Restricted guides page |

| ConnectionAlreadyProcessing | 409 | The Connection is already being processed |

| ConnectionCannotBeRefreshed | 406 | The next refresh attempt will be allowed according to the next_refresh_possible attribute, or if the Connection's status is inactive |

| ConnectionDisabled | 406 | Connection, reconnection, or fetching a Connection was attempted by the Client, but it appears to have been disabled |

| ConnectionNotFound | 404 | The requested connection_id does not match any existing Connections |

| CustomerLocked | 406 | The User was locked manually in the Dashboard and may be unlocked |

| ProviderDisabled | 406 | The accessed Provider has been disabled. Consequently, it is no longer supported. |

| ProviderKeyNotFound | 404 | The Client does not possess a key for the selected Provider |

| RateLimitExceeded | 406 | Too many connections are being processed at the same time from one application |

| TPPregistration | 406 | Issues related to the certificates and/ or app ID have been detected |

| WrongRequestFormat | 400 | Some parameters or the entire JSON request are in the wrong format |

URL

https://www.saltedge.com/api/v6/connections/{connection_id}/refresh

Method

POST

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"return_connection_id\": true, \

\"return_error_class\": false, \

\"automatic_refresh\": true, \

\"show_widget\": false, \

\"attempt\": { \

\"fetch_scopes\": [ \

\"holder_info\", \

\"accounts\" \

], \

\"fetch_from_date\": \"2023-09-30\", \

\"fetch_to_date\": \"2023-10-25\", \

\"account_natures\": [ \

\"account\", \

\"bonus\", \

\"card\", \

\"checking\" \

], \

\"exclude_accounts\": [ \

1111111111111, \

22222222222222, \

3333333333333 \

], \

\"custom_fields\": {}, \

\"locale\": \"DE\", \

\"unduplication_strategy\": \"delete_duplicated\", \

\"return_to\": \"http://example.com\" \

}, \

\"widget\": { \

\"show_account_overview\": true, \

\"javascript_callback_type\": \"iframe\", \

\"skip_stages_screen\": true, \

\"template\": \"default_v3\", \

\"theme\": \"default\" \

} \

} \

}" \

https://www.saltedge.com/api/v6/connections/11111111111111111/refreshSample response

{

"data": {

"expires_at": "2024-02-19T17:07:59Z",

"connect_url": "https://www.saltedge.com/connect?token=78abc19673b5978ec2bed15bc7b395e5f4775ccfbc78ecf45cc41e64a9ac51d46",

"customer_id": "1111111111111111111111"

}

}Background RefreshPOST

The triggering of a background refresh of the data associated with a specific Connection without User presence is enabled by calling this endpoint at the Client's convenience as an alternative to Salt Edge's timeslots for automatic refreshes. Subject to automatic refresh limit.

Path Parameters

- connection_idstring (integer)mandatory

Request Body Parameters

- attemptobjectHide child attributes

- fetch_scopesarray of stringsA list of scopes requested by Clients from the Provider, deriving from the

consent_scopesoptions.

Possible values inside the array:holder_info,accounts,balance,transactions.

Accountsconsent_scopescoversaccountsandbalancefetch_scopes. - fetch_from_datestring (date)The starting date for fetching the data

- fetch_to_datestring (date)The ending date for fetching the data

- account_naturesarray of stringsPossible values:

account,bonus,card,checking,credit,credit_card,debit_card,ewallet,insurance,investment,loan,mortgage,savings - exclude_accountsarray of integersThe IDs of accounts that do not require refreshing

- custom_fieldsobjectA JSON object that will be sent back on any of the Client's callbacks

- unduplication_strategystringThe unduplication strategy used for duplicated transactions.

The provided value remains unchanged until another value is sent duringConnections/reconnectorConnections/refresh.

mark_as_pending: leaves identified duplicated transactions in Pending status for clients that establish connections with providers having a non-nullcustom_pendings_period.

mark_as_duplicate: identifies transactions as duplicated and sets the duplicated flag totrue.

delete_duplicated: removes identified duplicated transactions.

Possible values:mark_as_pending,mark_as_duplicate,delete_duplicated

Default value:mark_as_pending

- automatic_refreshbooleanAllows Clients to enable/ disable automatic refresh.

Default value is the one that was used when the Connection had been created

Possible errors

| Error Class | HTTP code | Description |

|---|---|---|

| ActionNotAllowed | 400 | The Client has no access to the required route |

| ActionTemporarilyNotAllowed | 400 | The maximum limit of daily refreshes for this Customer has been reached. |

| AispConsentExpired | 406 | Refresh is not possible because the consent has been revoked |

| AispConsentRevoked | 406 | Refresh is not possible because the consent has been revoked |

| AllAccountsExcluded | 406 | All accounts have been excluded from the Connection fetching process |

| BackgroundRefreshNotAllowed | 406 | Background refresh is not allowed, as this Connection requires User interaction (via Widget) |

| ClientRestricted | 406 | The Client is in restricted status. More information about the restricted status can be found on the Restricted guides page |

| ConnectionAlreadyProcessing | 409 | The Connection is already being processed |

| ConnectionCannotBeRefreshed | 406 | The next refresh attempt will be allowed according to the next_refresh_possible attribute, or if the Connection's status is inactive |

| ConnectionNotFound | 404 | The requested connection_id does not match any existing Connections |

| CustomerLocked | 406 | The User was locked manually in the Dashboard and may be unlocked |

| ProviderDisabled | 406 | The accessed Provider has been disabled. Consequently, it is no longer supported. |

| ProviderInactive | 406 | The requested Provider has the inactive status. This means that new Connections cannot be created, while the current ones cannot be refreshed or reconnected. |

| TPPregistration | 406 | Issues related to the certificates and/ or app ID have been detected |

| WrongRequestFormat | 400 | Some parameters or the entire JSON request are in the wrong format |

URL

https://www.saltedge.com/api/v6/connections/{connection_id}/background_refresh

Method

POST

Sample request

curl -v -H "Accept: application/json" \

-H "Content-type: application/json" \

-H "App-id: $APP_ID" \

-H "Secret: $SECRET" \

-X POST \

-d "{ \

\"data\": { \

\"automatic_refresh\": true, \

\"attempt\": { \

\"fetch_scopes\": [ \

\"holder_info\", \

\"accounts\" \

], \

\"fetch_from_date\": \"2023-09-30\", \

\"fetch_to_date\": \"2023-10-25\", \

\"account_natures\": [ \

\"account\", \

\"bonus\", \

\"card\", \

\"checking\" \

], \

\"exclude_accounts\": [ \

1111111111111, \

22222222222222, \

3333333333333 \

], \

\"custom_fields\": {}, \

\"unduplication_strategy\": \"delete_duplicated\" \

} \

} \

}" \

https://www.saltedge.com/api/v6/connections/1111111111111111111/background_refreshSample response

{

"data": {

"id": "1111111111111111111",

"customer_id": "1191191191191191191",

"customer_identifier": "example_identifier",

"provider_code": "fake_oauth_client_xf",

"provider_name": "Fake OAuth Bank with Client Keys",

"country_code": "XF",

"status": "inactive",

"categorization": "personal",

"automatic_refresh": true,

"next_refresh_possible_at": null,

"created_at": "2024-03-25T13:20:53Z",

"updated_at": "2024-03-25T13:29:09Z",

"last_consent_id": "1241241241241241241",

"last_attempt": {

"id": "1221122112211221122",

"consent_id": "1241241241241241241",

"api_version": "6",

"api_mode": "service",

"automatic_fetch": false,

"categorize": true,

"custom_fields": {

"id2": "value",

"id3": "value",

"id4": "value"

},

"automatic_refresh": true,

"exclude_accounts": [],

"fetch_from_date": "2024-01-25",

"fetch_to_date": "2024-01-25",

"fetch_scopes": [

"accounts",

"holder_info",

"transactions"

],

"finished": false,

"finished_recent": false,

"include_natures": [

"account"

],

"interactive": false,